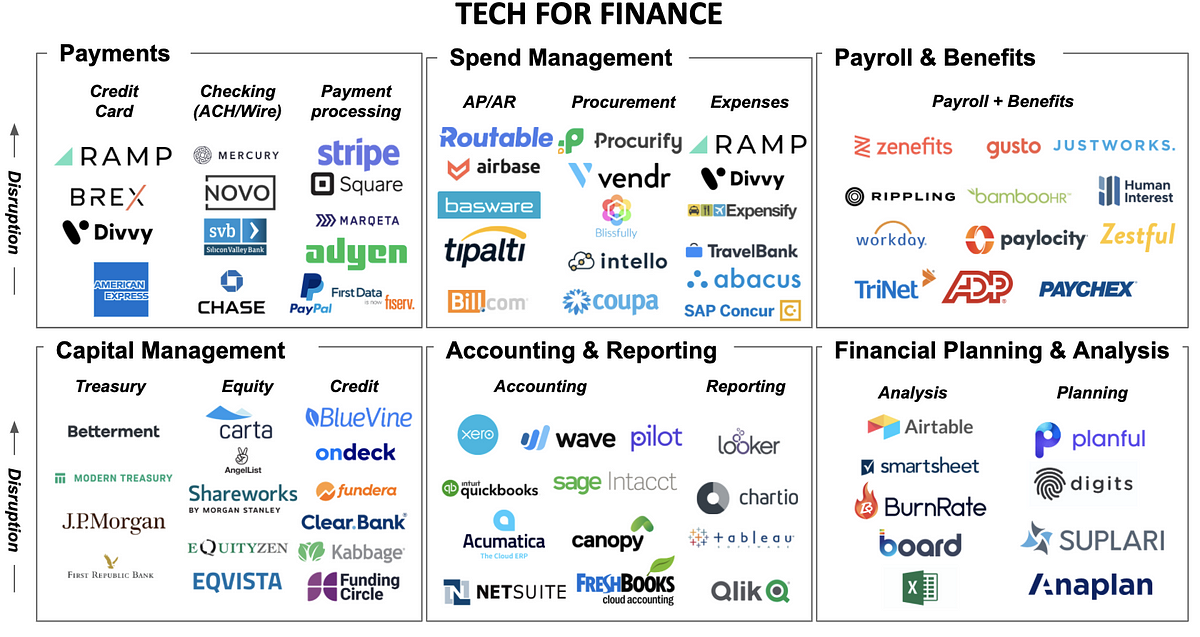

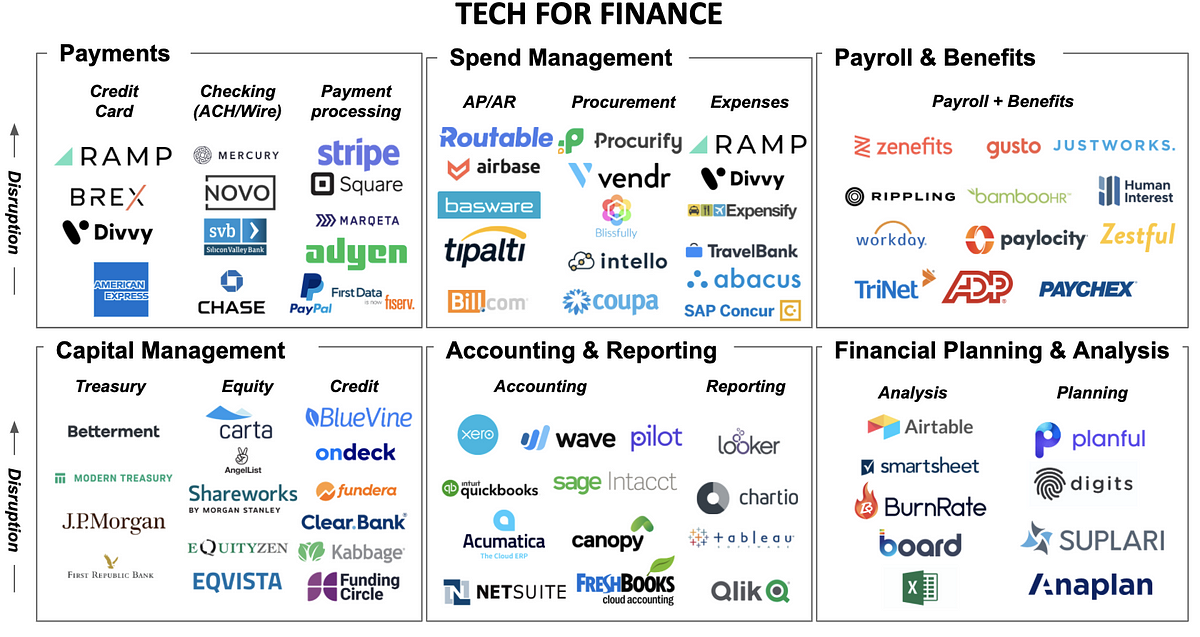

With the growth of cloud, functions that were previously manual like billing customers, managing expenses, and forecasting budget, became actions that could be productized — which led to a better experience for the user (the finance role) and the end customer (the payee, the customer, and one’s own employees.)