Sublime

An inspiration engine for ideas

Not advice but these folks own the only neodymium mine in the USA https://t.co/FbWVtc85TO

🎧Physical #Uranium trader Per Jander from @WMC_Energy is back for part 2 of @Sprott's 'All Eyes on Uranium"📻⚛️⛏️👀 to discuss recent production guidance from Kazatomprom & Cameo and the overarching structural supply deficit (with Transcript📄🧐)🗜️🤠🐂

▶️https://t.co/vhXuX0piuC https://t.co/w29YaAC4Zf

Uranium Price

cameco.com

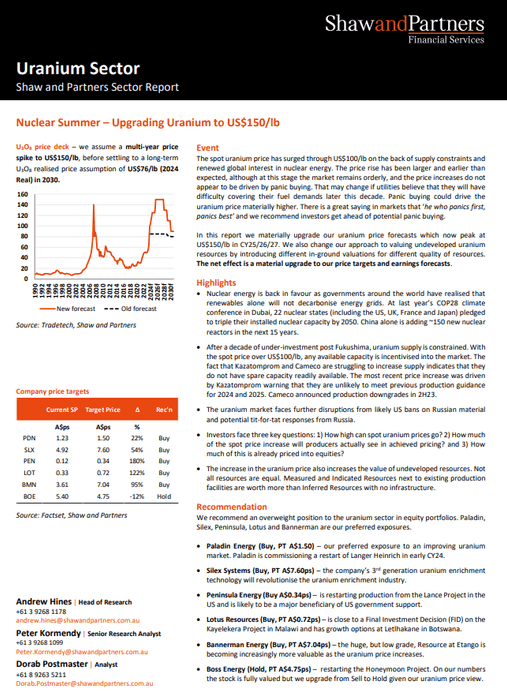

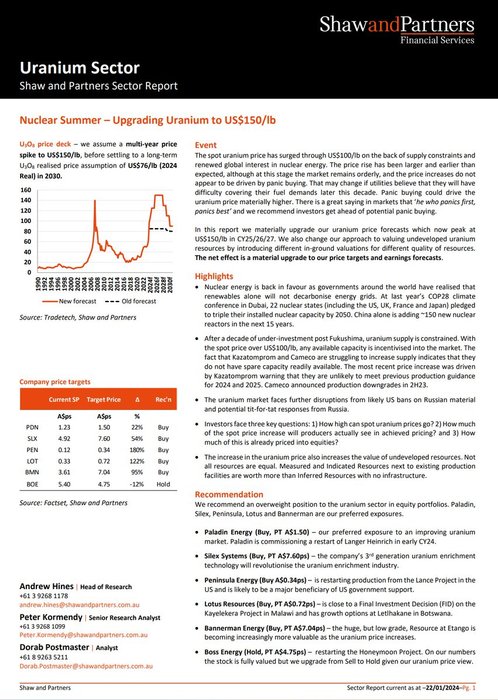

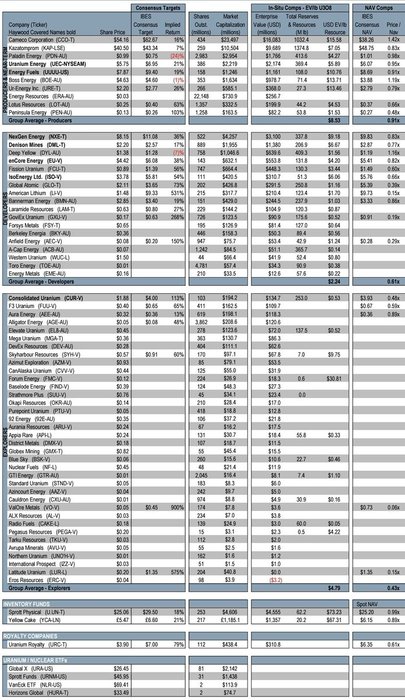

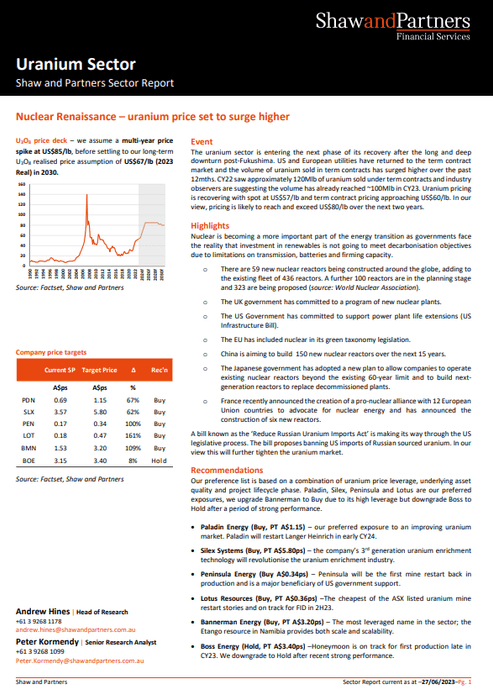

Latest #uranium sector research from Shaw & Partners, upgrading price forecasts to US$150/lb and highlighting a structurally under-supplied market.

@Lotus_Resources $LOT named as a preferred exposure in the below, Buy & $0.72/share target 📈 https://t.co/lqYSmr9VtR

