Equity Market Outlook

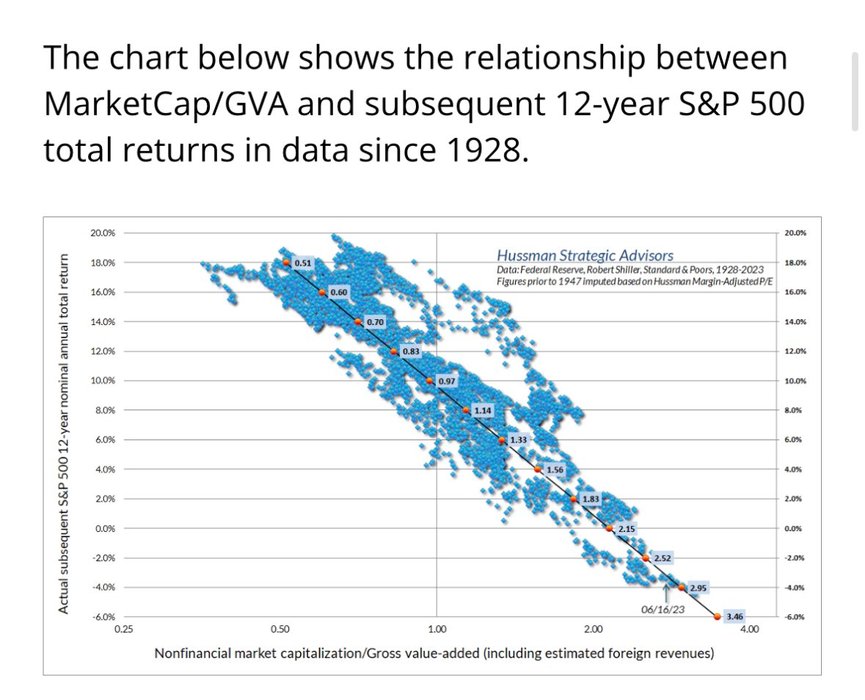

One of the greatest mistakes I see smart people making is assuming that the S&P 500 will yield 8% “because it always has”.

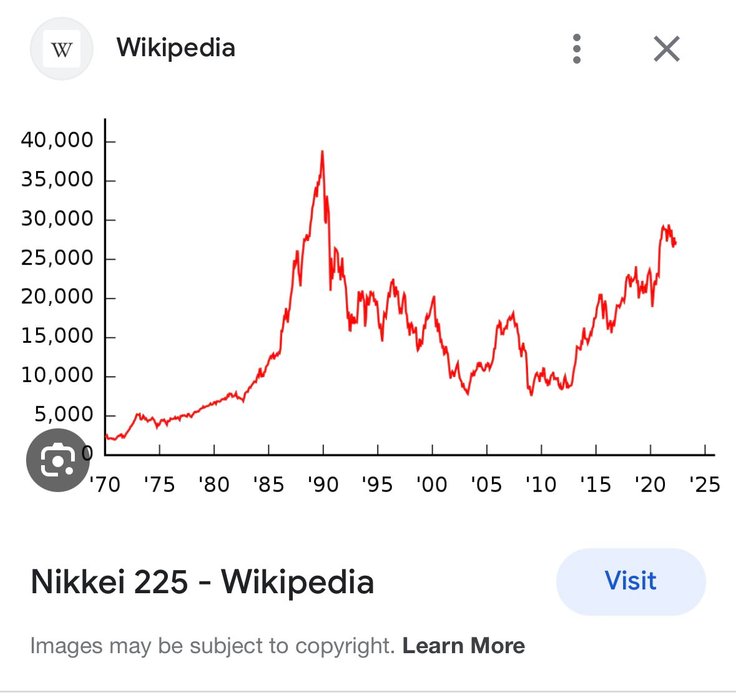

I would to introduce them to Japan’s Nikkei 225. If you bought the index in 1988 (!!!) your return would be negative 25 years later.

Turns out valuation matters.... See more

The most beautiful summary of the last 2 years of equity market activity by Howard Marks https://t.co/5Ma9Vcavwe

The End of The Beginning

aitkenadvisors.com

Explained below is how the market can go up even more in the coming 3 months.

If inflation moves down really fast + the FED not cutting rates fast enough — that can cause real rates to rise which likely = equities sell off.

Delinquencies are NOT rising.

Credit risk remains low

"Credit spreads remain at cycle lows" Therefore, the amount of growth risk

... See more