Saved by sari

Investors Are Behaving as if the Future Has Already Happened

The investing behaviors of young ‘degens’ is far less irrational than you might think… (and why It matters in 2025) https://t.co/rZE70ZV5Tz

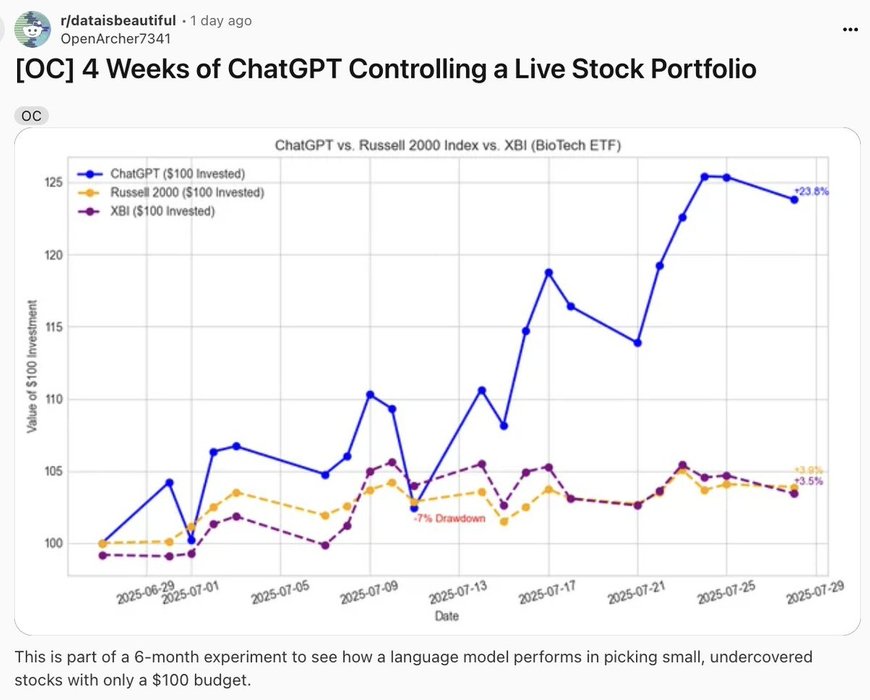

someone on reddit let ChatGPT manage a $100 stock portfolio for four weeks and beat the market by 23%.

here are 14 things it means for you, markets and the future of finance:

1. there will be a massive market crash caused by too many AIs making the same trades. when millions of ChatGPT... See more