Sublime

An inspiration engine for ideas

Stablecoins 2.0 - Fintech Ruminations

fintechruminations.com

A stablecoin is a digital currency created with the intent of holding a stable value. The value of most existing stablecoins is tied directly to a predetermined fiat currency or tangible commodity. However, stablecoins can also achieve price-stability through collateralization against other cryptocurrencies or algorithmic token supply management.

Jay Drain Jr • Web3 Starter Pack

Contributor payments: make a bulk of contributor payments in stables while long-term contributors are partly paid in vested protocol tokens

Shreyas Hariharan • How DAOs should approach treasury management on Bankless

May 2024: Stablecoins are helping create a buyer of second-to-last resort for US Treasurys

writing.kunle.app

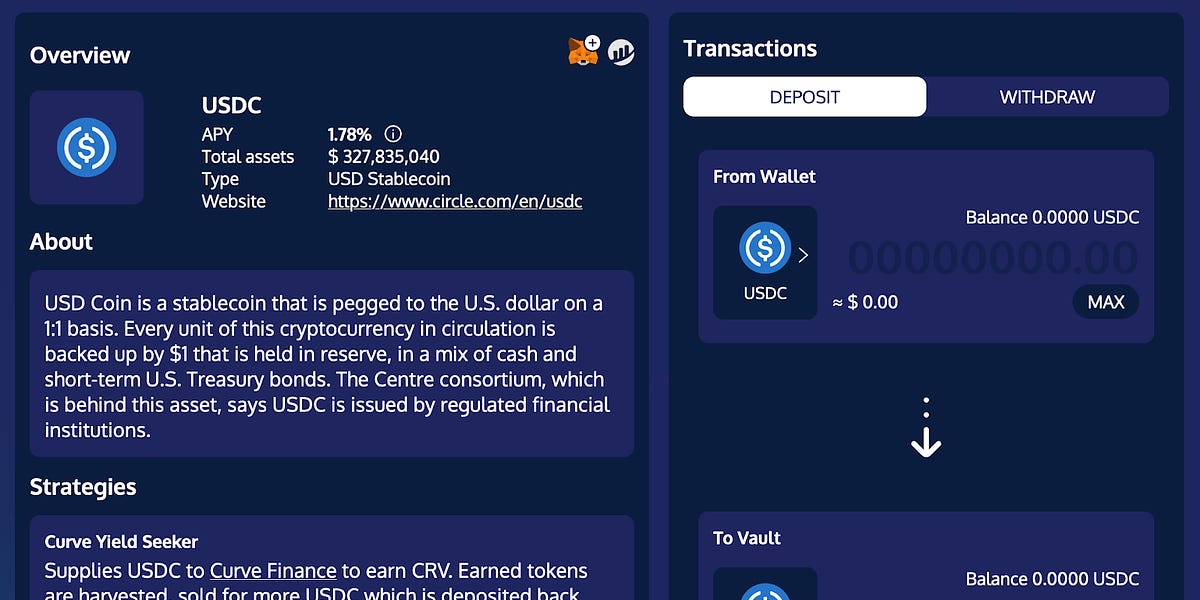

How to Farm Stablecoins

cryptonat.substack.com

------------------------------------------------------------- Introducing the players - Fei Protocol: $FEI is one of the few truly decentralized stablecoins because it is mostly backed by $ETH. Fei Protocol’s Protocol Controlled Value (PCV) holds ~$653mn, providing a 206% collateralization ratio for all circulating $FEI.

xkydo • Metagovernance in Crypto

Hybrid — Some projects like Frax Finance use a hybrid approach to find a balance between these issues. The peg to USD is algorithmically maintained, but they also have reserves available to handle periods of extreme volatility and market demand. This strategy seems the most likely to survive long term.

Exploring Stablecoins

The prices of cryptocurrencies are extremely volatile. In order to mitigate this volatility, stablecoins pegged to other stableassets such as the USD were created. Stablecoins help users hedge against this price volatility and allow for a reliable medium of exchange. Stablecoins have since quickly evolved to be a vital component of DeFi that is piv

... See more