Sublime

An inspiration engine for ideas

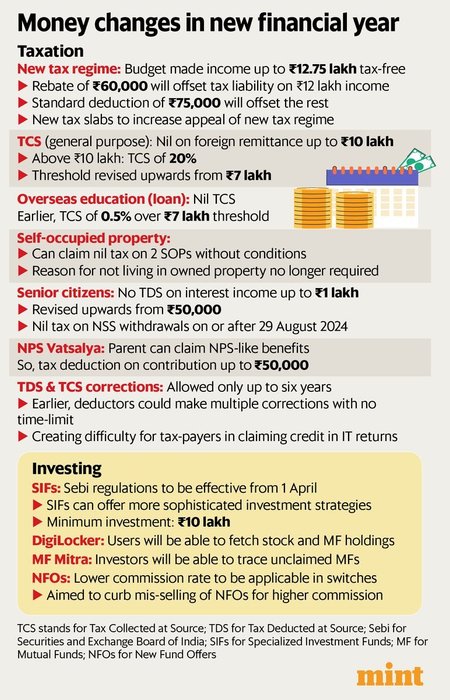

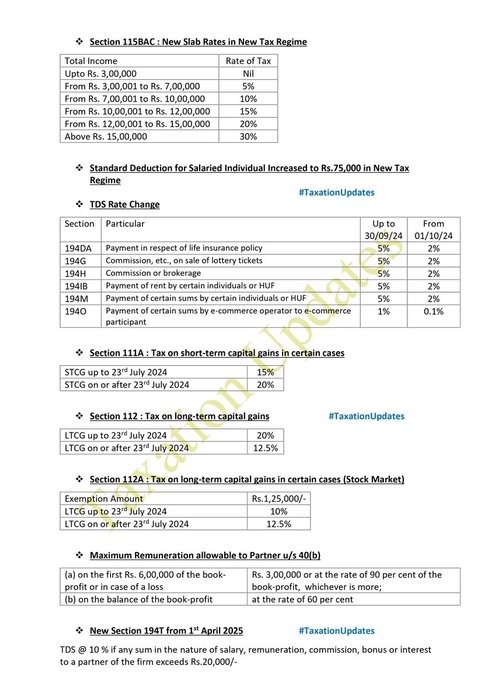

Short Summary of Some #Budget2024 Amendments

@FinMinIndia #TaxationUpdates https://t.co/eyF1gc75lu

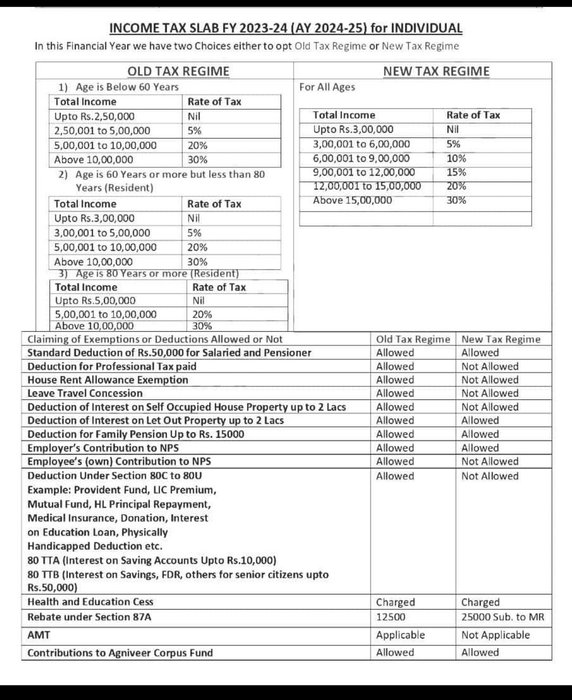

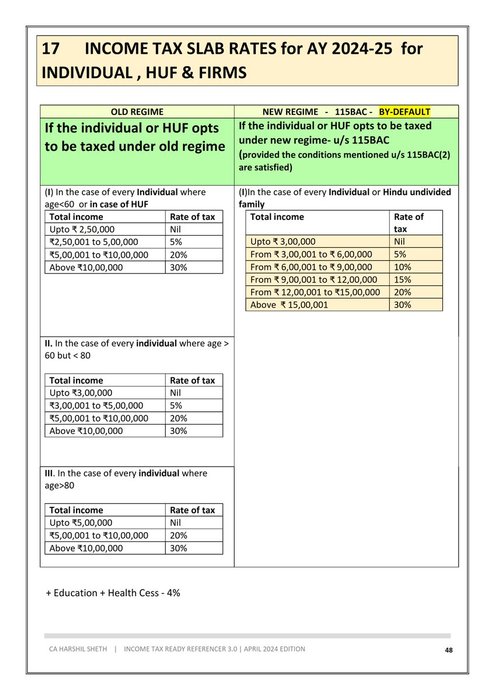

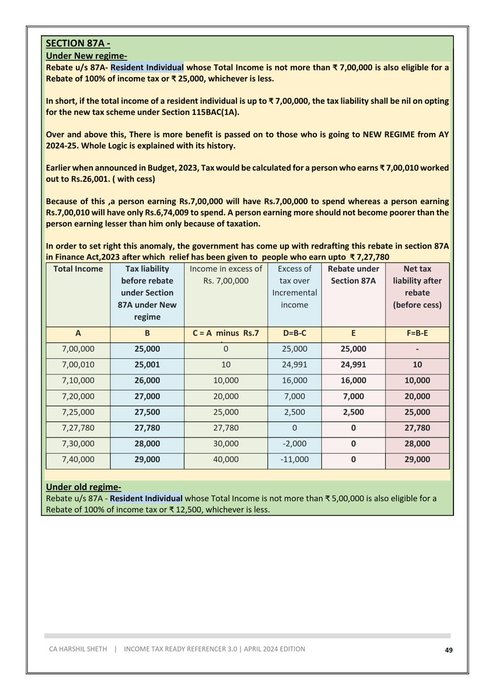

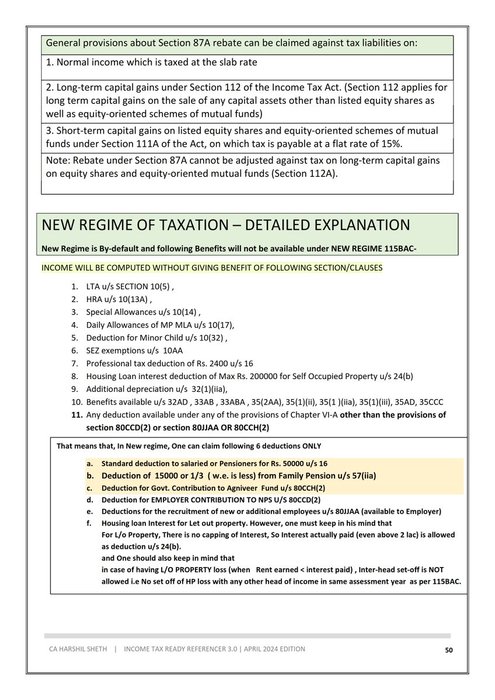

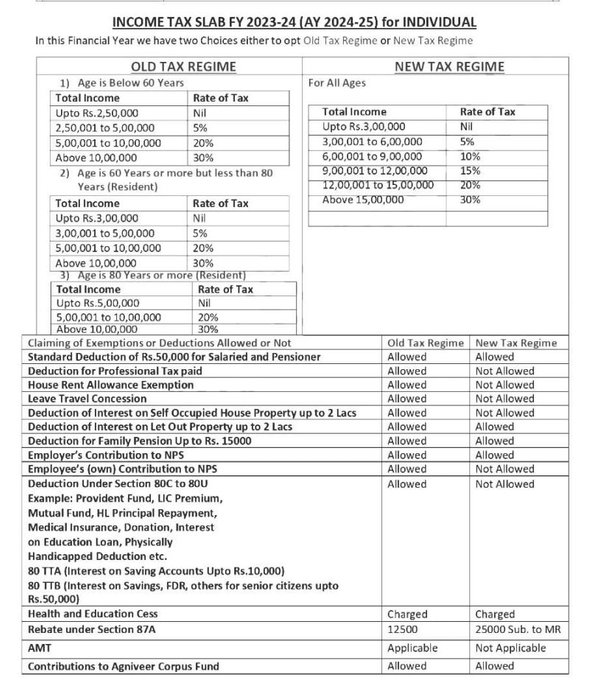

NEW REGIME FOR AY 2024-25- for Individuals

Most discussed topic for current year ITR

