Sublime

An inspiration engine for ideas

Embracing Paradox

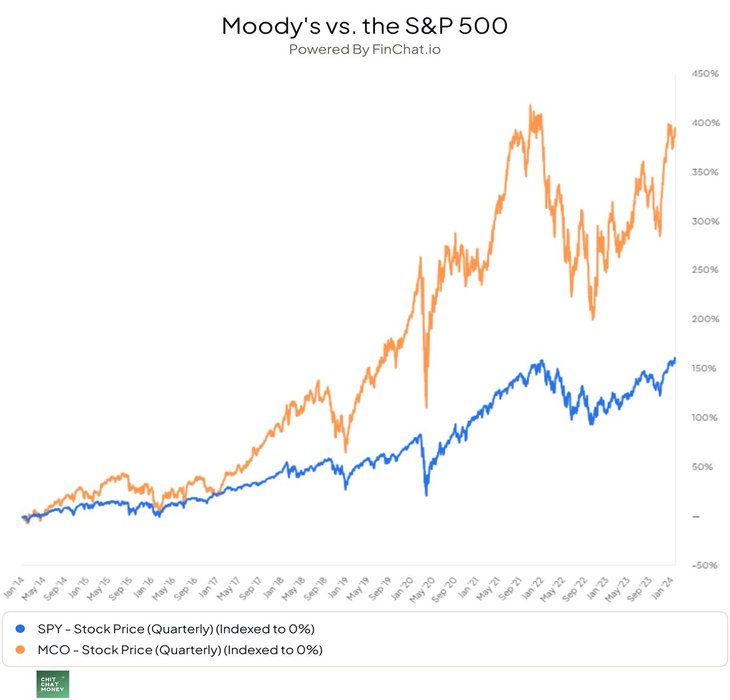

Some investors—Warren Buffett, for example—like to look at the “market to book” ratio. Buffett often tries to find companies that are trading at a market cap close to or even below their book value.

Joe Knight • Financial Intelligence, Revised Edition: A Manager's Guide to Knowing What the Numbers Really Mean

This is a marketplace and valuations can go up and down, but valuations are not as important as understanding who the other investors are, how the business is doing, who the customers are, and who’s on the team.

Jason Calacanis • Angel: How to Invest in Technology Startups—Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000

C Current Quarterly Earnings and Sales: The Higher, the Better A Annual Earnings Increases: Look for Significant Growth N New Products, New Management, New Highs: Buying at the Right Time S Supply and Demand: Shares Outstanding Plus Big Volume Demand L Leader or Laggard: Which Is Your Stock? I Institutional Sponsorship: Follow the Leaders M Market

... See moreWilliam J. O'Neil • How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

amazon.com

So You Want To Be The Next Warren Buffett? How's Your Writing?