Sublime

An inspiration engine for ideas

Spark Capital

sparkcapital.com

Venture capital funds, at the other end of the spectrum, are commercial organizations whose business it is to find the 5 to 20 companies each year that they believe have a chance of being one of the only 80 companies a year that will ultimately exit in a sale of over $50 million. Because funds are highly visible and listed in the phone book, every

... See moreDavid S. Rose • Angel Investing: The Gust Guide to Making Money and Having Fun Investing in Startups

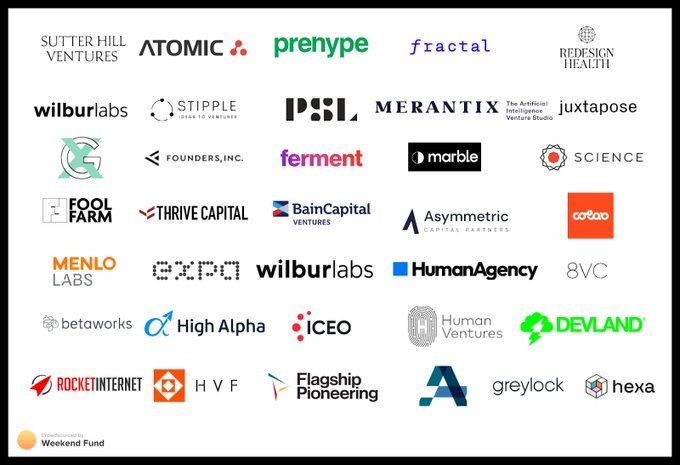

Dream Ventures

dreamventures.com

venture capital is the business of risk taking.

Arlan Hamilton • It's About Damn Time: How to Turn Being Underestimated into Your Greatest Advantage

The venture capital method is not a definitive way to value a company, but rather a back of the napkin approach that VCs and angels can use to back out a valuation for an early stage company. We determine what we think the company will be worth at exit through market conditions and industry multiples, then divide this number by the anticipated retu

... See moreBradley Miles • #BreakIntoVC: How to Break Into Venture Capital And Think Like an Investor Whether You're a Student, Entrepreneur or Working Professional (Venture Capital Guidebook Book 1)

VC firms often come together in a deal by syndicating, meaning having multiple VC firms participate in an investment round.

Patrick Vernon • Venture Capital Strategy: How to Think Like a Venture Capitalist

A venture capital firm invests under the premise of an upside scenario, this is to say that if the firm invests in 10 companies through the fund, they only expect one or two companies to hit a home run (an 8-10x return or more), and couple solid returns ( >1x), while the other six or seven companies may fail (no return) or simply return the amou

... See more