Sublime

An inspiration engine for ideas

Spent 7 hours researching a true master of small cap private equity:

- 586 transactions

- Acquire $1 million to $10 million EBITDA companies

- Average deal $12 million

- 72% IRR

- 7x cash on cash returns

He had two rare public... See more

PrivateEquityGuy (Mikk Markus)x.com

Bill Ackman Manages Over $8.7 Billion in Assets

Achieved 373% accumulative return 2004-2010.

A 58% return in 2019!

He makes all of his Analysts read these 11 books:

📚 https://t.co/XomKpXdDVI

In it’s heyday, Goldman’s special situations group was the navy SEALs of money making. Today’s guest, Alan Waxman, used to run that group before leaving to build Sixth Street, now a $115b behemoth.

SSG heads were sometimes of the more brainy, nerdy variety. Not Waxman. He is a force of nature and energy who apparently... See more

Patrick OShaughnessyx.com

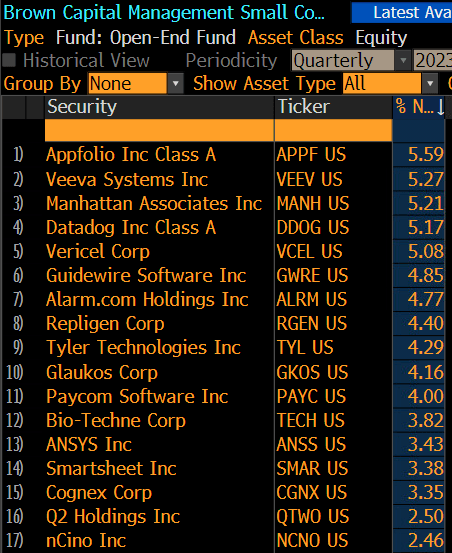

I enjoyed this podcast with Keith Lee at Brown Capital Management (Small Cap Growth PM).

His main fund (top holdings below) has a high Tech sector exposure (60%). Keith and the team are focused on finding exceptional growth companies.

Notes from the interview:... See more

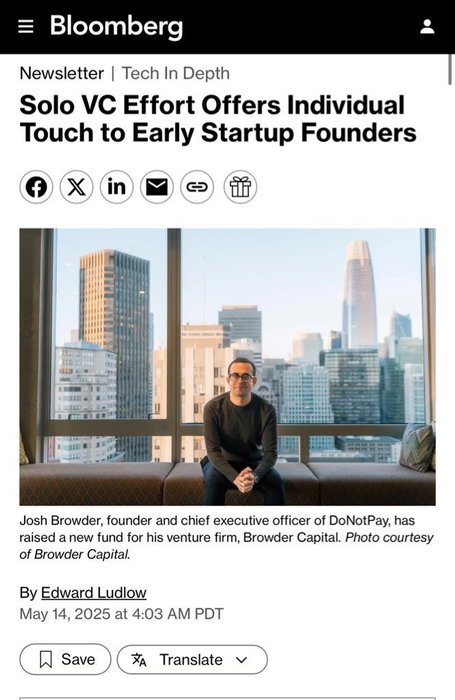

Sequoia Capital, Marc Andreessen and top institutions back New $30m Browder Capital Fund Four:

Today, I’m excited to announce that I’ve raised Browder Capital Fund Four, a $30,000,000 fund backed by Sequoia Capital, Marc Andreessen, Chris Dixon, Arthur Patterson (founder of Accel), Walter Kortschak (founder of... See more

Imagine being in your early 30s, starting a private equity fund and raising $450 million as your first fund.

All this with no prior track record and without your rich father or uncle.

Years later, you own 90 companies, have $147 billion in AUM, your EBITDA is growing at 15% year-over-year,... See more

PrivateEquityGuy (Mikk Markus)x.com

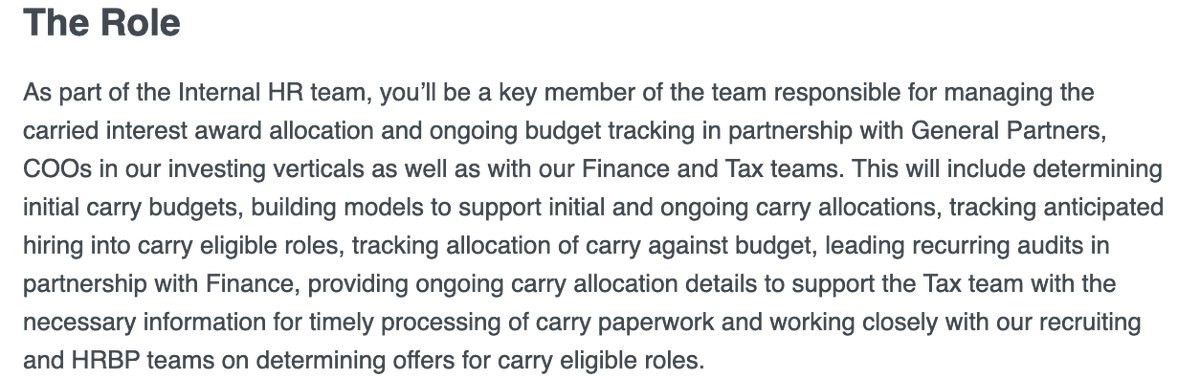

Wow. a16z hiring a full-time person just to keep track of carry. https://t.co/WDzfFXpDB6 https://t.co/5WI1NsYPau