Sublime

An inspiration engine for ideas

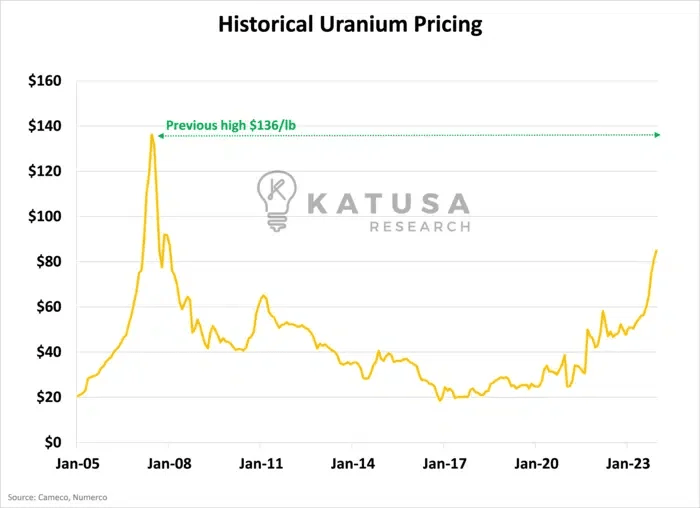

In 2013, near the very BOTTOM of the uranium market

GoldMining ($GLDG) took 75% ownership of the REA Project. Orano owns the other 25%

That’s not the most interesting part...

The exciting piece is that the Athabasca Basin is home to some of the highest-grade... See more

Katusa Researchx.comUranium ‘supergiant’

Only 3 unconformity basins globally proven to host economic uranium Athabasca, McArthur + lesser-known Thelon where $FMC are

“Grades are exceptional only rivalled by the highest-grade basement-hosted deposits in the Athabasca Basin https://t.co/3raTLXPfu0

Andrew Nealx.com

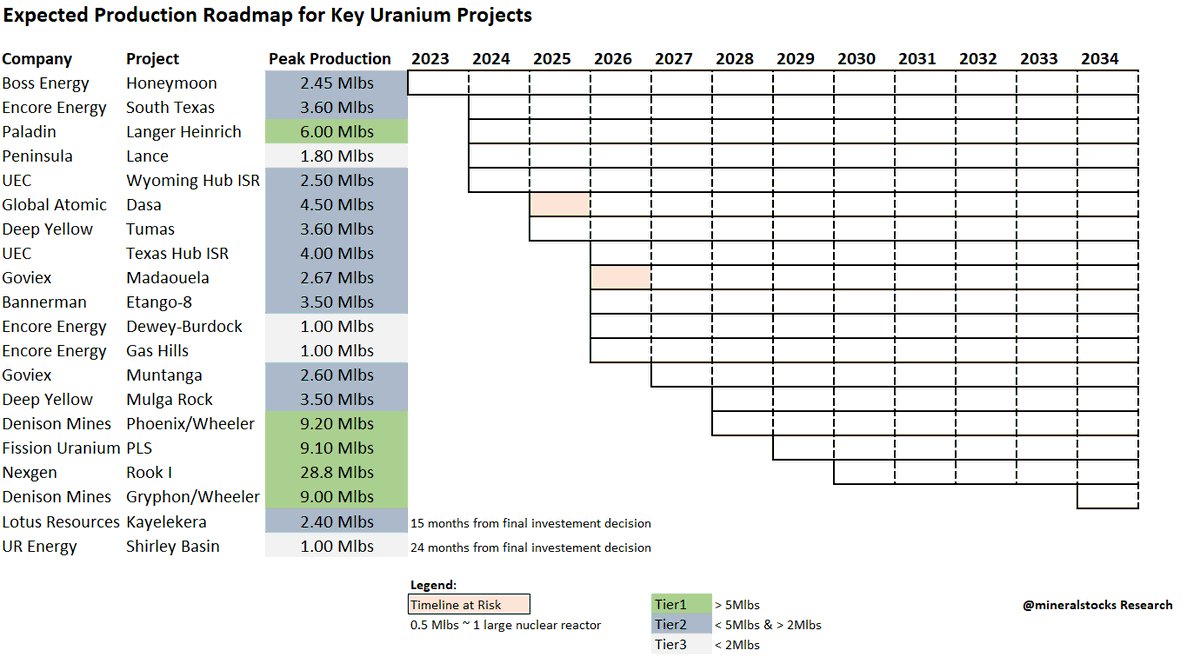

📊UPDATED Expected Production Roadmap for Key #Uranium Projects

I've gone through tons of investor presentations & analyst reports and aggregated the data to create a global roadmap.

The list might not be exhaustive, but should give good insights into the coming... See more

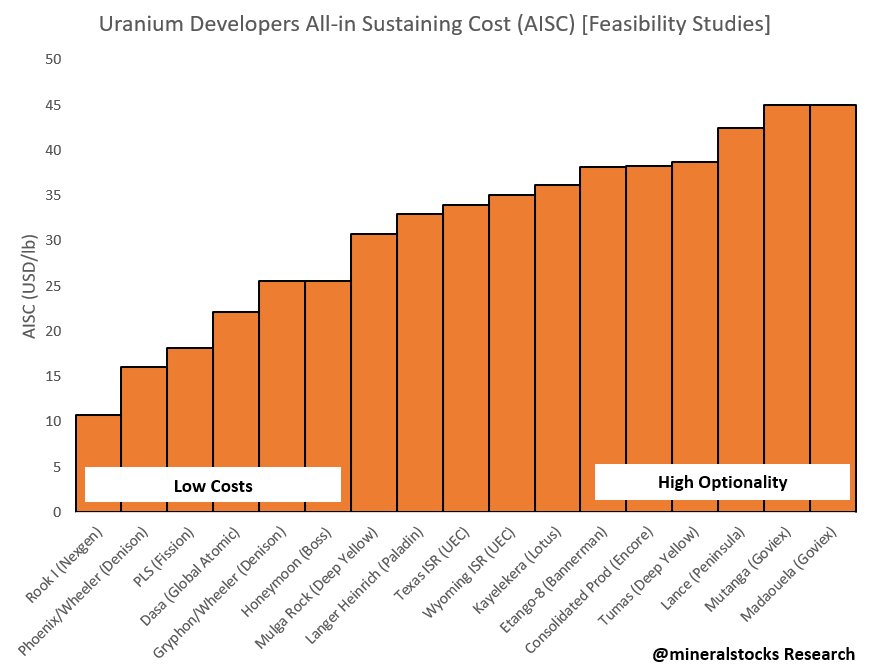

📊#Uranium Research: All-in Sustaining Costs (AISC) of Uranium Developers.

I've gone through tons of investor presentations & analyst reports and aggregated the data to create a global overview on reported costs for developers that plan to go into production this decade.

🧵1/5... See more

Is Kazatomprom becoming "The OPEC of Uranium"?

Kazatomprom quietly partnered with the nation’s Sovereign Wealth Fund to build a Strategic Uranium Reserve (A SUR Thing)...

That now has plans to purchase $500 million dollars of physical uranium.

Think about the... See more

My portfolio...

1. F3Uranium 39%

2. Energy Fuels 17%

3. Hercules Silver 11%

4. Denison Mines 10%

5. First Majestic 5%

6. Abra Silver 3%

7. Wheaton Prec. Metals 3%

8. Anfield Energy 2,5%

9. Ur Energy 2,5%

10.... See more

Uranium and Commodities watcherx.com