Sublime

An inspiration engine for ideas

A presentation by Christopher H . Browne

Value Investing and Behavioral Finance https://t.co/TMAdxrPrUB

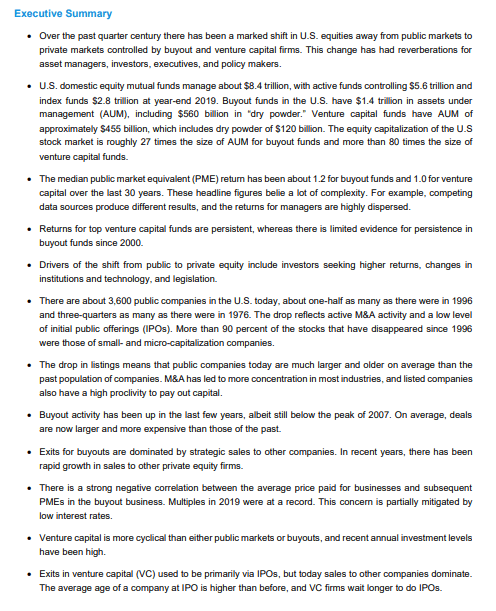

Michael Mauboussin's writeup on the rise of Private Equity in the US since the 1980s, and the reduction of listed companies to 1/2, is basically explaining what will happen in 🇯🇵 starting in 2024. https://t.co/gSQMmVGK3o

Allocation to smaller funds has continued to shrink, which is going to be a drag on the aggregate returns for VC moving forward.

This is not a new problem. The share of capital absorbed by 'venture banks' has risen constently since about 2008. In parallel, the performance of VC has broadly declined.... See more

As a strategist, if you want rare insight, you need to have access to rare perspectives and those come from people, not publications or posts on social media.

Information Nutrition

Jeff Horing has never done an interview like this because he’s too busy investing at Insight Partners.

Despite having built a $100B investment firm, he feels like he’s as in the weeds as he was during the firm's early days. As he said, “My schedule is dictated by 24-year-olds.”

Insight does... See more

Patrick OShaughnessyx.comInvestor Communications

sari and • 10 cards