Sublime

An inspiration engine for ideas

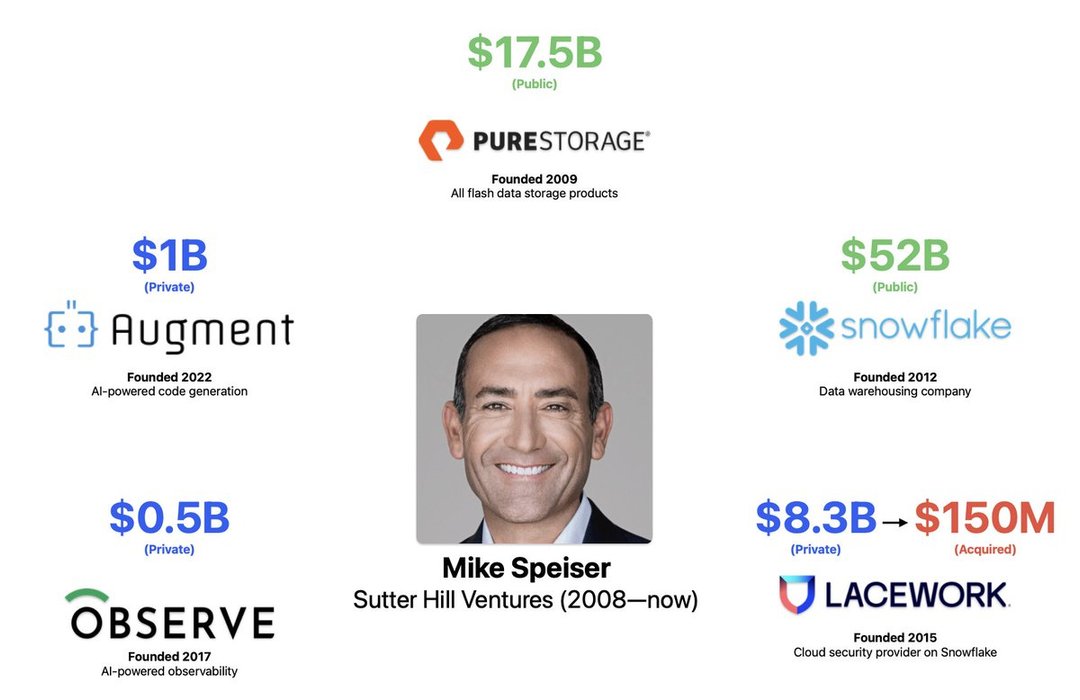

There are some important changes underfoot in private markets:

1. Returns are compressing - few funds are able to consistently achieve the necessary spread over the risk-free rate to justify fees and illiquidity.

2. LPs are segregating bi-modally: 1) a growing group of smaller family... See more

Chamath Palihapitiyax.com

SUBSCALE IPOs

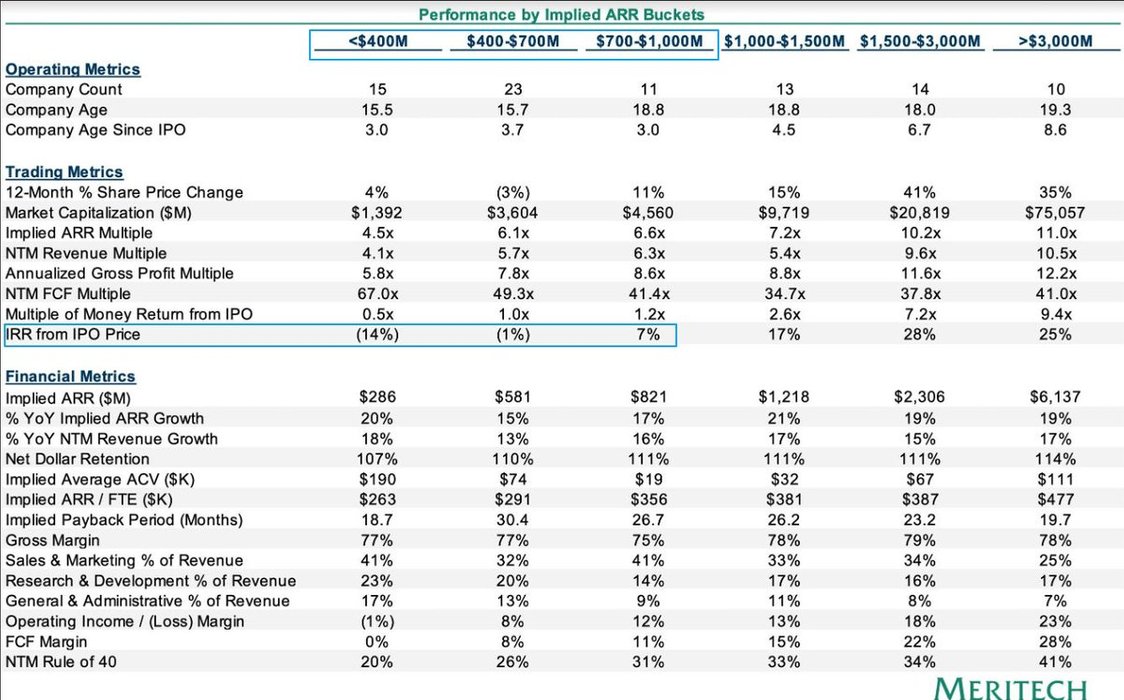

The Meritech team @MeritechCapital continues to put out some excellent analysis. This one is on IPO scale.

TLDR is that companies with less than $700m annualized revenue underperform after going public. Actually, not just underperform - they have NEGATIVE absolute returns. This... See more

Cliché Munger Quote: “I read Barron's for 50 years. In 50 years I found one investment opportunity in Barron's out of which I made about $80 million with almost no risk.”

I don’t know if all of these are <1k but they all put out incredible work, whether that’s through skill in reading the market or just having unique... See more

Citrinix.comParag Parikh's lecture series on Behavioural Finance is a gold mine for young investors.

It's unfortunate that he isn't any more.

https://t.co/NqXx0ViHBx

Dharmesh Bax.comThere's a gentleman who manages a $115 million aum fund with annualized returns of 35% (before fees) since inception.

And he wrote a 3,150-word letter for those who dream of compounding their money at 20-25% per year over the course of their careers.

1. Your chance of becoming a great... See more

PrivateEquityGuy (Mikk Markus)x.com

Leopold Aschenbrenner's fund has outperformed basically every mainstream hedge fund YTD and he's running 1bn+ of capital btw

the gulf billionaires & pension funds are watching this

capital management will soon become an activity exclusively done by chronically online zoomers... See more