Sublime

An inspiration engine for ideas

Explaining why crypto has low correlation with risk assets and predicting its future as a major institutional asset class.

TRANSCRIPT

Yeah, so I actually strongly believe that Bitcoin and other blockchain assets are going to generally have a very low correlation with risk assets.

The reason is smart money doesn't own it.

And the reason all these other weird asset classes that intrinsically have nothing in common or highly correlated is modern portfolio theory was so successful

... See more

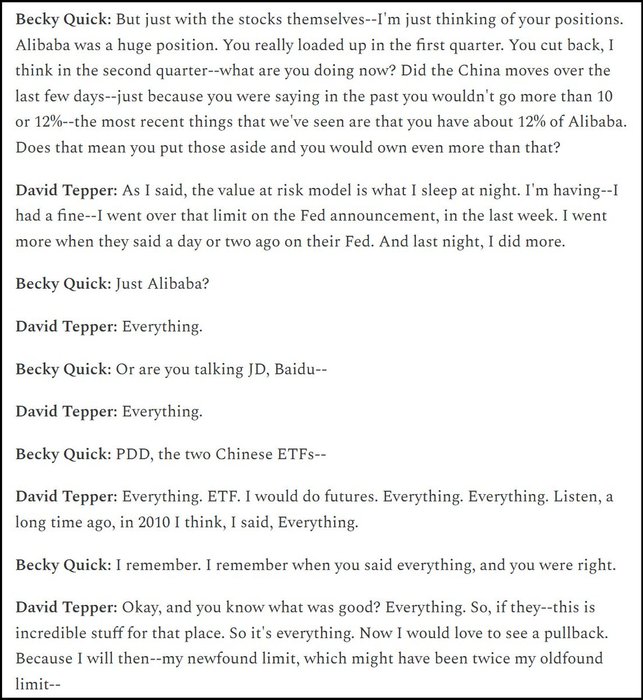

Fourteen years ago, David Tepper went on Squawk Box and shared how he made $7bn in a single year and laid out his worldview and a strategy that worked for the coming decade.

Last week, almost fourteen years to the day, David returned to Squawk Box to discuss China, stimulus, AI, and more. He starts by discussing whether... See more

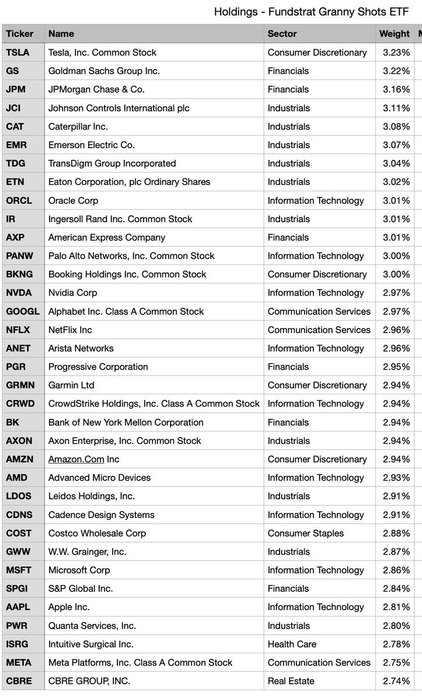

I just bought 1.223 shares of $GRNY

An amazing new #ETF that I will be building a position in on a weekly basis.

Look at these holdings! 😍 thank you #fundstrat #tomlee #grannyshot

Nice vid below by @derekquick1 👏 https://t.co/u8T84lE6yL

"Warren Buffett, the billionaire head of Berkshire Hathaway, will probably go down as the greatest investor in history... Berkshire shares have seen an average annual return of 20.0%..."

Meanwhile: https://t.co/7PGgpZta63

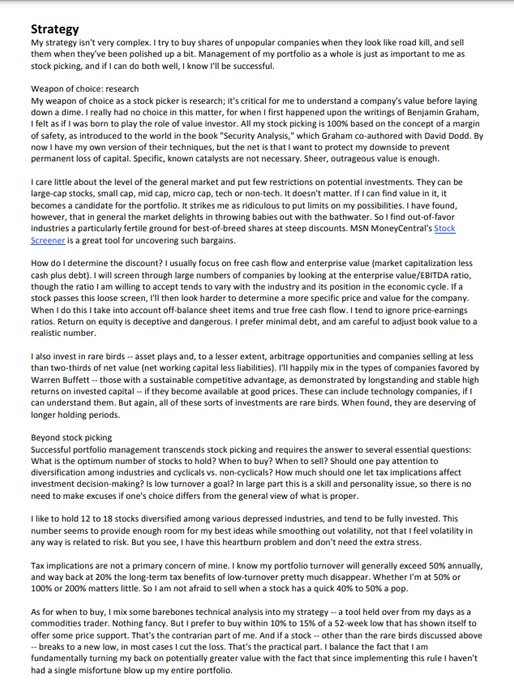

Burry's investment one sheet

worth reading for any investor https://t.co/ZqFn52xLsv

Discussing Bitcoin's long-term investment thesis, its volatility, and its low correlation with risk assets due to limited institutional ownership.

TRANSCRIPT

What we've always tried to stress to investors is this is a very disruptive trade. It's a multi-decade trade. And so only put on as much as you could hold if things do go down. In our 12 years of managing money, Bitcoin itself, the best of the currencies has gone down 85% three times. So you have to be able to withstand those kinds of drawdowns.

... See more