Sublime

An inspiration engine for ideas

For Seed investors in 2024, only 2 Things Matter: (1) Survivability and (2) Optionality for ‘Infinite Outcome’… https://t.co/NDac5ouseA

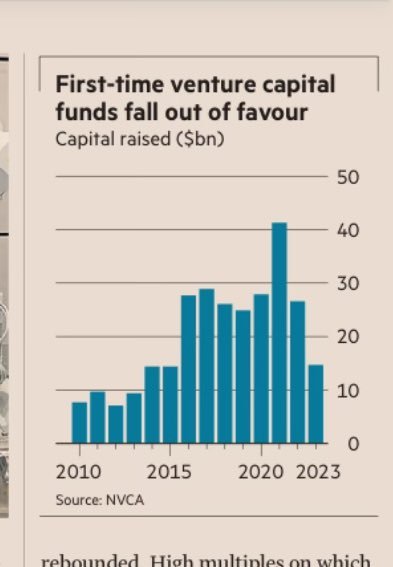

First-time VC funds fall out of favor

New GPs from past 3-4yrs will race to raise hoping LPs will re-up on paper marks + stories to give them a chance at a 2nd fund

a FEW will convince

MOST will shut down––

with I predict less than $6B total raised in each... See more

Acquiring lower-middle market companies is the best opportunity to build wealth right now.

Here’s how Permanent Equity’s 2023 shareholder letter explained the opportunity:

- The market is huge: There are 350,000 US companies classified as lower-middle market ($5m to $100m in annual... See more

More firms are incubating companies as early-stage valuations rise.

A few successes:

• Snowflake ($49B mrkt cap) by Sutter Hill Ventures

• Affirm ($6B mrkt cap) by HVF Labs

• Hims & Hers ($1.3B mrkt cap) by... See more

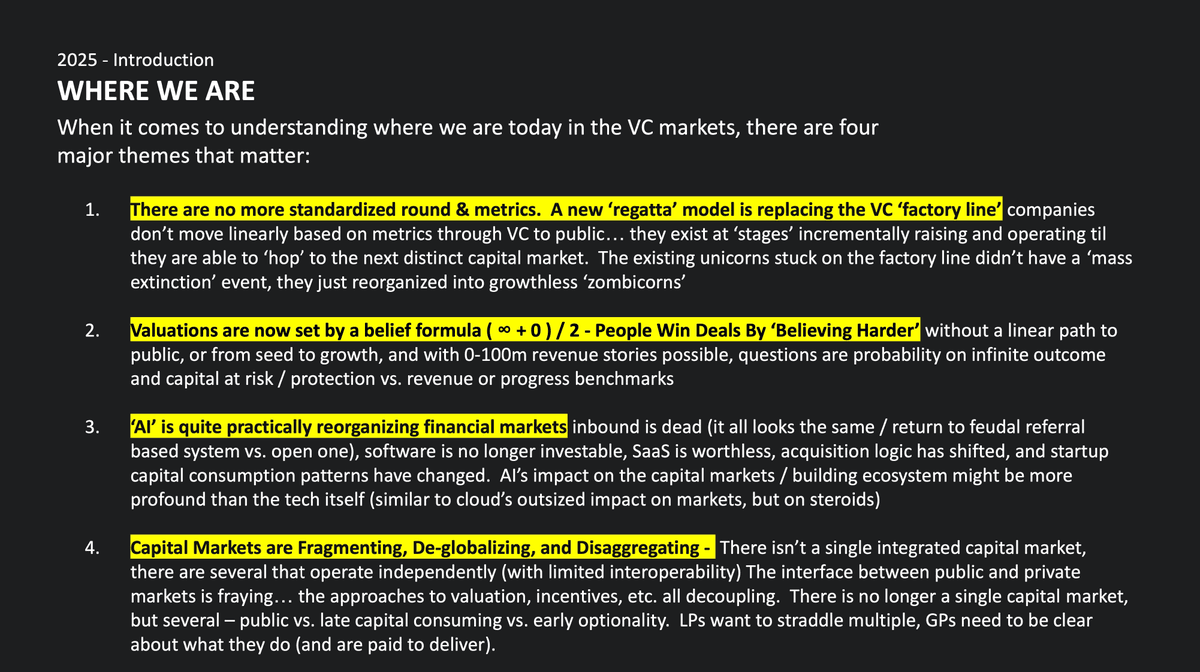

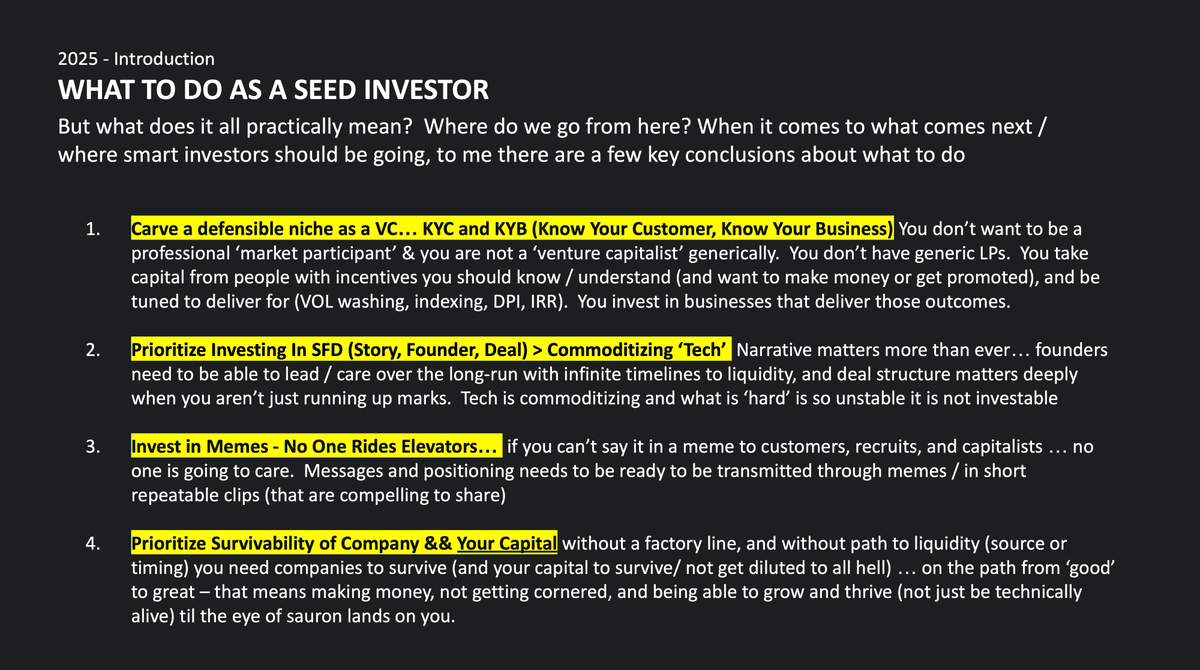

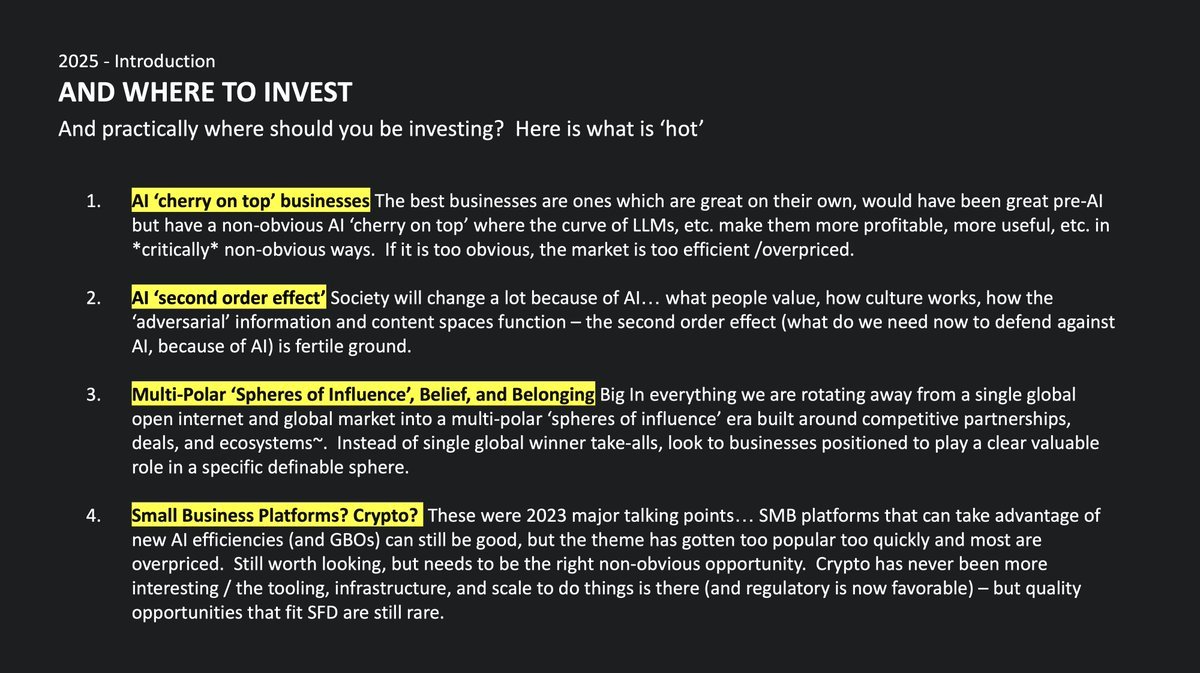

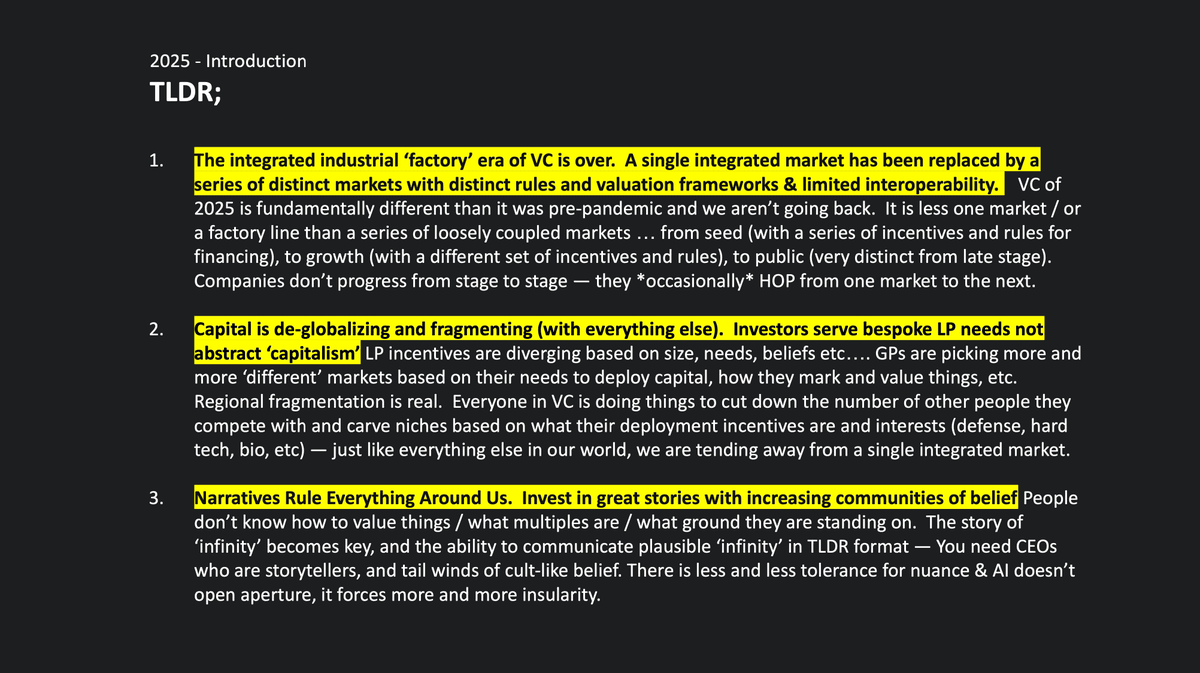

The state of VC in 2025. Where we are, where we are going, and where to invest ... https://t.co/NvOOYzeEpG https://t.co/cbXha8w19L

"We help companies build, survive, and scale, but one of the main components of my job is understanding how and when the world is going to change. Our portfolio is a collage