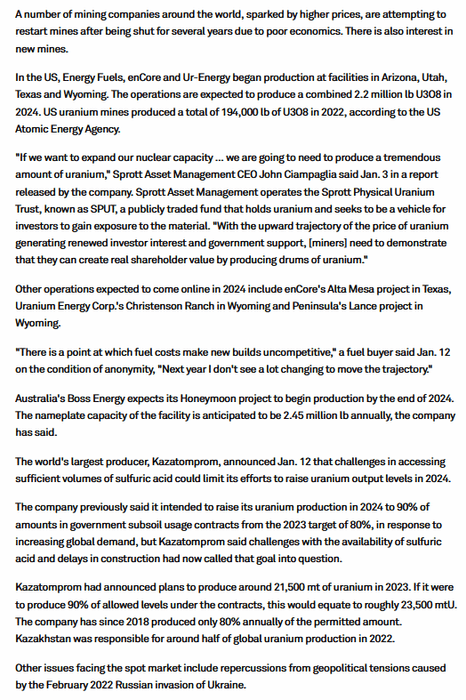

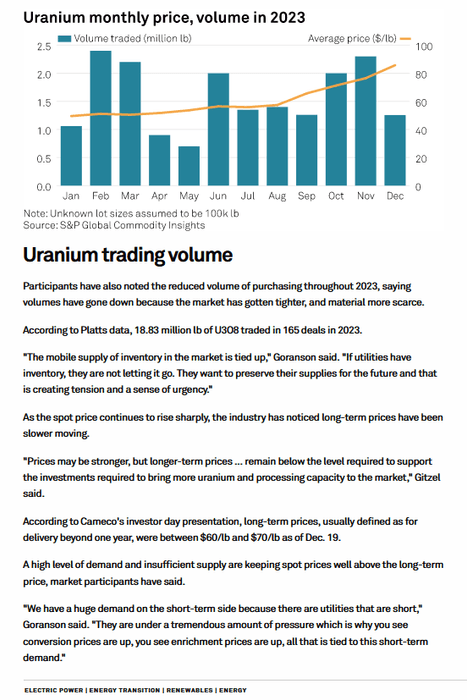

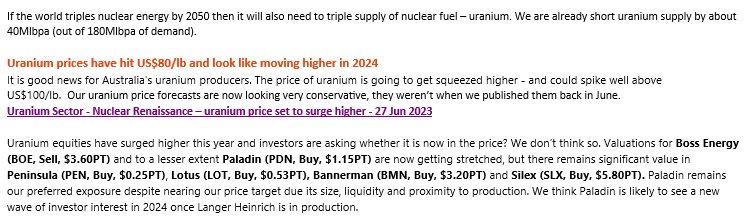

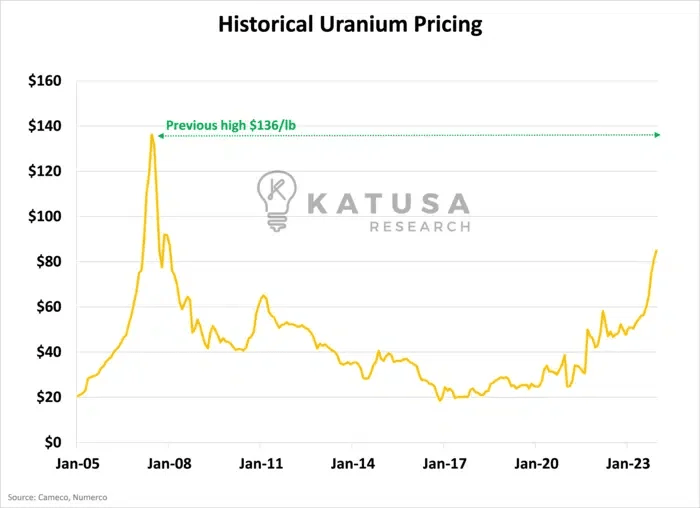

Everyone is talking about #uranium, and we've seen prices rising above $100/lb due to global supply constraints and renewed interest in #nuclearenergy. In Shaw and Partners' latest Uranium Sector report they predict a peak of $150/lb in CY25/26/27.

How high do you think prices can go?

Worth noting, in... See more

⚡️@SPGCI are Commodity Specialists.⛏️🧐 In their 2024 Outlook for #Uranium🔮👀 they lay out the main drivers supporting the bullish case for #investing in U #mining #stocks this year:🧑💼

👉#Nuclear fuel buyers are looking to new production to help mitigate the growing supply-demand imbalance but that's being hampered by supply chain... See more

