Sublime

An inspiration engine for ideas

So You Want To Be The Next Warren Buffett? How's Your Writing?

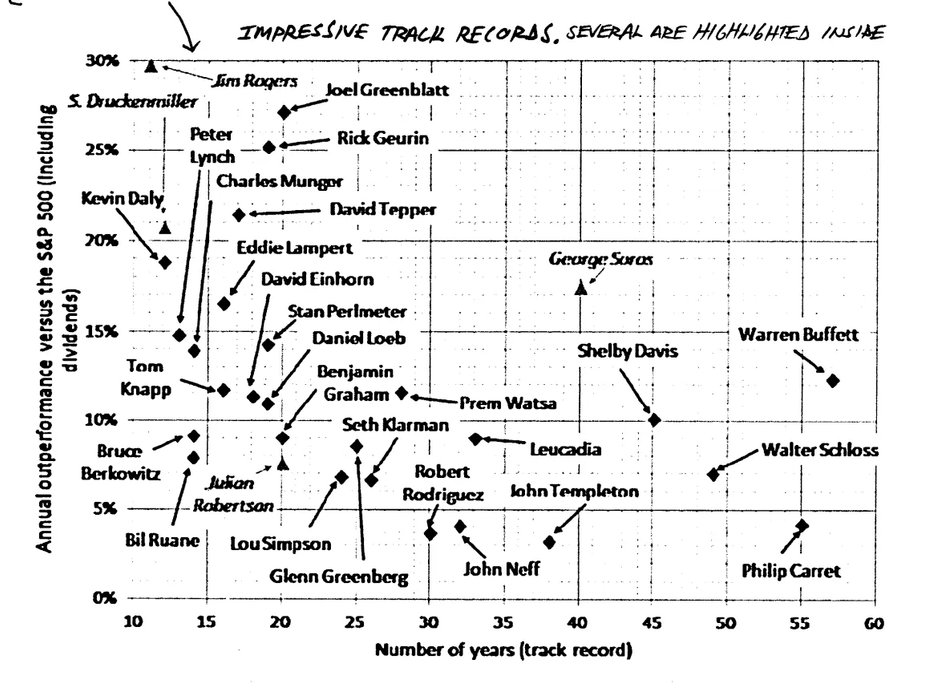

The document discusses why very few people have a chance of becoming great investors like Warren Buffett and identifies seven inherent traits that differentiate successful investors.

moiglobal-com.s3.eu-west-1.amazonaws.comNote that investing,

Benjamin Graham • The Intelligent Investor, Rev. Ed (Collins Business Essentials)

What I'm digging into this week...

-Warren Buffett and Greg Abel talk Japan on Squawk Pod

-Jeremy Grantham on TIP

-@chriswmayer talks 100 Baggers

-Charles Ellis on The Loser's Game

-Tom Gayner chats with @WilliamGreen72

Sources below

Brad Kaellnerx.comWhat's a Carry Trade? Definition, How It Works and Key Risks ...

bloomberg.com

Investing is a beautiful intellectual game.

Are you looking for investment inspiration?

Here’s what the best investors in the world have in their portfolio today 👇 https://t.co/Qly4cR7PjA

O investidor de bom senso: A melhor maneira de garantir um bom desempenho no mercado de ações (Portuguese Edition)

amazon.com

Charlie Munger ‘The Art of Stock Picking’.

A 18-page transcribed speech of Charlie describing his investing philosophy.

A must-read for every investor.

I'm sharing it with you for free: https://t.co/bOaVw6nrdo