Sublime

An inspiration engine for ideas

Uranium…saying this as someone who bought $21.50/lb in the physical market in early 2018 and was able to get a million pounds on without getting the spot price over $23/lb

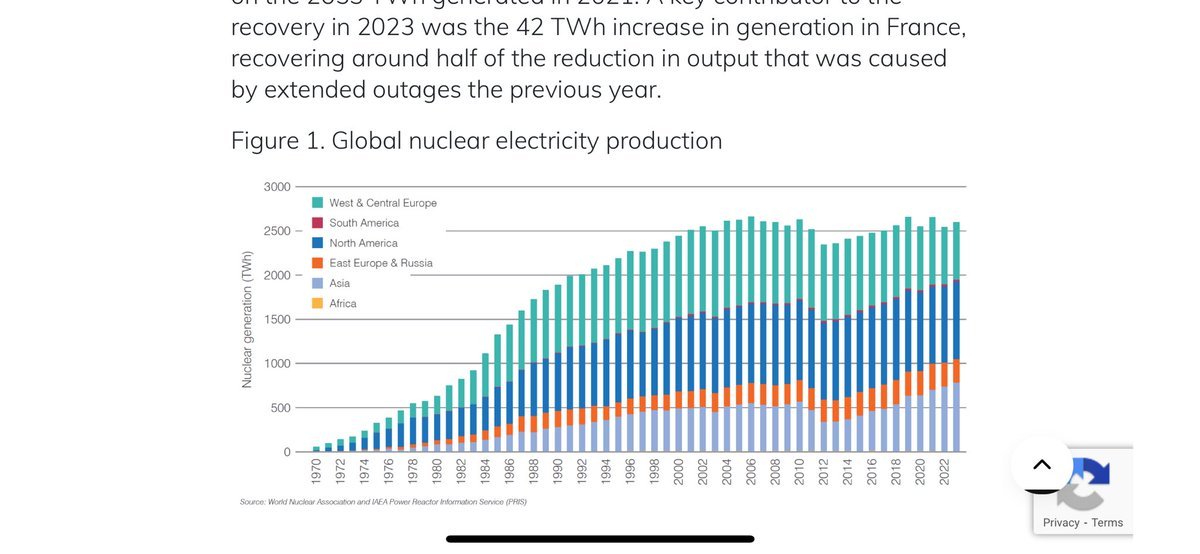

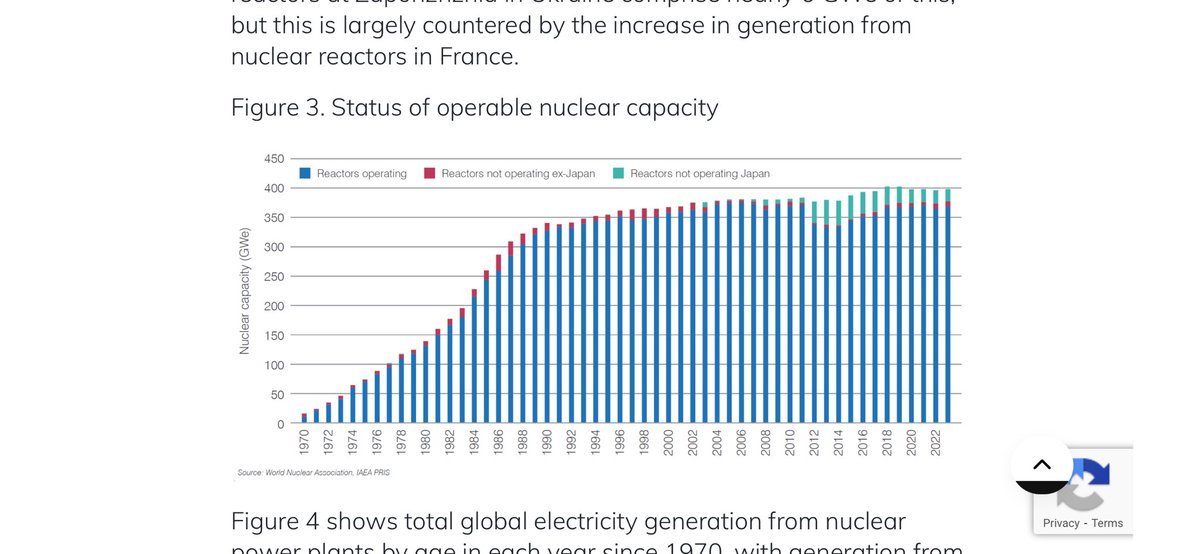

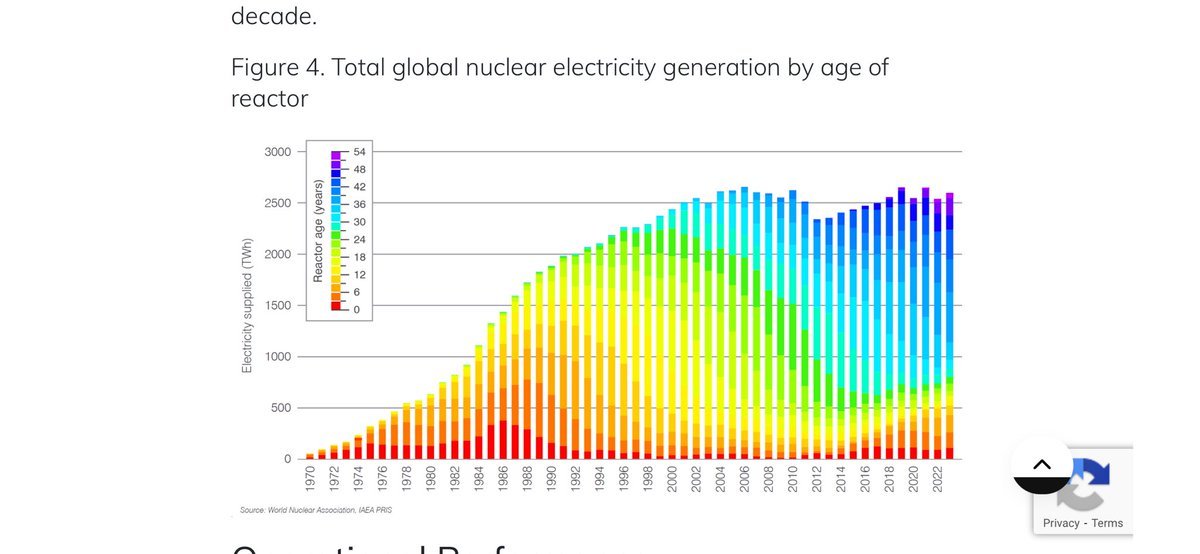

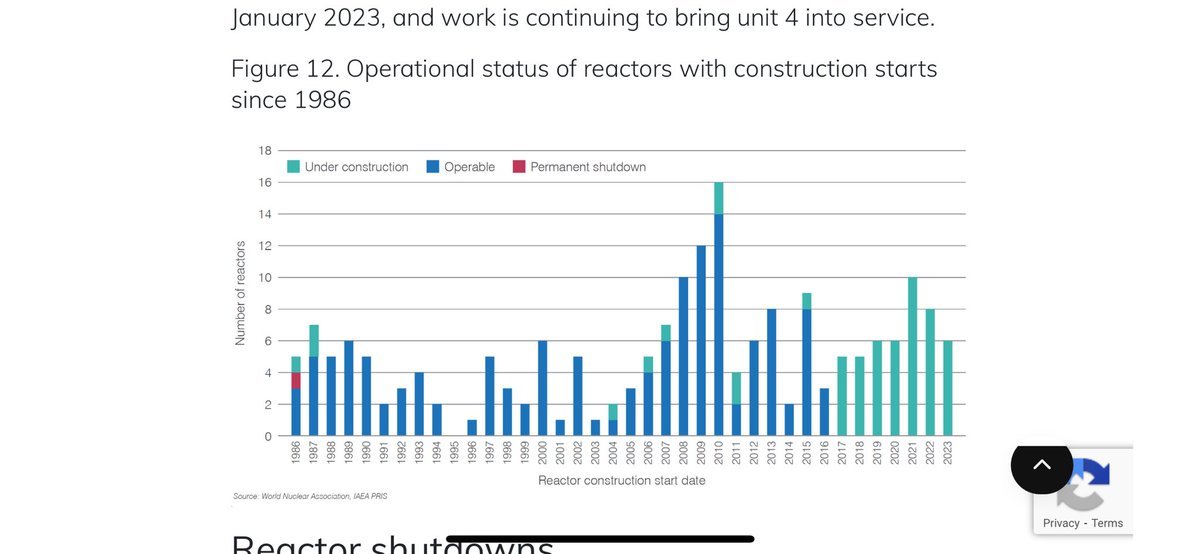

Where is the actual demand growth?

Where are the new reactors?

Look, I get the koala hasn’t been one with... See more

Brian Curran

@brc

"A well-chosen basket of, say, 10 of the highest quality #uranium juniors, I suspect, will be a five-year triple from here."

