Saved by Aman and

Impossible trinity

Saved by Aman and

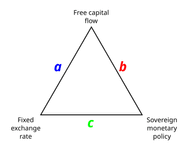

Modern economics has formulated “The Impossible Trinity” to express the plight of modern central bankers, which states: No government can successfully achieve all three goals of having a fixed foreign exchange rate, free capital flows, and an independent monetary policy.

This trilemma was first mentioned by economists Flemming and Mudell in the 1960s and describes the trade-off between (i) exchange rate stability, (ii) autonomous monetary policy, and (iii) capital mobility24 that national currencies are facing.