Sublime

An inspiration engine for ideas

Dan Krikorian

@dpk

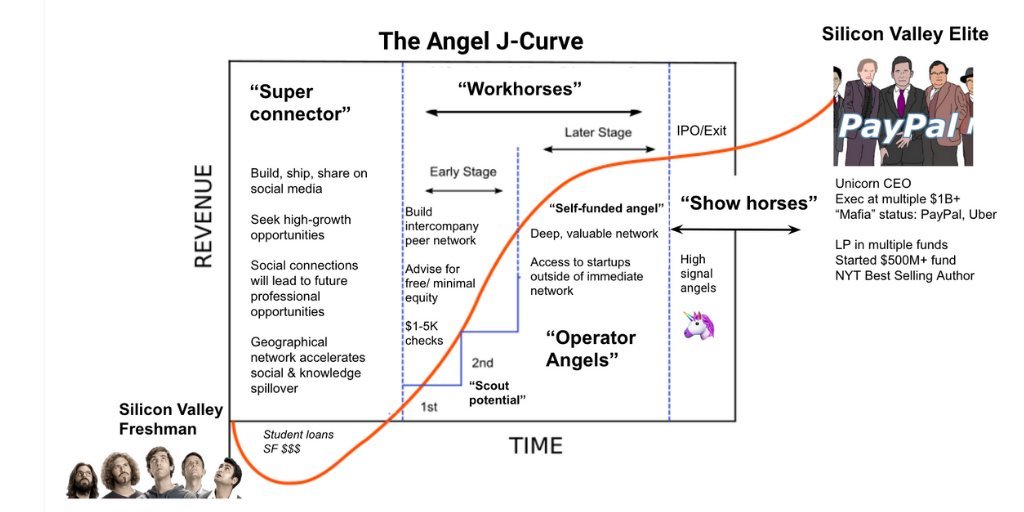

After 12+ months of research, dozens of angel dinners and a new micro-fund:

The Angel J-Curve is a framework for operators w/ tactical advice to build & scale your angel portfolio

We need more “triple threats” who operate, angel invest & have a beat!

https://t.co/0VSCC34PmL... See more

Seth A. Klarman remarks at MIT

valuehunter.files.wordpress.com2020-Search-Fund-Primer.pdf

alyeskaintl.com“All people are entrepreneurs, but many don’t have the opportunity to find that out.”

Michael W. Preis • 101 Things I Learned® in Business School (Second Edition)

Laura Chappell

@lkhchappell

Maja Shapiro

@marionjoyce

Sieva Kozinsky on LinkedIn: We’re building a baby Berkshire Hathaway. The crazy part? We plan to pay… | 25 comments

linkedin.com