Sublime

An inspiration engine for ideas

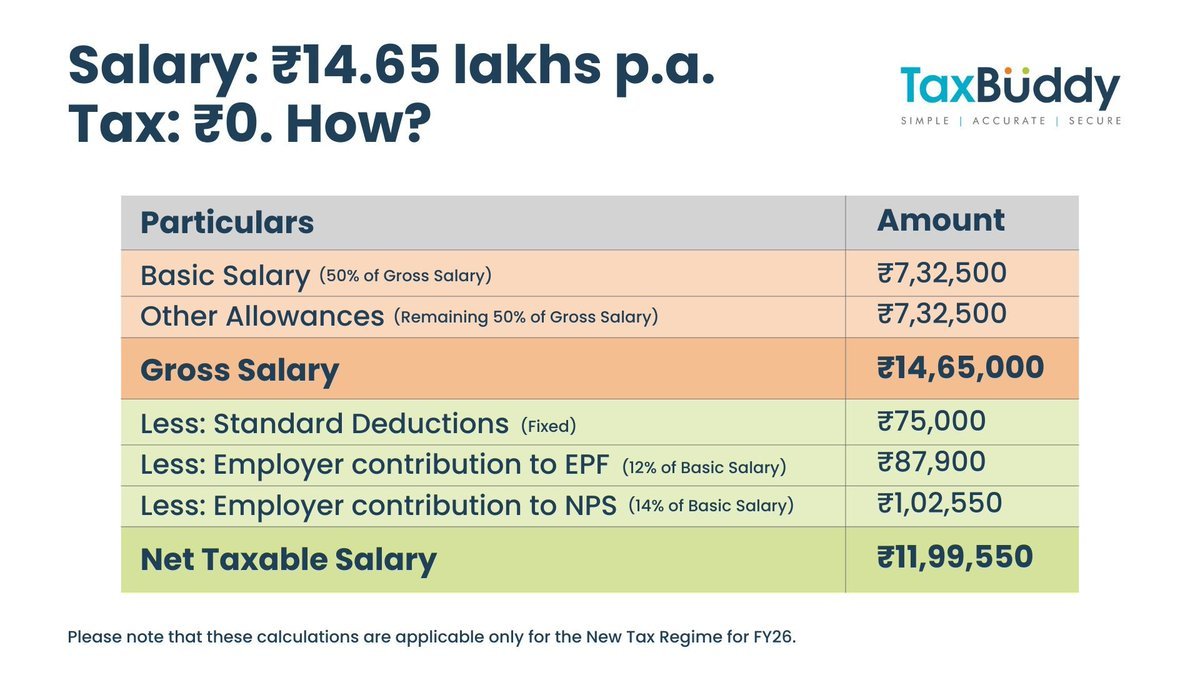

Thanks to the announcements made by the Finance Minister in Budget 2025, you can now enjoy a tax liability of ₹0 even with a salary of ₹14.65 lakhs per year. https://t.co/jHloiijNZy

Today, a new financial year begins.

What does this financial mean to you if you are salaried.

It means lower taxes & higher disposable income.

It also means greater responsibility.

You need to take full ownership for your future.

If you are earning less than 12 lakhs as annual... See more

Shyam Sekharx.com

As the final part of the financial year starts

Tax Saving investments become important

There are many other tax-saving investments available apart from Rs 150,000 available under Section 80C

A thread🧵on list of tax-saving instruments that can be used to save... See more

Mau Cerita tentang KOL perorangan & Pajak.

Kebanyakan KOL itu ingin terima duitnya nett & biasanya agency/pengguna kadang udah kesel dluan karna brand yang menggunakan jasa mayoritas brbentuk perusahaan yg berkewajiban motong pajak,

Pdhal ada cara lain biar KOL tetep dapet nett

Ahli Pembukuan 📚x.comINCOME TAX BREAKING: FM Sitharaman directs CBDT to withdraw tax appeals below ₹60L (ITAT), ₹2Cr (HC), ₹5Cr (SC) within 3 months.

This is a big move to reduce litigation and ease taxpayer burden.

CA Himank Singlax.com