Sublime

An inspiration engine for ideas

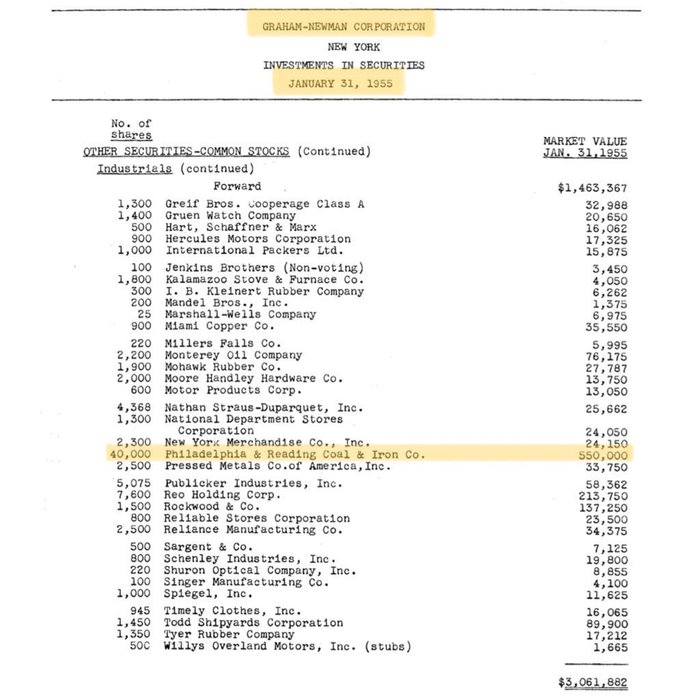

A Case Study in Capital Allocation: Philadelphia & Reading

In 1955, Ben Graham took control of P&R. Over the next 12 years, Graham transformed P&R from a failing coal mine into a high-return holding company.

Here's why P&R was Buffett's

- Largest investment

-... See more

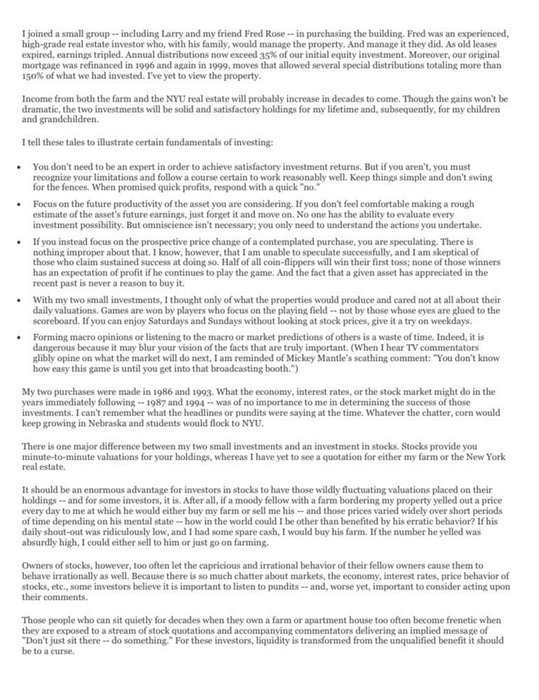

Some investors—Warren Buffett, for example—like to look at the “market to book” ratio. Buffett often tries to find companies that are trading at a market cap close to or even below their book value.

Joe Knight • Financial Intelligence, Revised Edition: A Manager's Guide to Knowing What the Numbers Really Mean

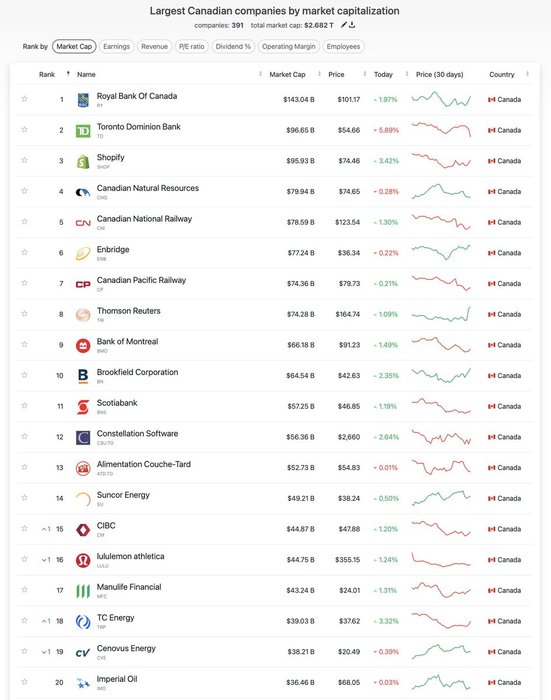

Warren Buffett is currently evaluating a Canadian investment 👀

“We do not feel uncomfortable in any way shape or form putting our money into Canada. In fact, we’re actually looking at one thing now,” he revealed at the 2024 Berkshire Hathaway annual meeting.

$CNSWF $SHOP $CP $TD $BN

More than 2,000 books are dedicated to how Warren Buffett built his fortune. Many of them are wonderful. But few pay enough attention to the simplest fact: Buffett’s fortune isn’t due to just being a good investor, but being a good investor since he was literally a child.

Morgan Housel • The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Around the turn of the millennium, with $NVR soaring (and Lou not selling), Lou became more of an acolyte of the Munger and Buffett style of investing

Specifically, he liked Buffett's "punch card" metaphor that you won't find more than 20 high-quality businesses that you understand in your... See more

Chit Chat Stocksx.comWARREN BUFFETT Founder and CEO, Berkshire Hathaway

David M. Rubenstein • How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game Changers

Todd: “Warren, I have a new company that likely clears our hurdle. We used to own it back in 2011. We made a quick 50% on the stock. It’s Dollar General.”

Buffett: … https://t.co/6j16vwZKmk