Sublime

An inspiration engine for ideas

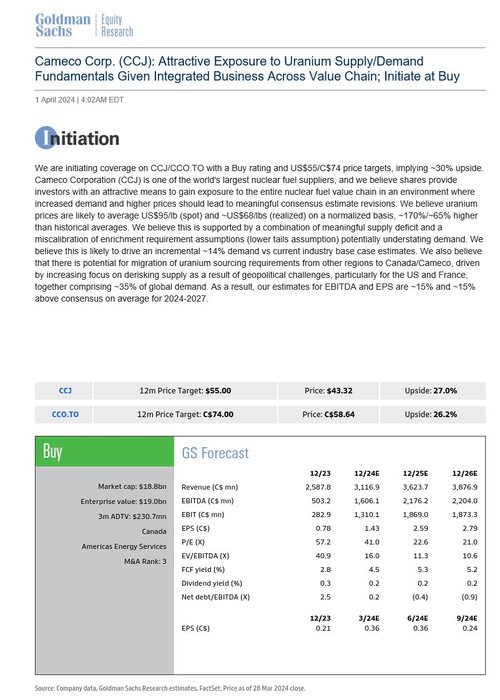

And here comes Goldman: initiates CCJ with a BUY and $55 Price target: "the shares provide investors with an attractive means to gain exposure to the entire nuclear fuel value chain in an environment where increased demand and higher prices should lead to meaningful consensus estimate revisions"

Remarkably, many of the small caps and some of the mid caps (even advanced developers) show comparatively low valuations still. E.g.

▪️ $LOT: $0.88/lb

▪️ $DYL: $1.69/lb

▪️ $ISO: $2.02/lb

▪️ $GLO: $2.05/lb

▪️ $BMN: $1.35/lb

▪️ $FSY:... See more

Mineral Stocks Investorx.com

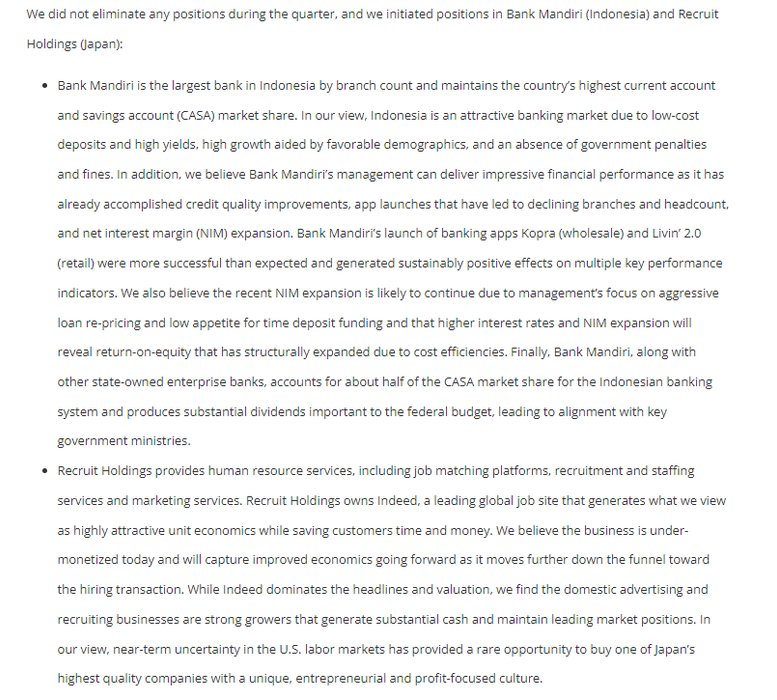

Oakmark International with 2 new positions: Bank Mandiri (Indonesia) and Recruit Holdings (Japan). https://t.co/0dzlyLstqW

