Sublime

An inspiration engine for ideas

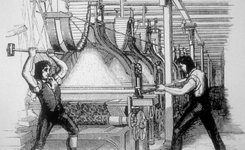

Obsolescence is a crime

youtube.comTaste is unconscious competence

Bill Burr’s advice will banish anxiety from your life:

“You’re gonna be fine. And even if you’re not gonna be fine, isn’t it better to just exist thinking you’re gonna be fine. And then when it’s not fine you can just f*cking handle it then.”

"Think of your mother as your grandmother's daughter and get to know her that way." (Michael Kerr)

OneLogin

Life is a constant dance between seeking comfort and being bored by it