Sublime

An inspiration engine for ideas

you make good work when you let your guard down.

Mel Ottenberg • Aidan Zamiri Is the Moment

If I put this candle in an all white gallery space it looks like a piece of art.

If I put this candle in a garage it looks like a piece of trash.

I can either spend my time designing the candle or I can spend my time designing the room that it sits in. - Virgil Abloh

You can either focus on your art.

Or you can focus on the space, narrative, and

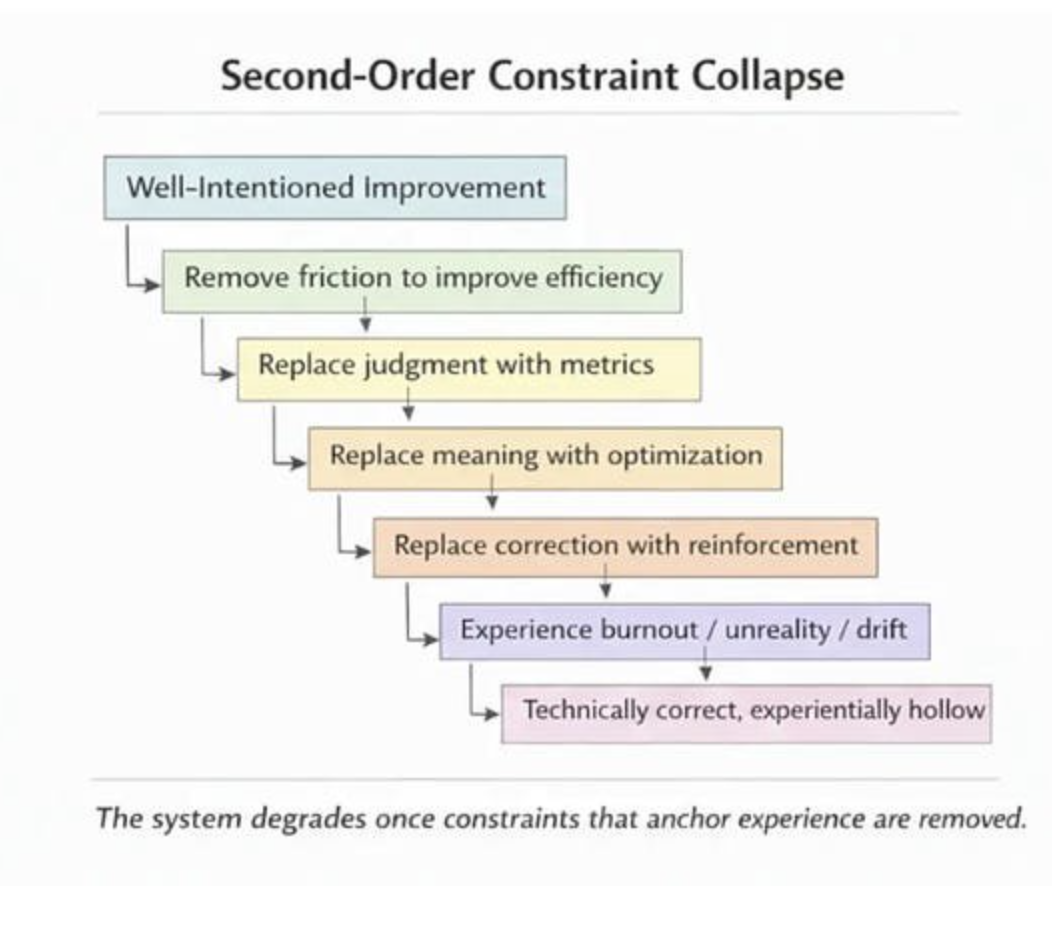

... See moreRedefining intelligence as effectively getting what you want from life, and why this exposes AI’s limitations

TRANSCRIPT

But intelligence is poorly defined. What is the definition of intelligence? There's the G factor, which predicts a lot of human outcomes. But the best evidence for the G factor is its predictive power. It's that you measure this one thing and then you see people get much better life outcomes along the way in things that seem even somewhat unrelated

... See more