⚡With a #CarbonFree #Nuclear Renaissance boosting #Uranium price & demand🌄⚛️🏗️⏫ just as #U3O8 is in a supply deficit⛏️⏬ with rising risks to supply security🇷🇺🇳🇪 26 October Bloomberg Consensus Estimates & Targets🎯can help point U to undervalued U #mining #stocks🛒💎 🤠🐂🌊🏄♀️ https://t.co/CZRAXylrkz

Shaw & Partners Head of Research Andrew Hines discusses #uranium outlook in desk note this week.

"Our uranium price forecasts are now looking very conservative, they weren’t when we published them back in June... There remains significant value in Lotus $LOT (Buy, $0.53 PT)."⬇️ https://t.co/K07R3x76l0

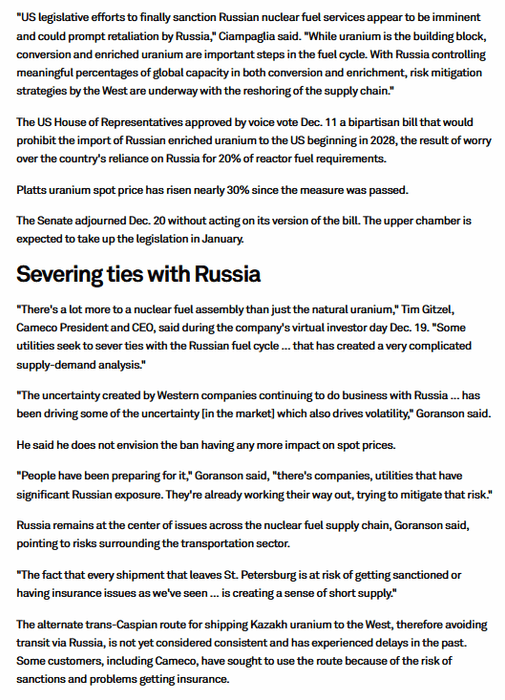

Is Kazatomprom becoming "The OPEC of Uranium"?

Kazatomprom quietly partnered with the nation’s Sovereign Wealth Fund to build a Strategic Uranium Reserve (A SUR Thing)...

That now has plans to purchase $500 million dollars of physical uranium.

Think about the... See more