Rick Rule Rhetoricx.comRon Mills

@ronmills

Gyroid

@thegreatstinker

Ultra Safe Nuclear

usnc.com

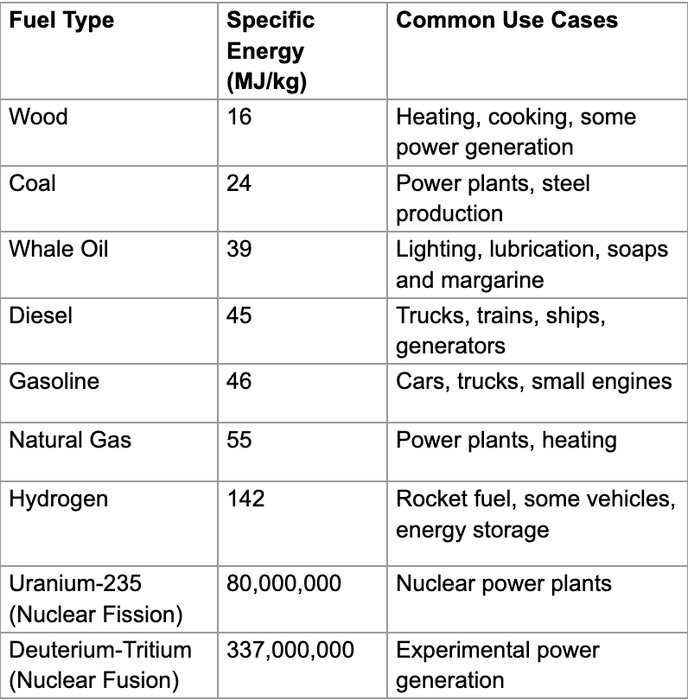

One way to compare different fuels is by "specific energy", or energy (mega-joules) per unit of mass (Kg).

From this lens, humanity's development traces ever more energy dense fuels.

Why the HUGE jump at Uranium-235?

Some reactions are better than others. (1/)... See more

If you have 20 minutes today, listen to our discussion with Grant Isaac and what he thinks of M&A in the #uranium sector and if #energy or #utilities would get involved.

James Connorx.com