Sublime

An inspiration engine for ideas

As it turned out, out of every 100 publicly traded firms founded since the 1970s, 50 were backed by VC funds.

Ilya Strebulaev • The Venture Mindset: How to Make Smarter Bets and Achieve Extraordinary Growth

Land of the “Super Founders“— A Data-Driven Approach to Uncover the Secrets of Billion Dollar…

Ali Tamasebalitamaseb.medium.com

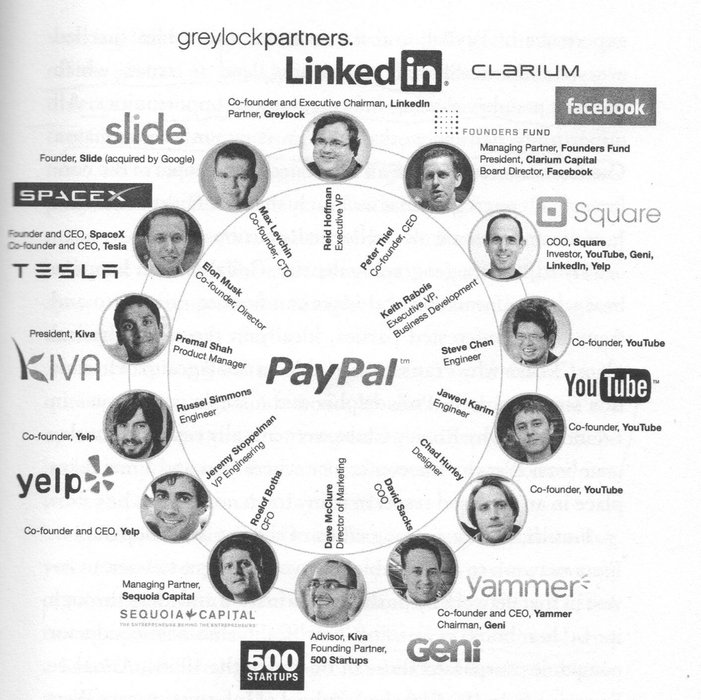

This is Peter Thiel.

He's worth $7.1 billion after founding & investing in $1B startups.

From creating the "PayPal mafia" to hiring Sam Altman, Reid Hoffman, and partnered with Elon Musk...

He is also the greatest recruiter ever!

His... See more

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.comThey sure do. Here is a quote from a blog post written 19 years ago:

…in the game of venture lotto, "too much money chasing too few deals" is an oft-cited phrase among VCs who find themselves in competition for deals. The most sought after deals are led by proven entrepreneurs. Especially popular are serial... See more

Ho Namx.com