Sublime

An inspiration engine for ideas

Study

Sophia Morrison • 1 card

Anton Brevde

@antonbrevde

Take a close look at the table below 👇

$IBIT bought 100% of newly mined Bitcoin since March & bought another 150,000 Bitcoin from willing sellers. There will be business school case studies written about this ...

HODL15Capital 🇺🇸x.com

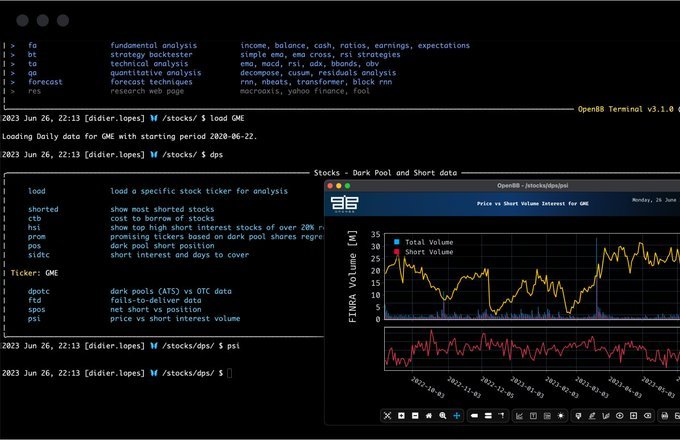

OpenBB: A free alternative to the $20,000 Bloomberg Terminal

Available 100% free on GitHub: https://t.co/nFpAe8Q2t2

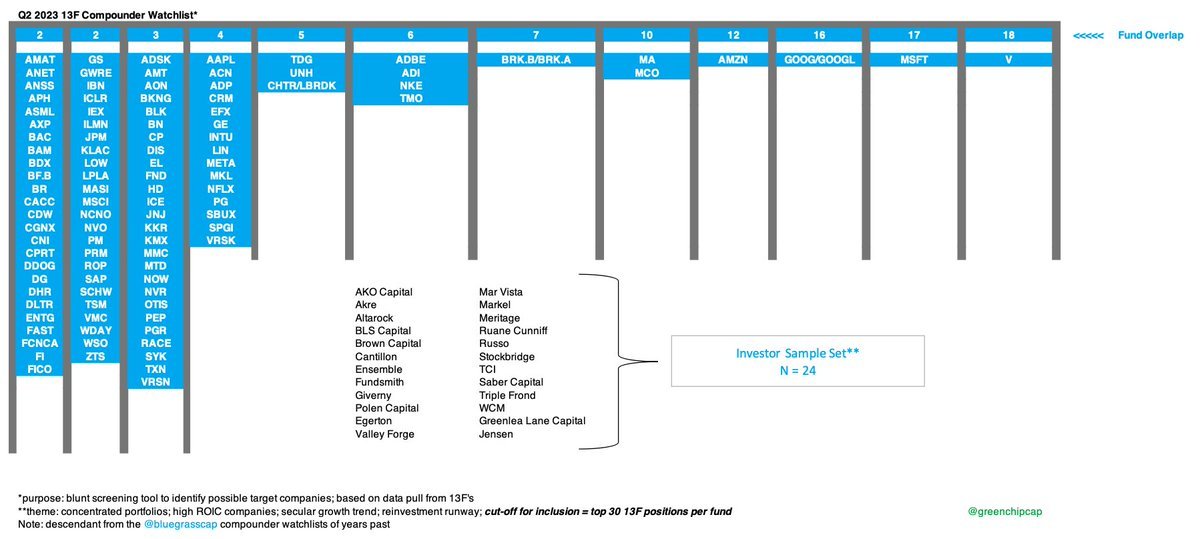

Q2 2023 13F Compounder Watchlist

h/t @bluegrasscap created original

h/t @sleepwellcap sparked revival https://t.co/pujqG3bMRx

Cuneyt Unlu

@unlucu

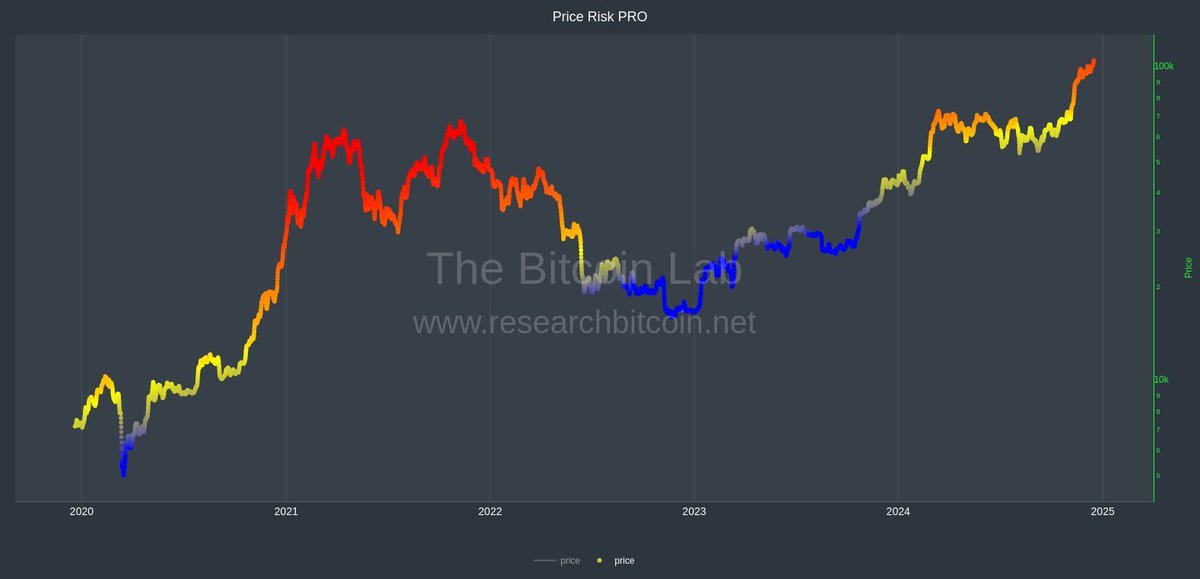

The #Bitcoin Researcher's Price Risk PRO metric is currently at 0.88, similar to December 2020.

It ranges from 0 (deep bear) to 1 (raging bull).

Combine this with STH-SOPR and STH-MVRV, and you get a pretty clear picture.

Limited upside. More time is needed if >1... See more