Sublime

An inspiration engine for ideas

We applied our usual three tests for a new line of business. It must have the potential to be hugely rewarding for investors. It must add to Blackstone’s intellectual capital. And it must have a 10 in charge

Stephen A. Schwarzman • What It Takes

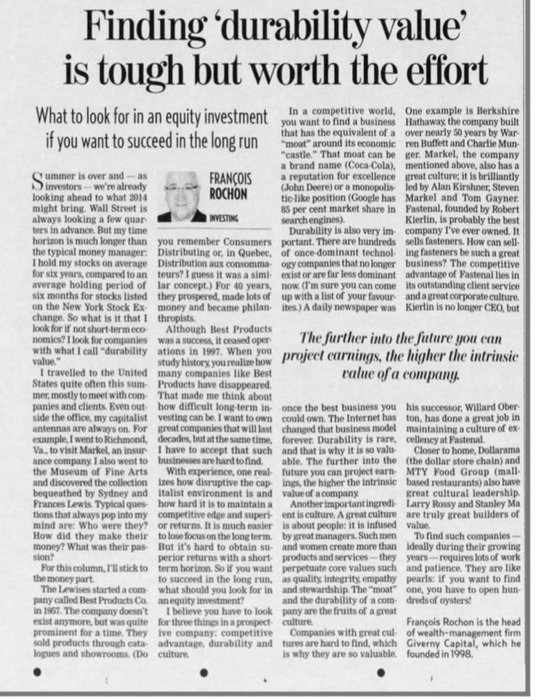

Do want to know what to look for in an equity investment if you want to succeed in the long run?

Read this article by François Rochon.

François Rochon runs Giveryn Capital which has returned 15.7% annually since 1993. https://t.co/BLbcBe1vzJ

Sieva Kozinsky on LinkedIn: We’re building a baby Berkshire Hathaway. The crazy part? We plan to pay… | 25 comments

linkedin.com

Give special attention/effort to firms that have recently had a personnel change.

John Gannon • Road to a Venture Capital Career: Practical Strategies and Tips to Break Into The Industry

The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success

amazon.com

leverage is also central to its economics.