Sublime

An inspiration engine for ideas

On Bullshit

The document discusses the nature and prevalence of bullshit, distinguishing it from lying and exploring its connection to skepticism and the pursuit of personal sincerity.

www2.csudh.eduI know how many times you have sacrificed your present pleasures for the long-term good of your company,

Rabbi Daniel Lapin • Thou Shall Prosper: Ten Commandments for Making Money

In 2001, Warren Buffett gave a talk at the University of Georgia.

He asked them the most Warren Buffett question ever:

• If you could invest in a friend and get 10% of their income for life -- who would you pick?

Once the students answered the question, he then a... See more

Mr Brooke’s conclusions were as difficult to predict as the weather: it was only safe to say that he would act with benevolent intentions, and that he would spend as little money as possible in carrying them out. For the most glutinously indefinite minds enclose some hard grains of habit; and a man has been seen lax about all his own interests exce

... See moreRosemary Ashton • Middlemarch

He is both well liked and very intelligent. He is also very rich. I consider his annual “Chairman’s Letter” (in the Berkshire annual report) to be indispensable reading for anyone wanting to do well in business.

Rabbi Daniel Lapin • Thou Shall Prosper: Ten Commandments for Making Money

Do all the other things, the ambitious things — travel, get rich, get famous, innovate, lead, fall in love, make and lose fortunes, swim naked in wild jungle rivers (after first having it tested for monkey poop) – but as you do, to the extent that you can, err in the direction of kindness. Do those things that incline you toward the big questions, ... See more

George Saunders • “Failures of Kindness”

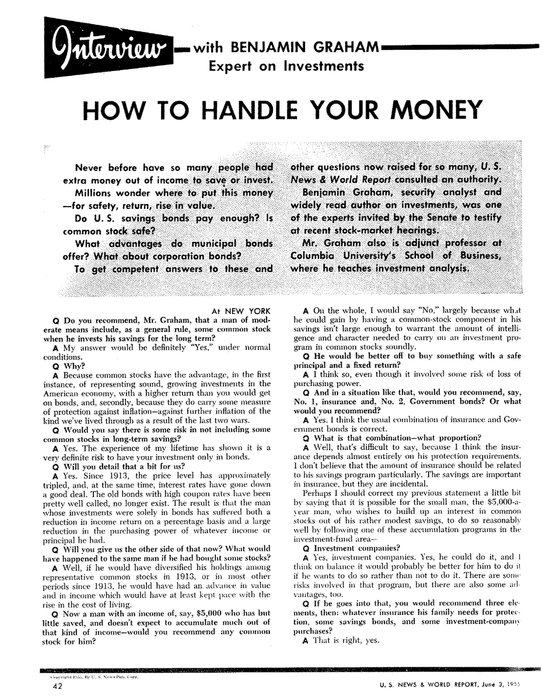

The best report Benjamin Graham ever wrote?

How to handle your money.

I am sharing this 7-page masterpiece with you today: https://t.co/wUdxOsSgqU

Well I think I've been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I've underestimated it. And never a year passes, but I get some surprise that pushes my limit a little farther.