Sublime

An inspiration engine for ideas

"What if what you do to survive / Kills the things you love?"

-Bruce Springsteen's 2005 song "Devils & Dust"

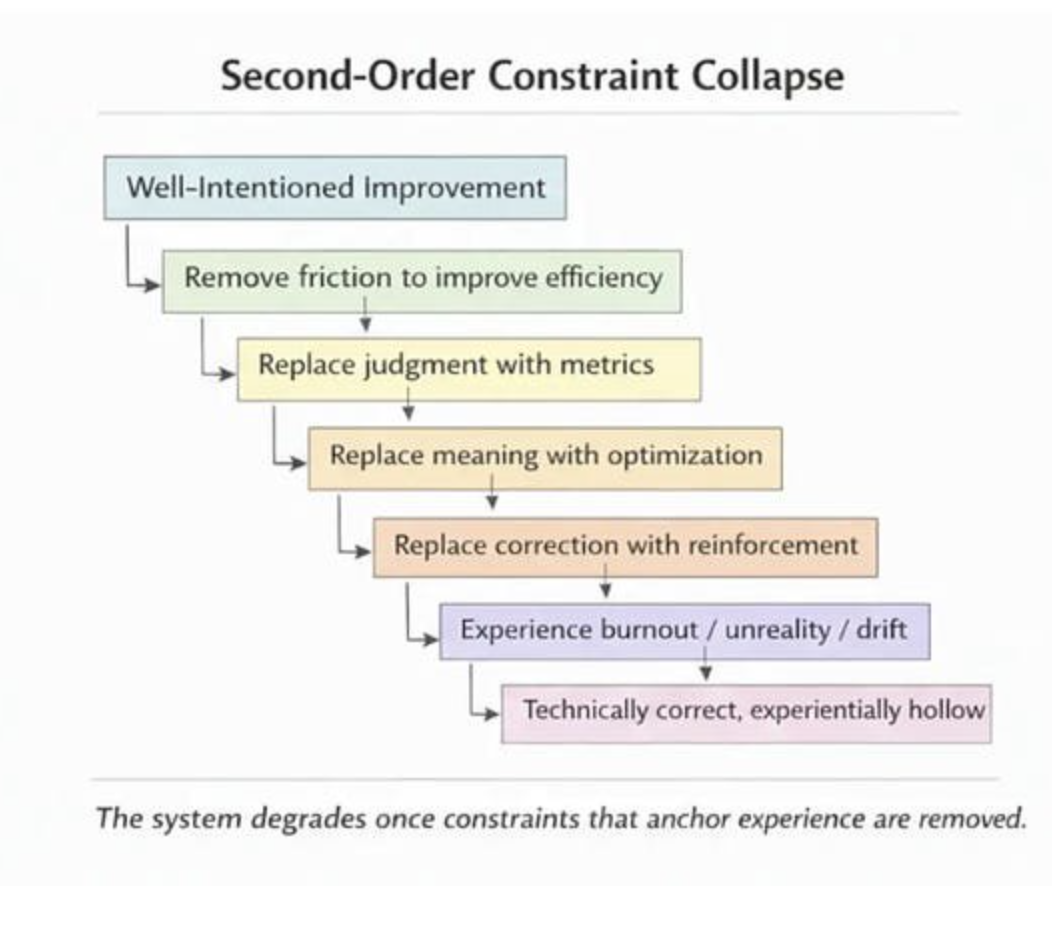

Adult life, I’ve decided, is about cohesion. Which is to say it’s about conflict, trade-offs. The ability to acknowledge parts of your psyche you aren’t proud of. The idea that sometimes in life you have to make a choice, and the choice is not only not a perfect choice, but often not even a particularly moral choice: that you can argue for it or... See more

Ava • cohesion

you make good work when you let your guard down.

Mel Ottenberg • Aidan Zamiri Is the Moment

If I put this candle in an all white gallery space it looks like a piece of art.

If I put this candle in a garage it looks like a piece of trash.

I can either spend my time designing the candle or I can spend my time designing the room that it sits in. - Virgil Abloh

You can either focus on your art.

Or you can focus on the space, narrative, and

... See more