Sublime

An inspiration engine for ideas

Byrne Hobart is one of the most interesting & wide-ranging writers out there right now

Here's a thread of some of his ideas on globalization, financial bubbles, social capital & more

His old work here: https://t.co/uYSfQ3gbcS

Sign up for new work here:... See more

Erik Torenbergx.comStan Druckenmiller:

▫️ No material signs of US recession

▫️ Inflation may not have peaked: deregulation, tariffs

▫️ Never invest in the present: look out 18-24 months

▫️ Bullish Nvidia after grads went from crypto to AI

▫️ Wake up 5:30, drink coffee, read WSJ / FT / NYT... See more

Michael Fritzell (Asian Century Stocks)x.com🚨FRIEDBERG: "60% of middle class household's net worth is in their home. Only 10% is in owning the S&P 500, index funds, whatever in their retirement accounts.

By creating this American dream around housing and allowing the Federal government to provide loans on housing, we've increased the cost of housing and created a... See more

Autism Capital 🧩x.com

Bloomberg writing the obituary for Wall Street. If you work there learn to code or something. 🇺🇸🏦 https://t.co/2LVJ2sJLLU

Overall, I continue to view the US economy as being of two speeds. Demographic segments and industries that are on the receiving side of the large deficits are generally doing well. On the other hand, segments and industries that are more affected by the Fed’s tight monetary policy (such as housing and commercial real estate and younger or

... See moreTwo Speed US Growth

Trump said he will nominate CEA Chair Stephen Miran to fill the Fed seat being vacated this week by Adriana Kugler.

Miran has been a resolute advocate of Trump's economic agenda and very critical of the Fed's decision to cut rates last year https://t.co/6i4Vj4U6Mt

Nick Timiraosx.comToday's issue of Bits about Money explains for technologists why the banking sector was (almost) a CrowdStrike Falcon monoculture and to bankers/regulators why one engineer making a mistake at one software company can turn off money.

https://t.co/rBcfXxnqMf

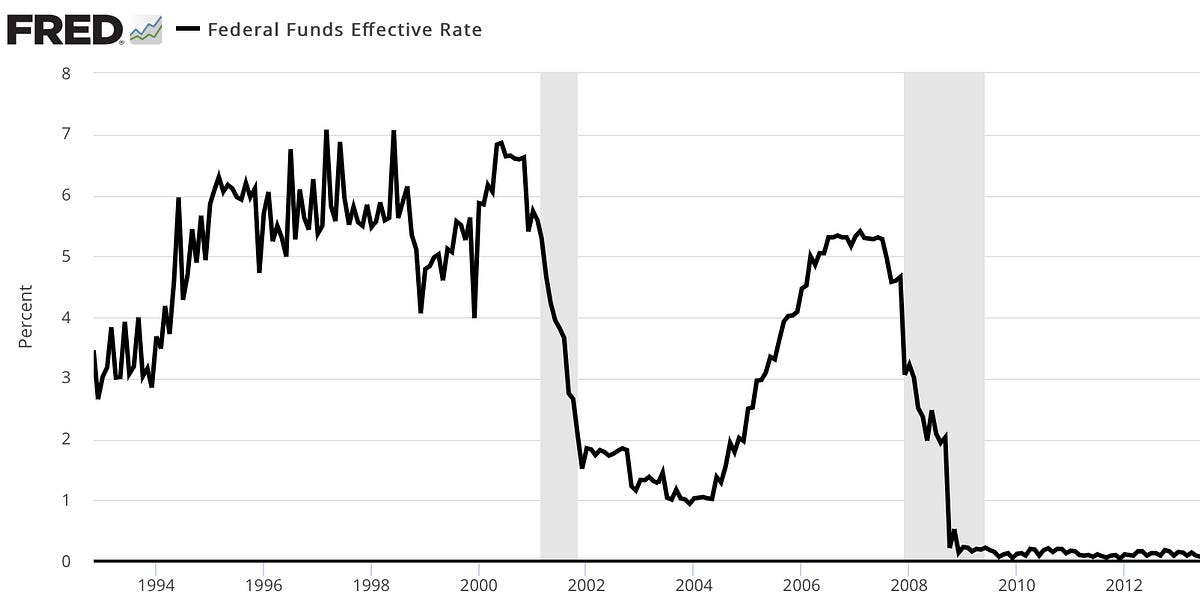

Patrick McKenziex.comHow Jay Powell is bending time and upending the business world

slowboring.com