Sublime

An inspiration engine for ideas

We agree.

Here’s a better method:

1. Buy property

2. Cost segregate and depreciate the purchase price

3. Use that loss to offset the income

4. End up with all cash and little to no tax

5. Repeat

We help... See more

RE Cost Segx.comThe playbook of so many wealthy clients of mine:

1. Cashflow from business

2. Invest in real estate

4. Depreciation & cost seg shields small biz income

5. End up with a lot of cash and very little tax.

RE Cost Segx.com

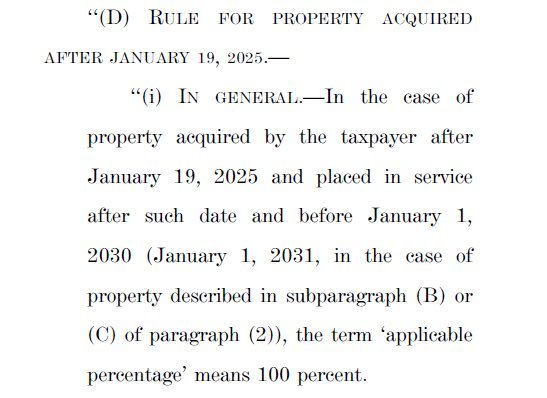

100% bonus depreciation is back online.

Relatively huge news for real estate professionals. https://t.co/XpVmQJ9ksK

If you’re a small manufacturer looking to expand keep an eye on section 168k.

Section 168k lets you deduct a majority of a large asset purchase in the first year. You can take the full deduction even if this results in a net loss for your business.

We have purchased millions of dollars in... See more

Jonathan | Fabworks 🏭x.com

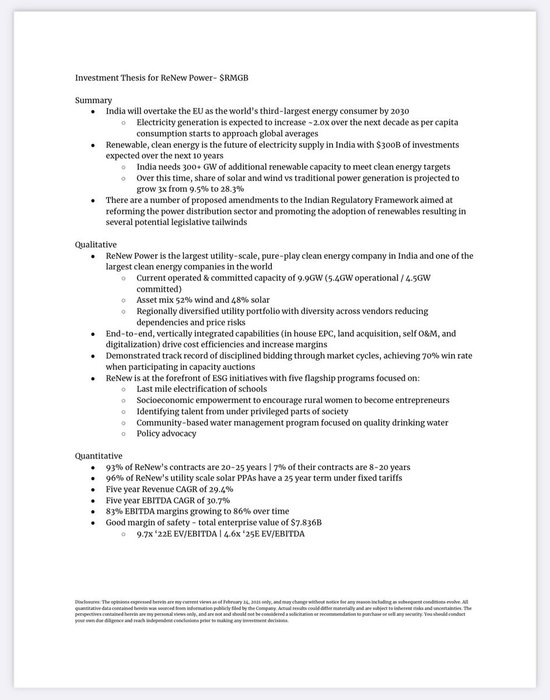

Excited to do the PIPE in ReNew Power as they merge with $RMGB

Renew is India’s largest clean energy company with scale in wind and solar. They are playing a huge role in moving one of the world’s most populous countries to clean energy.

83% EBITDA margins

4.6x 2025E EV/EBITDA... See more

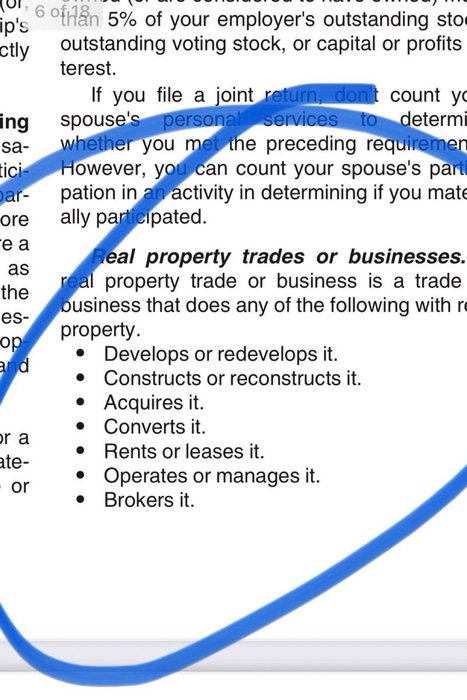

PSA -

You are a real estate pro if you own a trade or business in any of the following real estate categories.

It’s not only brokers and syndicators that get to join the fun.

Huge opportunities for contractors and property managers to own real estate and lower... See more

The tax lifecycle of real estate:

1. Buy with leverage

2. Cost segregate and depreciate initial capital in

3. Stabilize and borrow tax free against asset

4. Enjoy low tax cashflow year over year

5. 1031 exchange into larger asset, repeat

6. Die and... See more

Mitchell Baldridgex.comIndustrials - do an SEM cohort.

Grab the capacity data as proof for our utilities to dive in and invest in it.

SEEA runs the cohorts

what if the utilities looked at all the big facilities on one feeder where a Data Center is going to go and offered SEM? Its a more surgical approach.