Sublime

An inspiration engine for ideas

Investing is Just Answering a Series of Questions: Explaining the Reverse DCF

Speedwell Researchspeedwellmemos.com

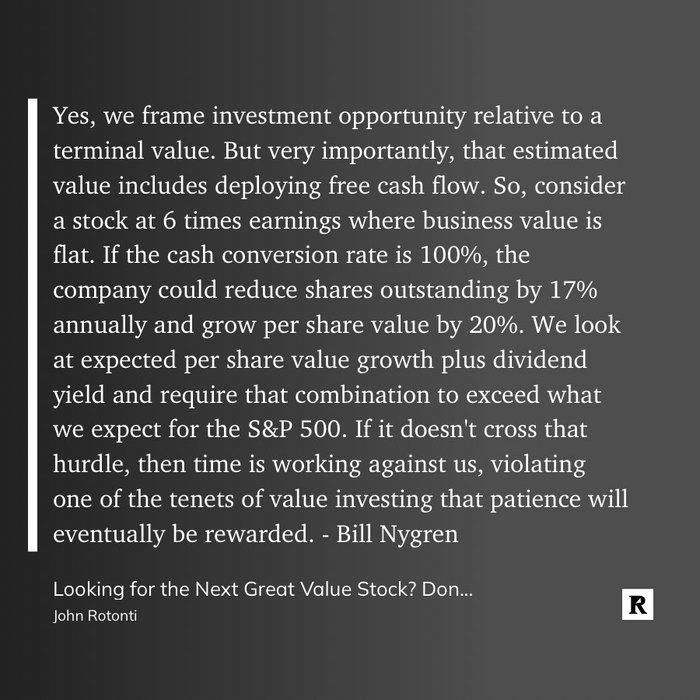

Framing investment opportunities relative to terminal value https://t.co/ZZZRls7VLP

MBOO analysis revealed that the sales reps were systematically destroying value by bidding too low, which increased their chance of winning the business but reduced the profits to the company

Guhan Subramanian • Dealmaking: The New Strategy of Negotiauctions (Second Edition)

This is by Todd Combs in the latest edition of Security Analysis. I wonder how he did this since the formula for this calculation doesn't work if growth rate > discount rate? https://t.co/HpL0pbP5kQ

Gentleman’s Idea #1:

Stonex Group $SNEX

Allocation: $30,000

Current Price: $98

Target: $120

Stonex Group, preciously INTL FC Stone, is a sleepy Futures Brokerage that has rapidly evolved into one of the largest agricultural and metals... See more