Sublime

An inspiration engine for ideas

Are you familiar with $CBOE? Cboe started the first marketplace for listed options back in 1973, and is still today a clear leader in derivatives trading.

Looking back over the last two decades, Cboe has compounded its revenue and EBIT at a 17% and 21% CAGR respectively 👀

It's worth noting... See more

Introducing Open Rates

I managed to sell over $250,000+ of ads in 60 days.

Not many people can do that. But now YOU can.

Open Rates is a tool i've created with @0xSamHogan that's here to help you:

👉 Find and close companies actively... See more

Wouter Teunissenx.com

Literally $99 for 1,000s of hours of education.

OR

$250 to get access to all of the portfolios, positions, trades and education.

That's where I got the pico top of $SPX and began my crusade against credit.

These are perfect conditions... See more

I bought some $PLTR $85 puts last Friday, expiring today. Sold them at a +400% profit on Tuesday.

If I had held them until today and sold on open, I’d instead made 13.8x. But if I had held them until today’s close, I would have lost -53%.

Lesson: Options are volatile. 🤷♂️

Wasteland Capitalx.com

John Zito is a Partner and Deputy CIO of Credit at Apollo, overseeing the firm’s global Credit business and team (which makes up ~$450bn of Apollo’s total ~$630bn AUM). John is also a member of the Firm’s Leadership Team. Apollo’s platform spans the full financing universe across public and private markets, including corporate credit, direct... See more

$4,000 is the number

Once you have that much in a brokerage you can product $7-10 a month in option income.

Thats taking into account 2-4 trades a month at low deltas & minimal effort.

Then life goes on easy mode.

Sound Dobadx.com

4/ Options

I like to use Short-Term profits to create Long-Term investments

Main way I do this is by utilizing options

Prospero has been a KEY to helping me with timing options

It helped me locate a $TSLA trade higher before it even... See more

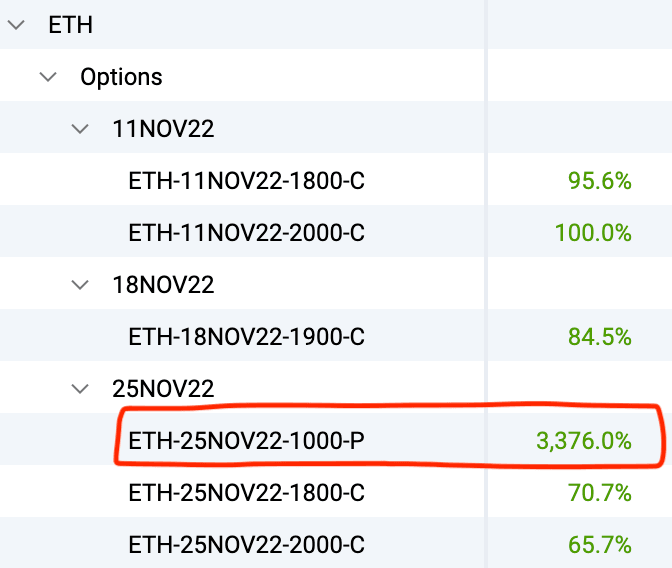

How I used options to hedge the FTX implosion making 3376%🤯 on the trade (even before Arthur Hayes👑)

and how YOU can use them to protect yourself against black swans🦢 events

🧵 on option basics and execution https://t.co/JXyiXXlF1K

Investors

Ben Moe • 3 cards