Sublime

An inspiration engine for ideas

Notes towards becoming a better investor

kaiton • 33 cards

Easy way to make money as an investor:

1) take no early-stage risk.

2) wait for product visionary to emerge in huge industry where incumbents are tech-clueless.

3) bet that the disruption will compound for decades.

Eg:

Tesla vs auto makers

Amazon vs... See more

David Sacksx.com

Michael Burry is one of the most popular value investors in the game.

He's a contrarian that buys odd-ball, roadkill stocks that others don't.

I dissected his seven write-ups from Value Investors Club to see how he analyzed stocks.

A thread on the five lessons I... See more

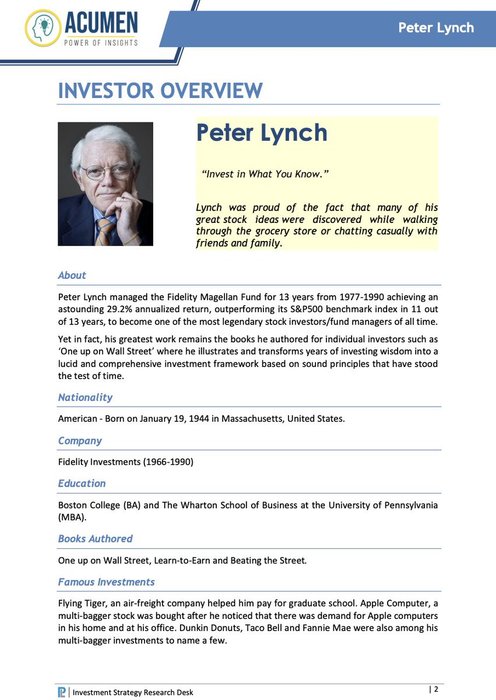

Peter Lynch Interview

Lynch is widely considered the most successful mutual fund manager ever.

In this interview, he shares his entire philosophy https://t.co/Ltv1Awwmff

How to take advantage of market correction - By Peter Lynch

#stockmarketcrash #StockMarketindia #StockMarketNews #Japan #nifty50 #NASDAQ #DowJones

https://t.co/xxy6gOV1Cb

Neetu Khandelwalx.comsuccessful investor is generally a well-rounded individual who puts a natural curiosity and an intellectual interest to work.