Everything under 4 slides - check slide 1 to 4

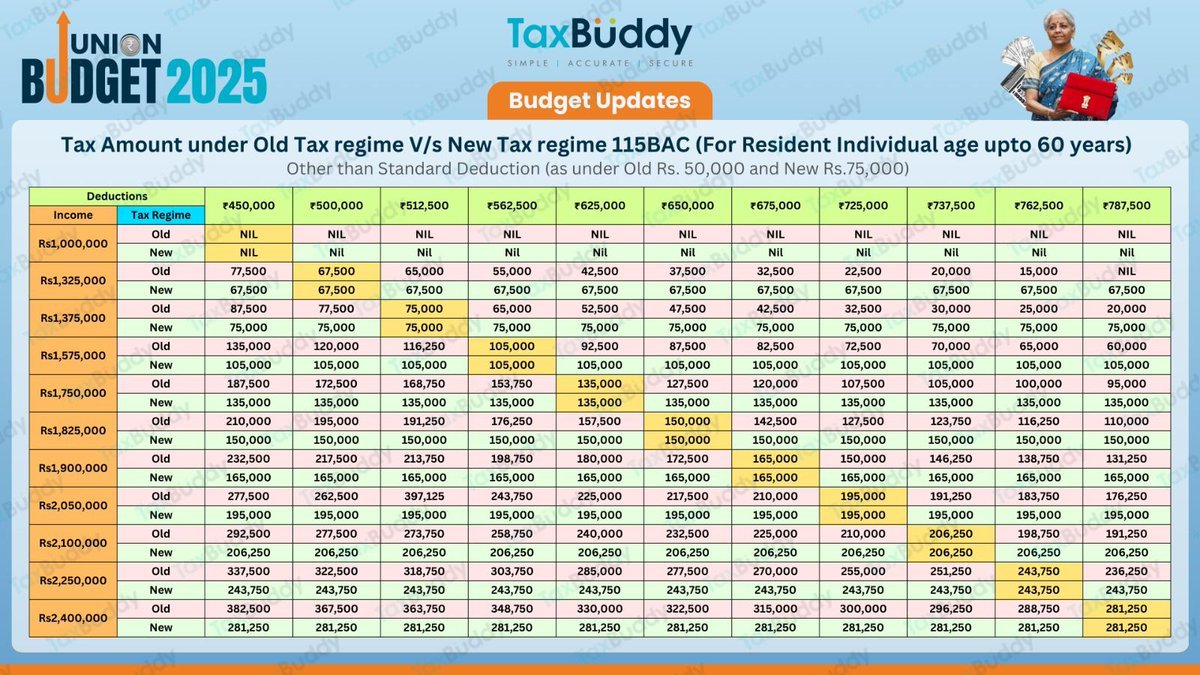

Check Tax amount under Old vs New regime comparsion at different Income & deduction level in comment... See more

Answering the million-dollar question: Old regime or new regime?

Here's a table that answers all your questions

For example, at ₹13.25 lakhs of income, you'll need more than ₹5 lakhs of deductions in old regime to pay less tax than new regime

Retweet to spread... See more

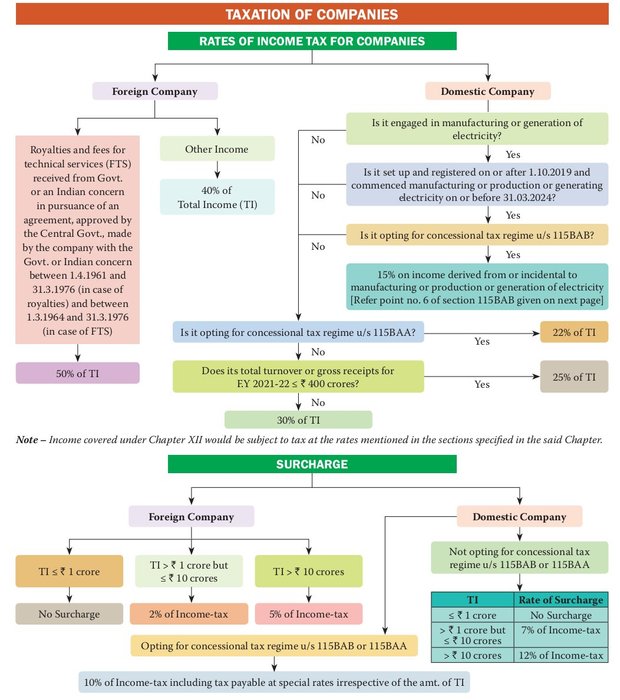

Income Tax Rates and Surcharge Rates for #Companies

