Sublime

An inspiration engine for ideas

10 SIGNS OF A GREAT COMPANY

People love working there

Dynamic leadership

Purpose driven

10-year vision

Very large market

Explorer mentality

Product > marketing

Growth mindset

Financial... See more

Tom Gardnerx.com

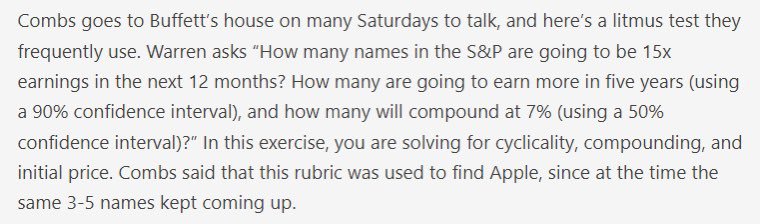

Todd: “Warren, I have a new company that likely clears our hurdle. We used to own it back in 2011. We made a quick 50% on the stock. It’s Dollar General.”

Buffett: … https://t.co/6j16vwZKmk

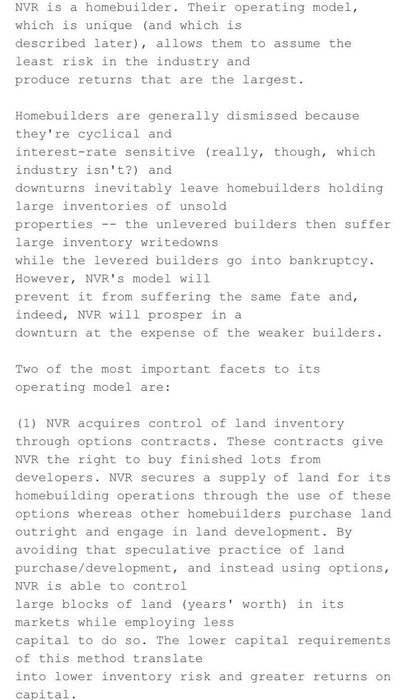

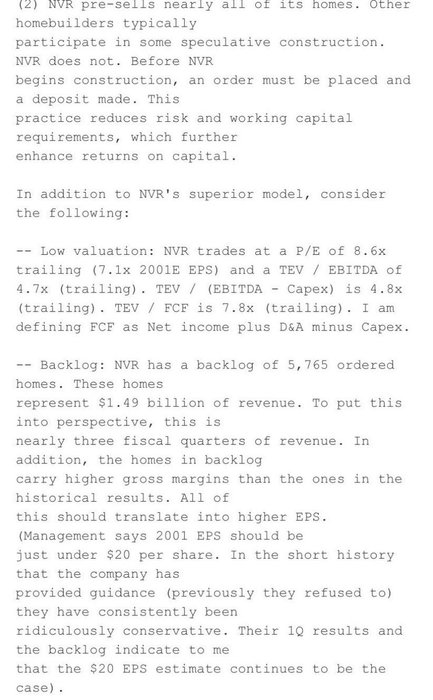

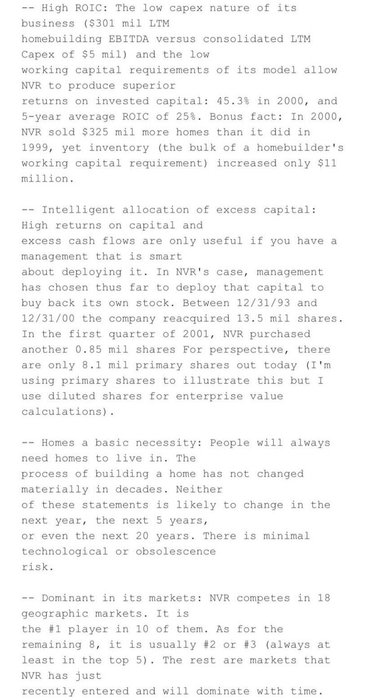

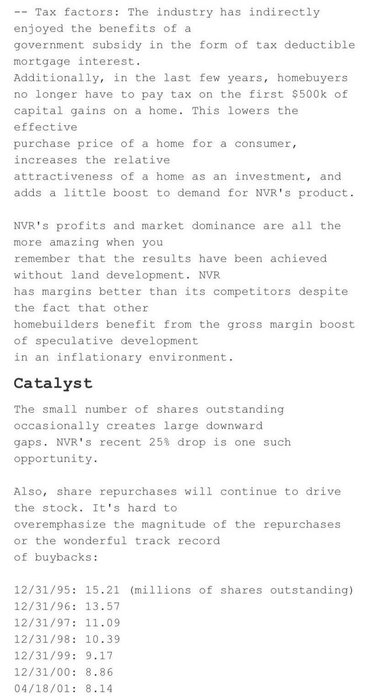

Joel Greenblatt would always hand out charlie479’s(Nobert Lou) first three write ups to his students a Columbia to show them what a brilliant investment thesis looks like.

Here is one of the VIC write ups that Joel Greenblatt hands out to his students:

$NVR https://t.co/HiemeJWYtL