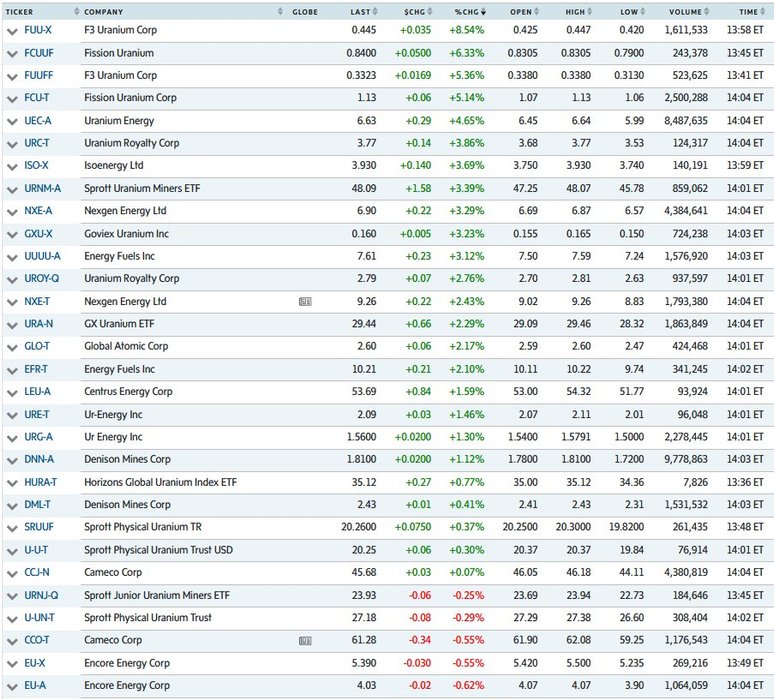

⚡️Now that it appears the #Uranium ETF's $URNM and $URNJ have finished dumping large volumes of U #mining #stocks to raise cash to pay a year-end dividend🪙 we're seeing #Canada/US U stocks begin to rally to catch up with 16-year high Spot price.⤴️🏃 https://t.co/XuruobkX1e

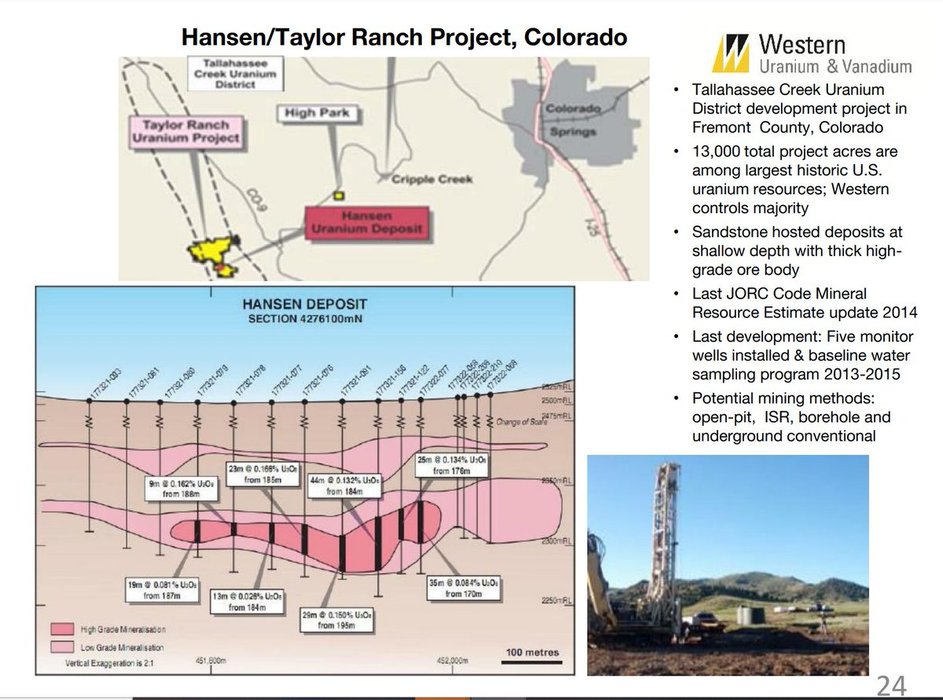

All those interested in the extremely undervalued #uranium and #vanadium company $WUC that is expected to soon start delivering ore to the White Mesa mill and see some cashflow, should take a look at this slide from their presentation, as it is something completely forgotten by most investors. Now look at those grades, widths and the depth. For... See more

My portfolio...

1. F3Uranium 39%

2. Energy Fuels 17%

3. Hercules Silver 11%

4. Denison Mines 10%

5. First Majestic 5%

6. Abra Silver 3%

7. Wheaton Prec. Metals 3%

8. Anfield Energy 2,5%

9. Ur Energy 2,5%

10.... See more

Uranium and Commodities watcherx.com