Sublime

An inspiration engine for ideas

Pierre

pierre.co

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.com

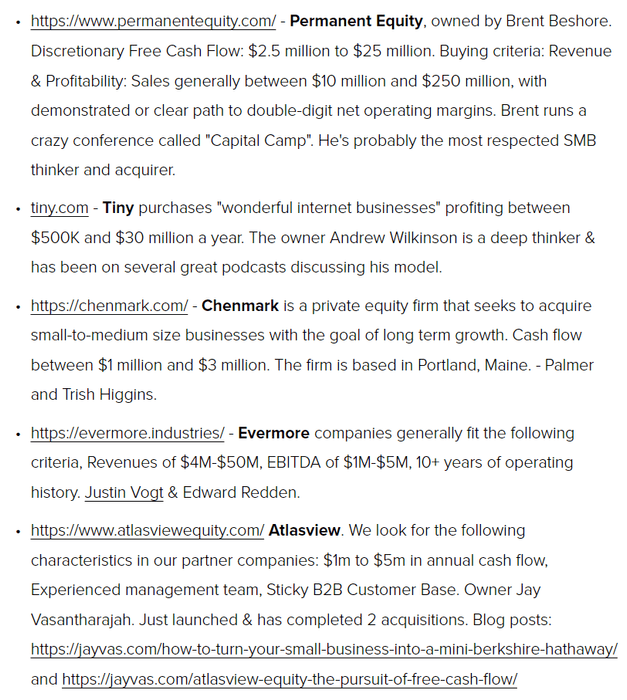

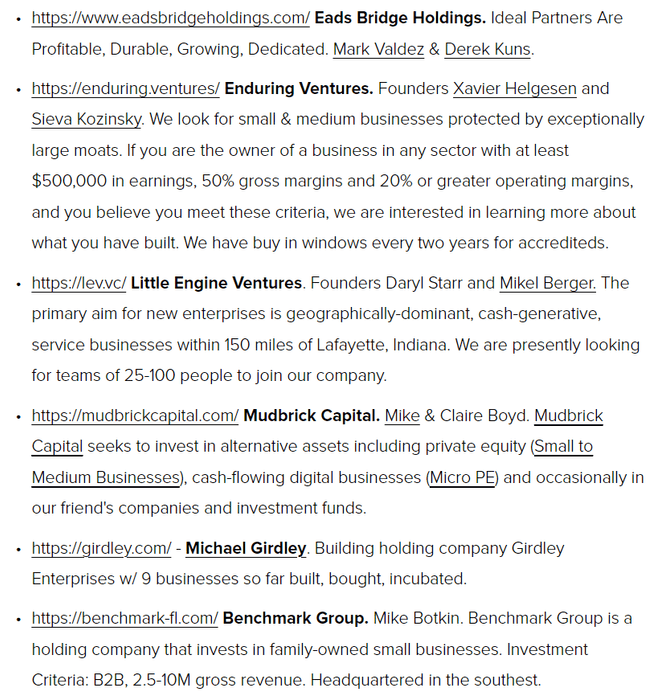

Mini-Berkshires: My business partner was amazed to learn it was possible to invest in mini-berkshire type companies (micro-PE). He asked for a list.

I whipped this up real quick and posted an article on my website. What did I get wrong? https://t.co/SfSb3RTaCm

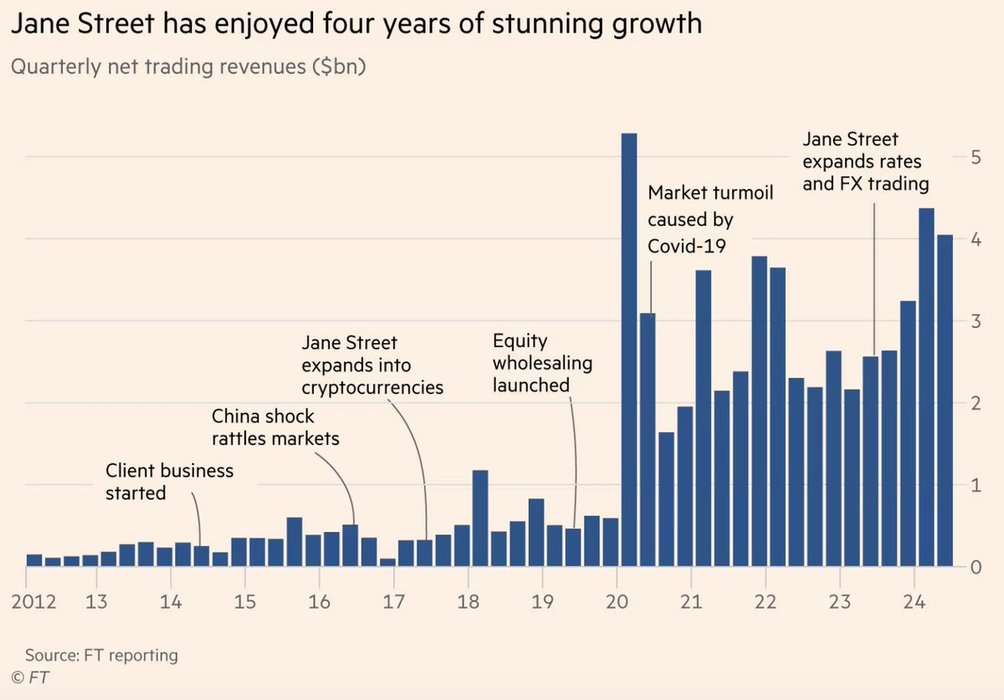

In 2000 a relatively unknown proprietary trading firm was founded - Jane Street Capital

Last year was the fourth straight year Jane Street generated net trading revenues of more than $10 Billion, comfortably beating Goldman Sachs and many others

🧵 Here's how they did it... See more

Here are the additional financial assumptions we make when considering the investment property: Acquisition costs are 6% of the purchase price Capital growth forecast is 7% per annum Expected rental yield is 3.5% per annum Property management fees are 7.7% per annum Occupancy rate is 92% (we have allowed 4 weeks vacancy each year) No depreciation

... See more