Sublime

An inspiration engine for ideas

Trends – Artificial Intelligence (AI) – May 2025 – BOND

The document analyzes rapid growth and transformative trends in artificial intelligence, highlighting unprecedented user adoption, technological advances, global competition, enterprise AI integration, and associated benefits and risks shaping the future.

bondcap.comLongevity Biotech Landscape — Ada Nguyen

adanguyenx.com

Fundamental Equity Analysis: A Primer

https://t.co/xz4Qu4TLGb https://t.co/uWqt0bzFk0

Good study on spin-offs by Houlihan Lokey

https://t.co/1G9X8GmVRd https://t.co/7aEZ3PjHhW

Congestion Pricing, Carpooling, and Commuter Welfare

nber.org

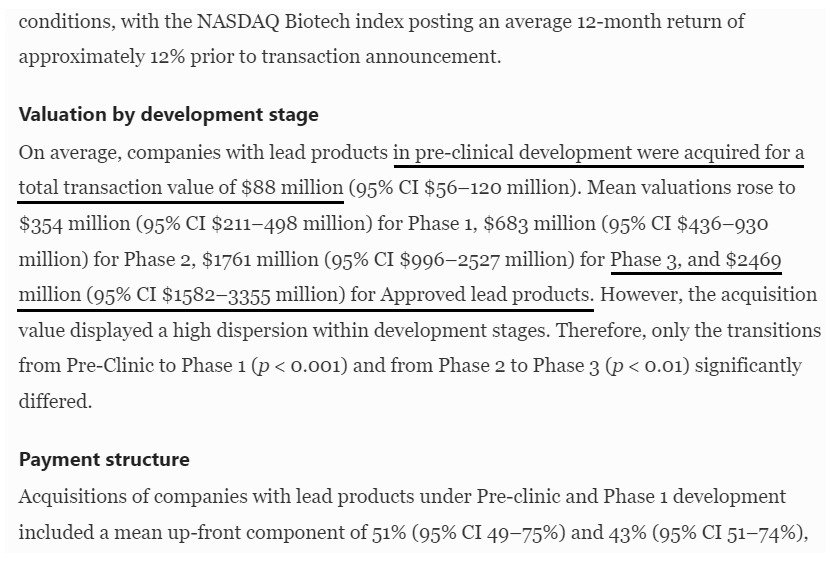

How 'undervalued' are #psychedelic pubcos ATM? A 2022 study shows that biopharma companies with lead products in Phase 3 were acquired for an avg of $2.47B. Even *pre-clinical* TX value was $88M.

$CMPS — Ph3 #psilocybin AT — $407M mc

$NUMI — Ph3 (via Maps) MDMA-AT — $58.4M mc https://t.co/m6Eg4e5Ul9

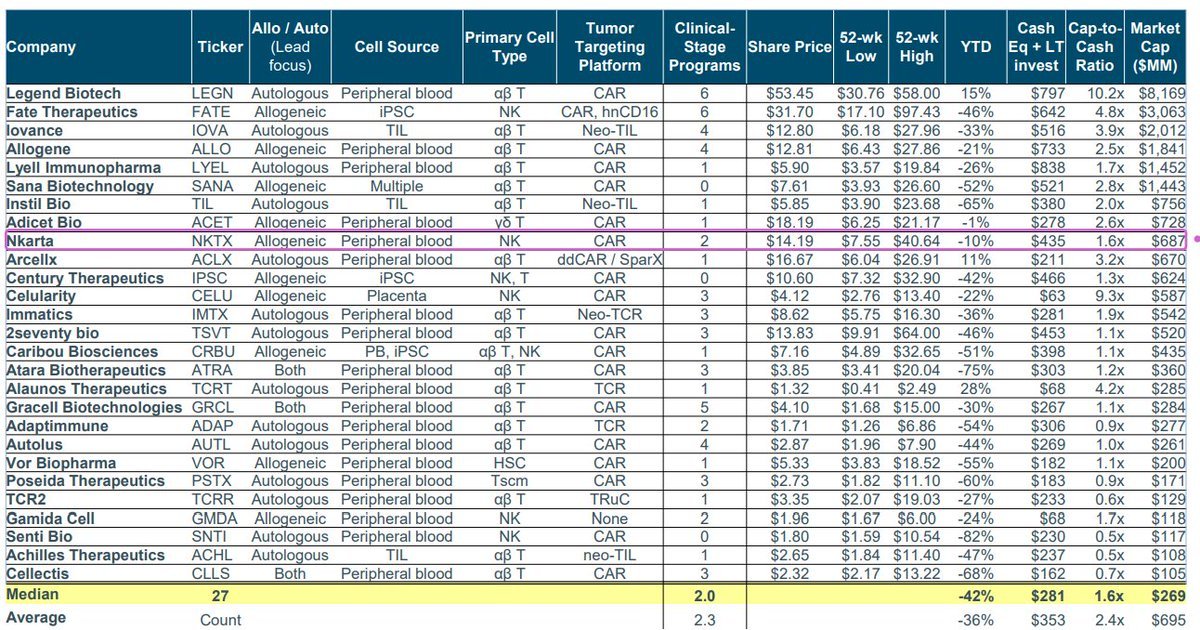

Comps: Mkt cap for pure play cell thx companies

Source: SVB https://t.co/lK6s7Qza6O