Sublime

An inspiration engine for ideas

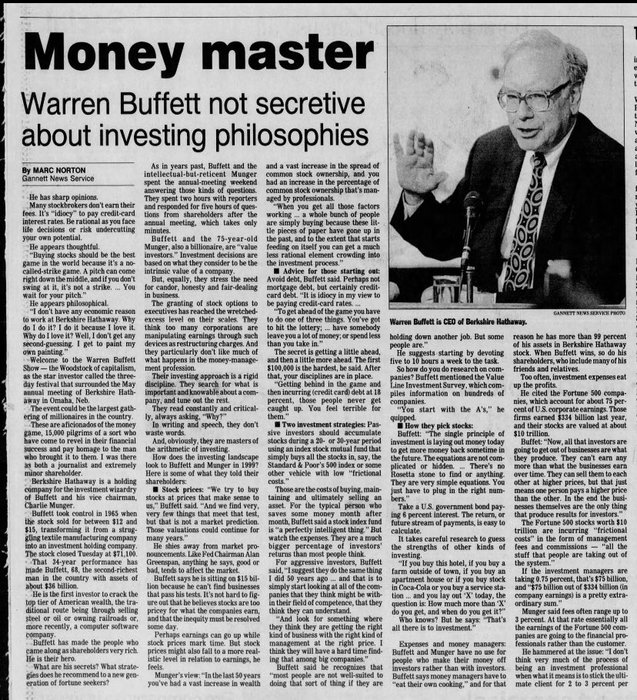

Warren Buffett:

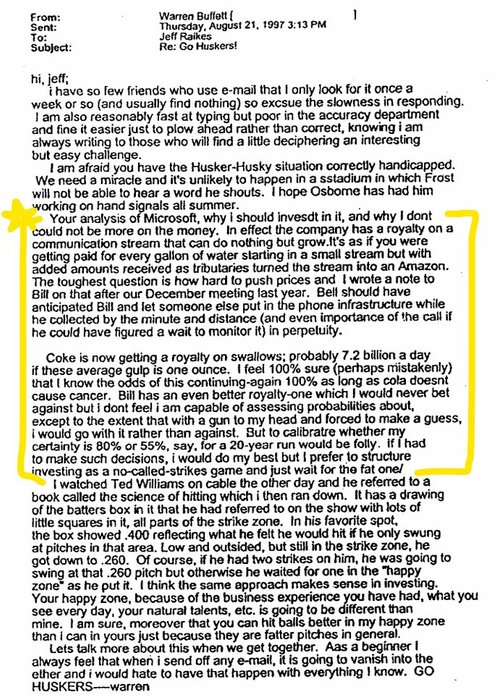

"I sent one e-mail in my life, I sent it to Jeff Raikes at Microsoft..."

A behind-the-scenes look at how Buffett analyzes investments 👇 https://t.co/kbami5t26q

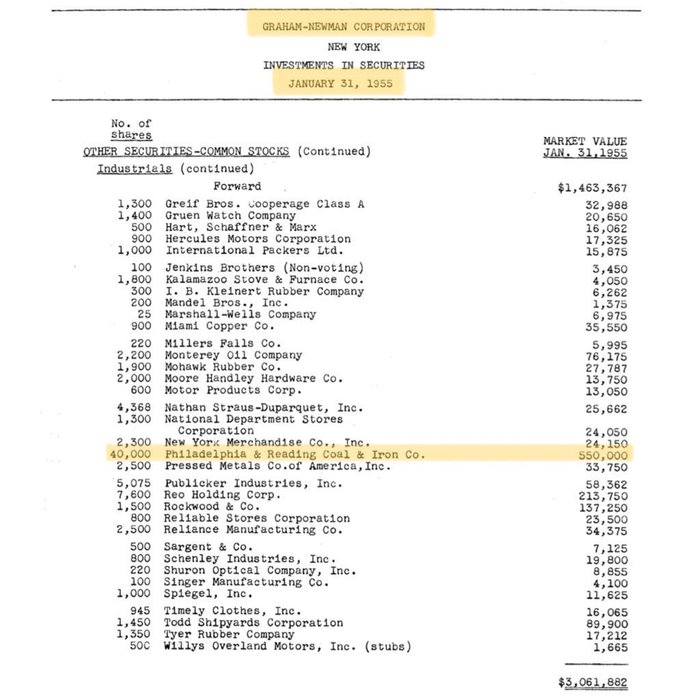

A Case Study in Capital Allocation: Philadelphia & Reading

In 1955, Ben Graham took control of P&R. Over the next 12 years, Graham transformed P&R from a failing coal mine into a high-return holding company.

Here's why P&R was Buffett's

- Largest investment

-... See more

Of all the things Berkshire could buy with their $350 billion+ of cash... they chose to buy this https://t.co/ylqVlNkDqK

Wow... Warren Buffet says goodbye in his final annual letter today (full copy in the comments below).

As he signed off, the following were final words of advice:

"One perhaps self-serving observation. I’m happy to say I feel better about the second half of my life than the first. My... See more

SMB Attorneyx.comBuffetts Filters

- he must understand the company and industry completely

- the company must have characteristics that give it a durable competitive advantage

- and have a management in place with a lot of skill, energy and integrity

- be available at a price that makes sense

Return on Capx.comSome investors—Warren Buffett, for example—like to look at the “market to book” ratio. Buffett often tries to find companies that are trading at a market cap close to or even below their book value.

Joe Knight • Financial Intelligence, Revised Edition: A Manager's Guide to Knowing What the Numbers Really Mean

Warren Buffett in a Nutshell

Credits: @Vivek_Investor https://t.co/HmxrptEbEM