Sublime

An inspiration engine for ideas

The IMF have their eyes on Britain. They’re very likely preparing to take over when the money starts to run out. Good chance the UK ends up in the hands of the IMF by 2030. 🇬🇧 https://t.co/qFbu38AFf0

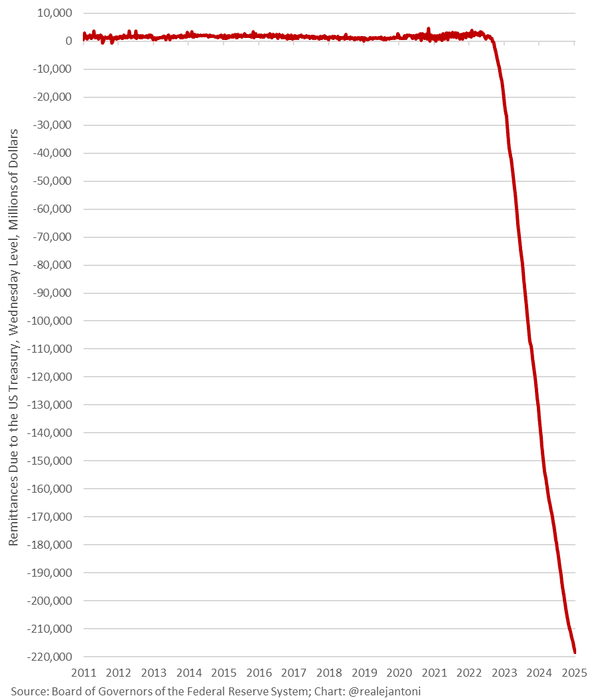

Trump is inheriting a Federal Reserve w/ not only unprecedented losses of $218 billion, but it's still losing money; the Fed won't send the Treasury a dime for the entirety of Trump's term; that's never happened since the inception of the Fed - another challenge for Trump... https://t.co/8gUeVnW4nm

China has been steadily reducing its holdings of US Treasury securities (US government debt), while Europe helps compensate for the fall in foreign demand.

As the US makes Europe its vassal, the EU helps fund the US government, keeping yields manageable.

https://t.co/1sZckqYAxY https://t.co/SZabdh2h1g

The gov’t has about 48 hours to fix a-soon-to-be-irreversible mistake. By allowing @SVB_Financial to fail without protecting all depositors, the world has woken up to what an uninsured deposit is — an unsecured illiquid claim on a failed bank. Absent @jpmorgan @citi or @BankofAmerica acquiring SVB before the open on Monday, a prospect I believe to... See more

Bill Ackmanx.coma) cashless intra-bank and interbank transactions b) fractional reserve banking and c) central bank monopolies on note issue, the very nature of money evolved in a profoundly important way.

Niall Ferguson • The Ascent of Money: A Financial History of the World: 10th Anniversary Edition

Geoeconomic Pressure

The study explores geoeconomic pressure, utilizing large language models to analyze firm responses to policies like tariffs and sanctions, highlighting the impact of both implemented actions and future threats on business behavior.

globalcapitalallocation.s3.us-east-2.amazonaws.comAmerica is in big trouble, no matter who wins this election. Why? Consider these numbers. Direct transfer payments made by the Feds = $3.8 trillion. That’s 48% of all Fed spending. These payments go to 67m Americans. However, only about 70m Americans pay any meaningful amount of income tax and those taxes only raise $2.3 trillion. And that’s not... See more

Porter Stansberryx.com21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19