Sublime

An inspiration engine for ideas

Observe the patterns of mistakes to see if they are products of weaknesses.

Ray Dalio • Principles: Life and Work

This wave will do to currency, financial instruments, and economic activity what the Internet of Information did to knowledge: reduce costs, increase speed, transcend barriers, improve accessibility, enhance certainty, and decrease bottlenecks to instantaneous transactions across the globe.

J. Christopher Giancarlo, Cameron Winklevoss, • CryptoDad: The Fight for the Future of Money

The Warren Buffett Portfolio: Mastering the Power of the Focus Investment Strategy

amazon.com

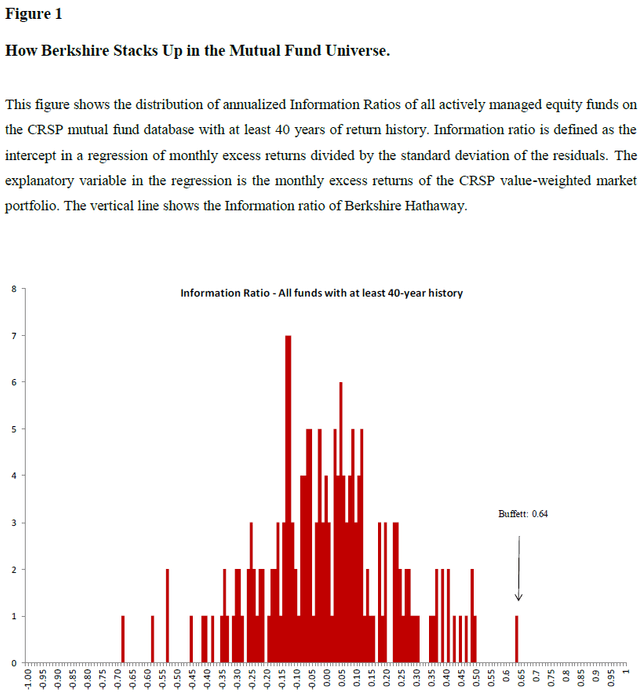

1/ Buffett's Alpha (Frazzini, Kabiller, Pedersen)

AQR finds that Berkshire Hathaway's large 13% CAPM alpha and 0.79 Sharpe ratio becomes insignificant after controlling for BAB and QMJ. Warren Buffet may have been the first multifactor investor.

https://t.co/OV60Vpg9HC... See more

New is overvalued relative to great.

Ray Dalio • Principles: Life and Work

Back in 1966, a goateed Stanford professor named Bill Sharpe developed a formula that has since become as common in investment-speak as RBIs are in baseball-speak. The formula looks like this: