Sublime

An inspiration engine for ideas

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.com

The net worth of Ray Dalio, founder of Bridgewater Associates:

$22,000,000,000

Bridgewater is one of the biggest hedge funds on Earth.

How did it get so big?

A portfolio strategy 100s of PhDs developed over 10+... See more

This is pretty disruptive from Coatue and I like it very much.

As an LP I’m done paying 2/20 and having 10-12 year illiquidity for shit performance in venture capital. I spoke about this once on the All In pod and shared a table of the various/numerous funds where I’m an LP and their meager DPI as evidence. And those... See more

Chamath Palihapitiyax.com

This is Bill Perkins.

He's worth 100s of millions, a hedge fund manager, poker player, asymmetric thinker...

And my smartest mentor.

Steal his 7 principles on how the rich think differently: https://t.co/NWqJZAVMZY

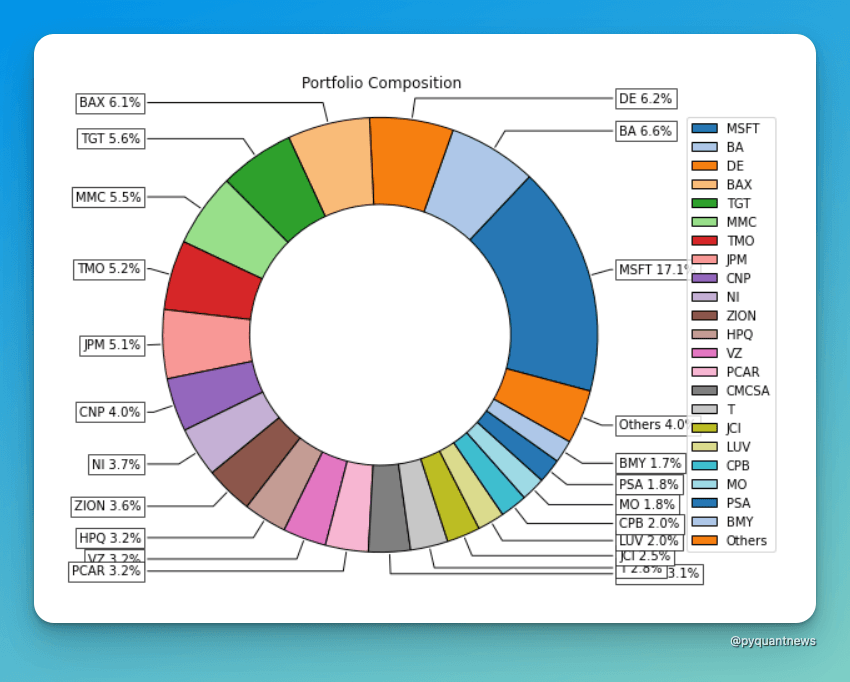

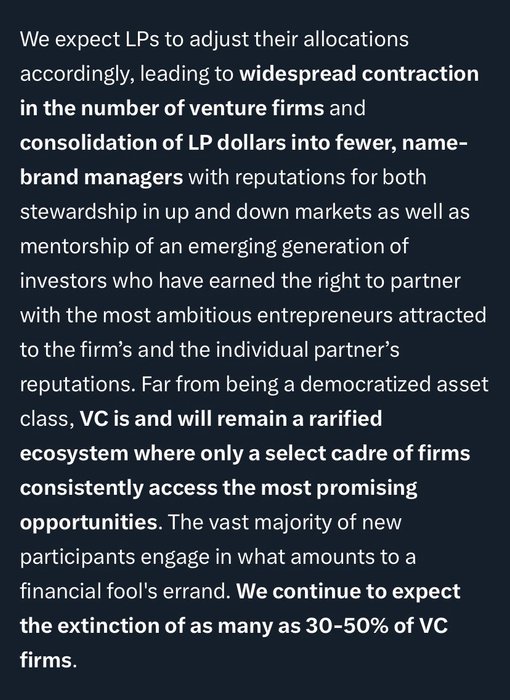

There are some important changes underfoot in private markets:

1. Returns are compressing - few funds are able to consistently achieve the necessary spread over the risk-free rate to justify fees and illiquidity.

2. LPs are segregating bi-modally: 1) a growing group of smaller family... See more

Chamath Palihapitiyax.comBill Ackman: "One thing I believe is that the private equity, venture capital and real estate portfolios are mismarked"

Ackman on Harvard and Yale endowment's exposure to private equity and VC. One of the best clips I have seen

From his recent interview at University of Austin... See more

Boring_Businessx.com

The concentration is already underway.

The five largest US VC funds captured 44% of new funding in Q1. It’s difficult to frame that as returning to a healthy status quo.

It’s worth considering the influence of a multi-stage brand name firm like Lux writing an open letter about the... See more