of various futures that we believe in, and our capital and expertise are assets to hopefully pull these futures forward."

Kyle Harrison • Markets, Markets, and Markets

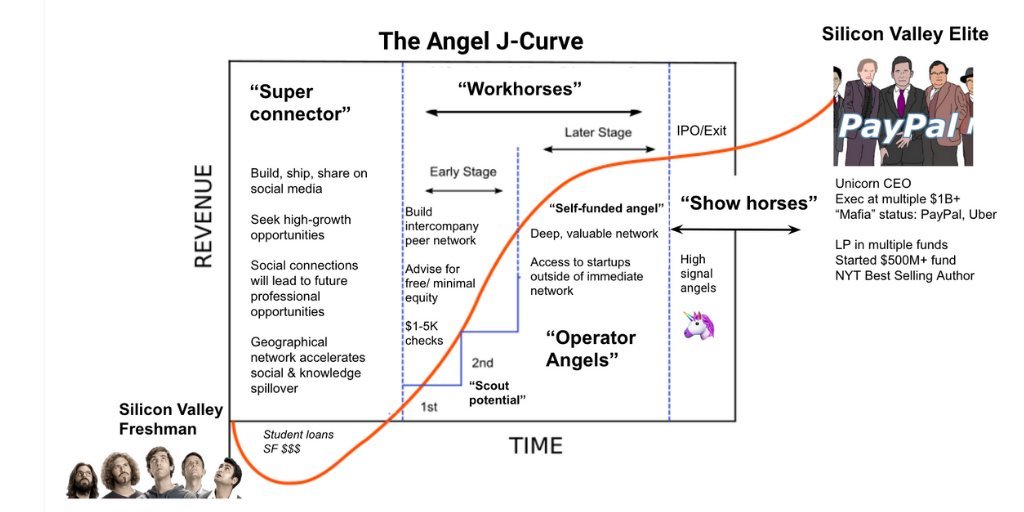

After 12+ months of research, dozens of angel dinners and a new micro-fund:

The Angel J-Curve is a framework for operators w/ tactical advice to build & scale your angel portfolio

We need more “triple threats” who operate, angel invest & have a beat!... See more

75M baby boomers will retire by 2030.

8 tools for finding and buying their businesses (before someone else does):

Codie Sanchezx.com