Saved by Aman and

Impossible trinity

Saved by Aman and

With good reason, however, many economists who previously favored greater freedom of capital movements have become less enthusiastic, and the Fund itself came around to a more neutral position. In a survey of the evidence published in May 2003, four Fund economists, including chief economist Ken Rogoff, wrote that "there is as yet no clear and

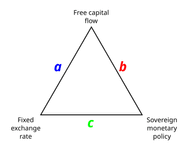

... See moreThus, for the next quarter century, did governments resolve the so-called ‘trilemma’, according to which a country can choose any two out of three policy options: full freedom of cross-border capital movements; a fixed exchange rate; an independent monetary policy oriented towards domestic objectives.57

The global crisis is a financial crisis driven primarily by global trade and capital imbalances, and it has unfolded in almost a textbook fashion.