Sublime

An inspiration engine for ideas

Gold is a credit default swap on Bitcoin. If Bitcoin fails, gold is all you’ve got. If you’re a gold investor with zero Bitcoin, you haven’t thought it through. If you’re a Bitcoiner with zero gold, same story” says @LawrenceLepard citing @FossGregfoss

If you’re all-in on one and completely ignoring the other, you haven’t done the... See more

Michelle Makorix.com

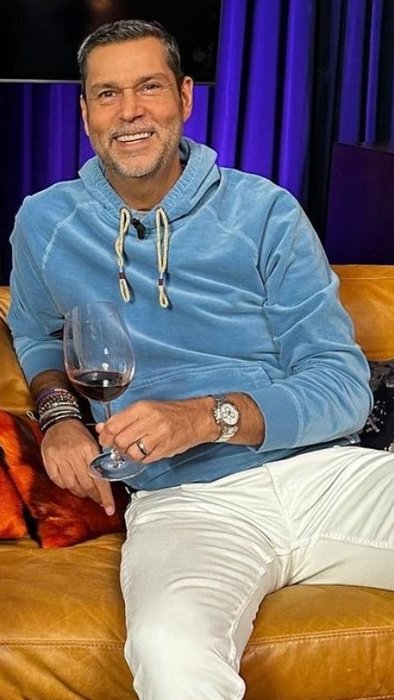

This is Raoul Pal.

The most in-demand guest for podcasts about money.

He teaches people how to think about money.

I spent thousands of $$$ to learn from him.

Here are 15 of his strategies that transformed my life (and will do the same... See more

The Trader - Paul Tudor Jones - 1987 Documentary

“My whole feeling is that anytime you try to get 13 people (OPEC) to agree to anything, and I have a chance to take a position on it, wild horses couldn’t keep me from betting against them succeeding in that.”

One of the best documentaries out... See more

"Raoul Pal & CZ: 100% Convinced Crypto Is About to Go Very Wild — Here’s Why."

youtube.com

This is Chamath Palihapitiya.

He’s the billionaire VC who scaled Facebook to 1B users.

And recently, he declared that “Social media is dead.”

5 predictions on the future of social media (and why you need to invest in the creator economy instead):... See more

While active at Benchmark, @bgurley would give an annual “state of the markets” presentation to his investors.

This conversation renews that format, with Bill exploring what he sees as both worrying and exciting about the investing landscape, with a special focus on private... See more

Patrick OShaughnessyx.comAt some stage, you run out of suckers to buy government debt. What is certain is we will only see more efforts at financial oppression, but we will see increasing attempts to monetize deficits and reduce the future value of liabilities through inflation. It will not be pretty.

Jonathan Tepper • Endgame: The End of the Debt SuperCycle and How It Changes Everything

Remember that every story has another side.