Sublime

An inspiration engine for ideas

Outstanding Investor Digest: Perspectives and Activities of the Nation’s Most Successful Money Managers

The content summarizes a compilation of interviews with prestigious money managers, detailing their perspectives on investment strategies, risk assessment, and market valuations over multiple volumes of the Outstanding Investor Digest.

LinkQ2_2024_PitchBook_Analyst_Note_Establishing_a_Case_for_Emerging_Managers

This document explores the performance of emerging versus established managers in the private fund industry, focusing on buyout, venture capital, real estate, and private debt strategies.

LinkAswath Damodaran Lesson 2

An introduction to Intrinsic Value

I can't believe this is free https://t.co/sZPKwyfzVJ

Value Theoryx.com

Laurent-Perrier $LPE.PA

- 200-year-old family-owned premium champagne maker

- tripled EPS in the past decade

- trades at a historically low multiple (12x FY22 EPS versus 20x mean)

- improved margins despite industry-wide volume decline through offsetting price/mix improvements... See more

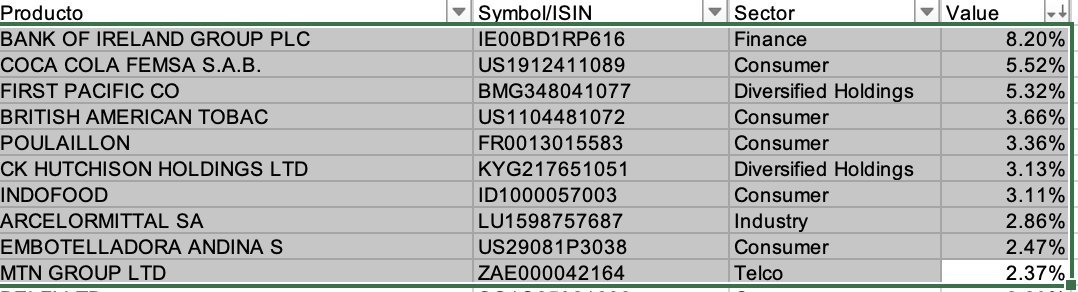

Portfolio update. some thoughts sent in my letter.

Top 10 positions. Up 10%.

-Not a huge fan of Bank of Ireland but huge multibagger returning capital.

-Coca Cola Femsa not cheap anymore, Hold.

Adding to new smaller positions, diversified value (French Lynch 😂) https://t.co/rMhlXtFxWo

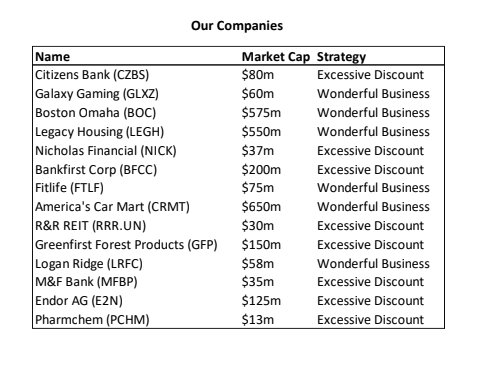

Enjoyed the River Oaks Capital H2 2023 Letter:

h/t @Whit_Huguley

https://t.co/DP3n5jscjJ https://t.co/clRbWAgFgS

Oakmark Funds run by Bill Nygren published their quarterly letter. The fund started 5 new positions and sold 5 others.

“Most of the eliminations were in companies that we invested last year when faster growing stocks sold-off sharply (Adobe, Uber, Take-Two, Netflix).”

1/19

🧵👇🏼

Hidden Value Gemsx.com

Gavin Baker is the CIO and Managing Partner of Atreides Management, a tech/consumer crossover fund that he founded in 2019. Prior to Atreides, Gavin spent nearly two decades at Fidelity, with the last eight years as PM of the $17bn Fidelity OTC Fund. During his tenure, the fund compounded at over 19% net of fees, outperforming 99% of its... See more

This was excellent.

River Oaks Capital H1 2023 Letter

h/t @Whit_Huguley

https://t.co/0fmhXprkf6 https://t.co/HrF2RyfsfK