Benji

@benji

Benji

@benji

The soul is born—he said vaguely—first in those moments I told you of. It has a slow and dark birth, more mysterious than the birth of the body. When the soul of a man is born in this country there are nets flung at it to hold it back from flight. You talk to me of nationality, language, religion. I shall try to fly by those nets.—

“Enchantment” thread is interesting, I’ve saved an article recently about enchantment and much of the thesis was that attention = enchantment. Play = attention, and a specific type of it.

💭Spirituality & Philosophy and Attention

• The world we know cannot be wholly mind-independent, and it cannot be wholly mind-dependent… What is required is an attentive response to something real and other than ourselves, of which we have only inklings at first, but which comes more and more into being through our response to it — if we are truly responsive to it. We nurture it into being; or not. In this it has something of the structure of love.

• Defining attention as “the manner in which our consciousness is disposed towards whatever else exists,” he writes:

• The choice we make of how we dispose our consciousness is the ultimate creative act: it renders the world what it is. It is, therefore, a moral act: it has consequences.

• Attention is not just another “cognitive function”: it is… the disposition adopted by one’s consciousness towards the world. Absent, present, detached, engaged, alienated, empathic, broad or narrow, sustained or piecemeal, it therefore has the power to alter whatever it meets. Since our consciousness plays some part in what comes into being, the play of attention can both create and destroy, but it never leaves its object unchanged. So how you attend to something — or don’t attend to it — matters a very great deal.

• As Peter Thiel observed in his famous Stanford lecture, founders occupy a peculiar place in the Valley's collective psyche, simultaneously worshipped and vulnerable to sacrifice.

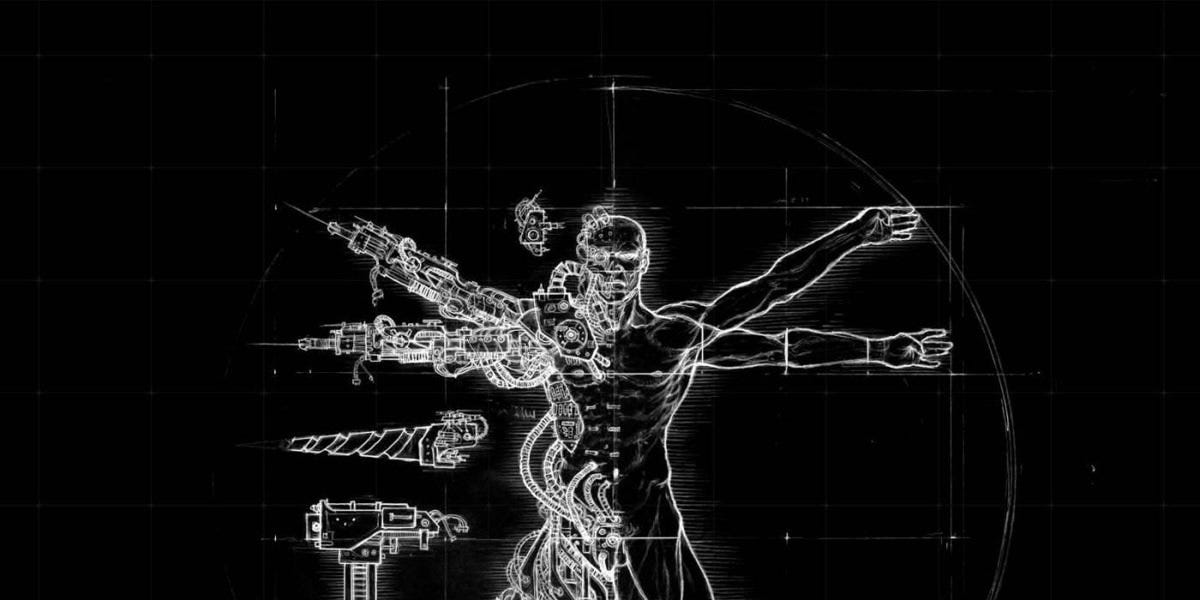

• The Valley's founding stories often follow ancient mythological patterns: the outcast-turned-hero (Jobs), the boy-king (Zuckerberg), the Prometheus figure bringing divine fire to mortals (Musk).

• As Thiel observes, the evolution of founders into sacred figures follows a consistent trajectory: the initial blessing (funding), a period of adversity (the "valley of death"), and eventual triumph or failure.

• When founders succeed at scale, their companies can transcend mere business to become something approaching cosmic centers.

• True sacredness is rooted in forms of value that cannot be bought or sold.

• The crypto space serves as a concentrated laboratory for understanding how sacred narratives can be corrupted into sophisticated fraud.

• The attention economy has created a new priesthood, where the sacred rite of "founding" requires no actual founding, only the ability to perform the outward signs of “founding.”

• When a critical mass of sacred narratives is exposed as cynical manipulations, the ability to discern genuine visionaries diminishes.

• This essay is less a prescription than a reckoning, a meditation on what we stand to lose.