Source @theicai #IncomeTax https://t.co/Ay9hXOfCoa

Comparative Analysis of Old Tax Regime vs New Tax Regime under Income Tax Act, 1961.

Helpful for filing ITR https://t.co/a3aN3mTR5V

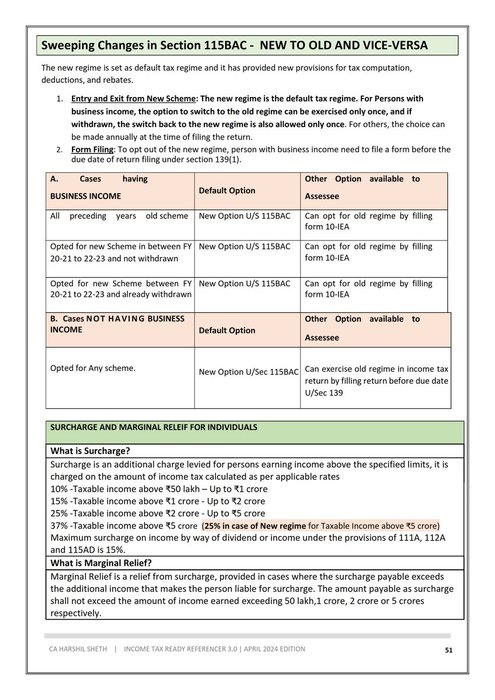

New Tax vs Old Tax regime

Now that the New Tax regime has been made the default regime, taxpayers who wish to shift back to the old regime, must now fill a brand new form called Form 10-IEA.

Fill this form by July 31.

This form asks for more details than... See more

Kayezad E Adajaniax.com