Sublime

An inspiration engine for ideas

I calculated @CapitalVoss returns on the 61 stock pitches they've mentioned in fund letters since 2018.

Avg 1y returns are 28%. Pretty, pretty good.

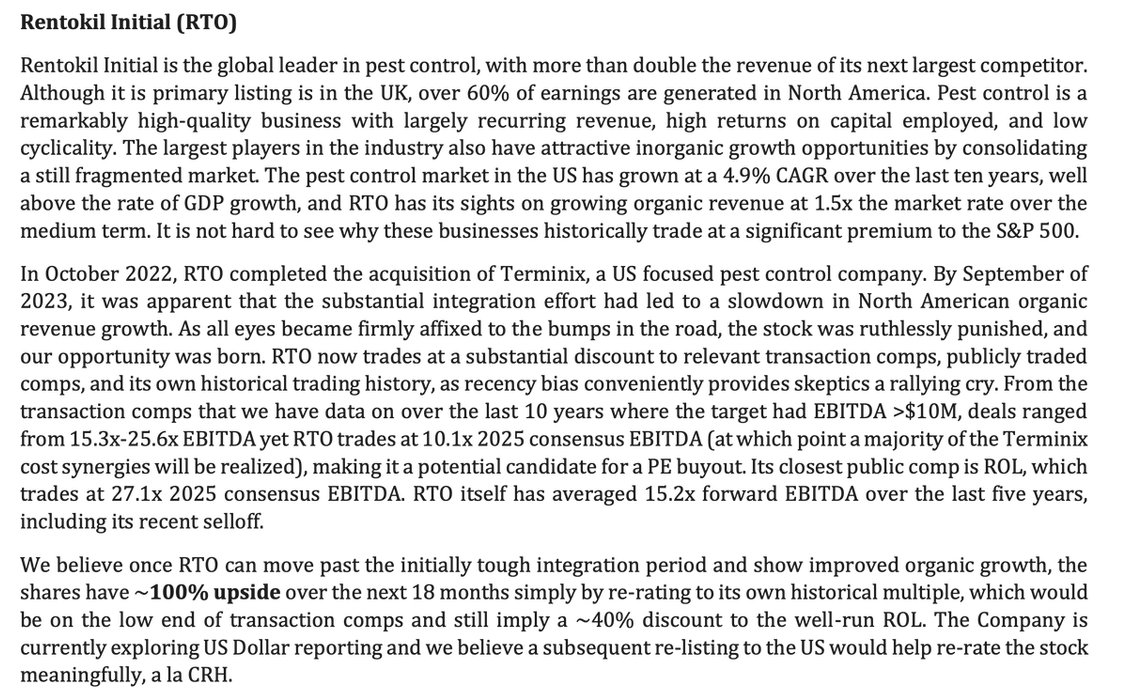

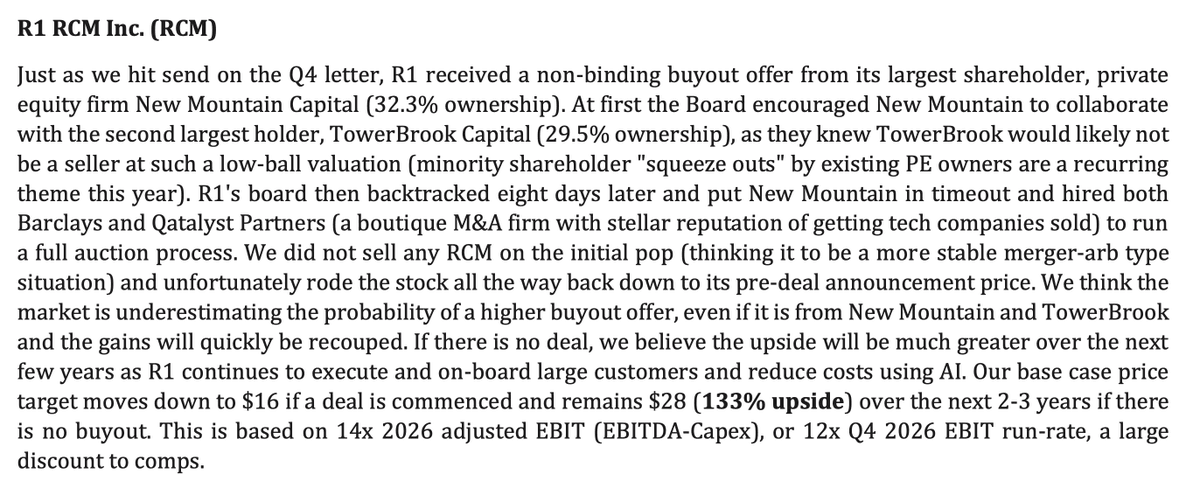

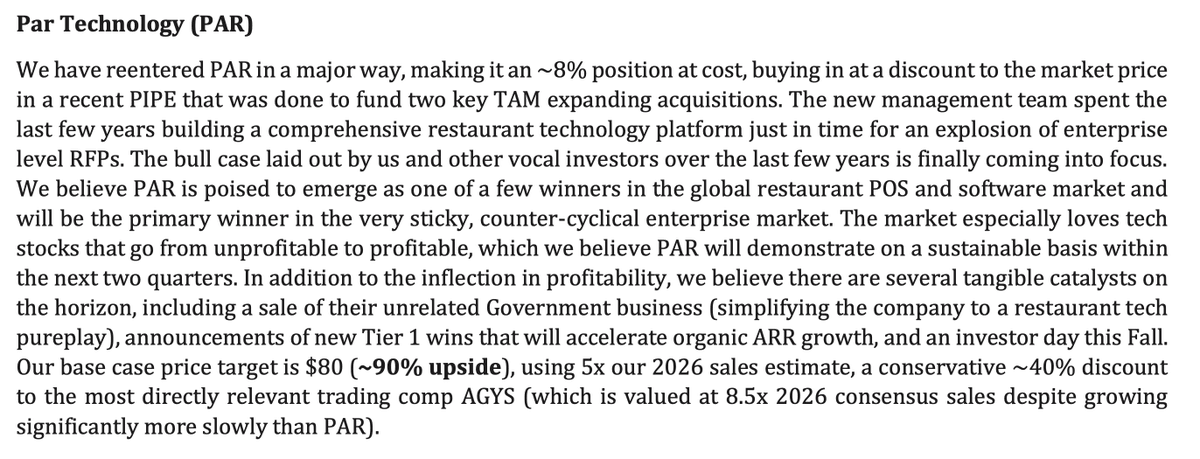

And they just put out their new fund letter with the following pitches: $IMXI, $GENI, $SWI, $SLCA, $RTO, $ALTG, $RCM, $PAR... See more

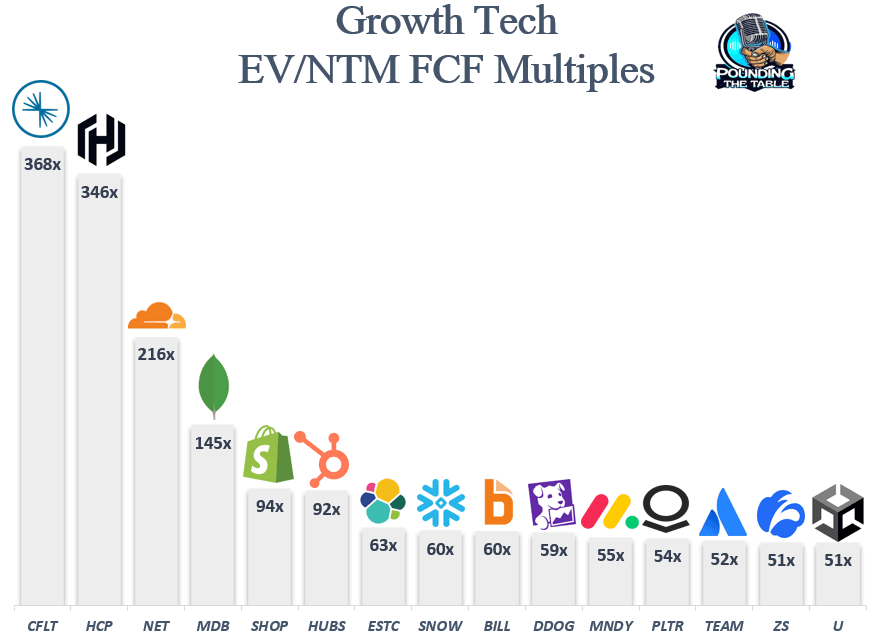

Given the outlook of prolonged high rates -- zeroing in on companies are FCF positive becomes crucial. Quality of business & defensive MOAT often justify their premium valuation 🧐

$CFLT, $HCP, $NET, $MDB, $SHOP, $HUBS, $ESTC, $SNOW, $BILL, $DDOG, $MNDY, $PLTR, $TEAM, $ZS, $U https://t.co/a194E4GF1u

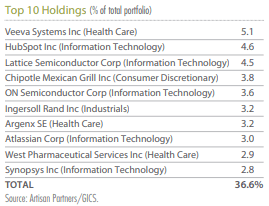

Artisan Mid Cap is a fund I like to track. The fund seeks to invest in franchises w/an accelerating profit cycle that are trading at a discount.

Top 10 holdings are below & here are the largest TMT positions: $HUBS, $LSCC, $ON, $TEAM, $SNPS, $MPWR, $TYL, $ANET, $ZS & $DDOG https://t.co/OJ53puzyGj

There’s a tiny founder pool responsible for 23 unicorns ($60B market cap) in the current cohort.

You’d think an army of VCs covers them, yet they’re almost wholly ignored. The best part—you can know them all well before company creation.

The Quant Thesis https://t.co/AHPvDmH5iJ

Nikhil Namburix.comPEHub’s PE Week Wire and Dan Primack’s Term Sheet are great ways to get tipped on when VC firms are raising new funds.

John Gannon • Road to a Venture Capital Career: Practical Strategies and Tips to Break Into The Industry

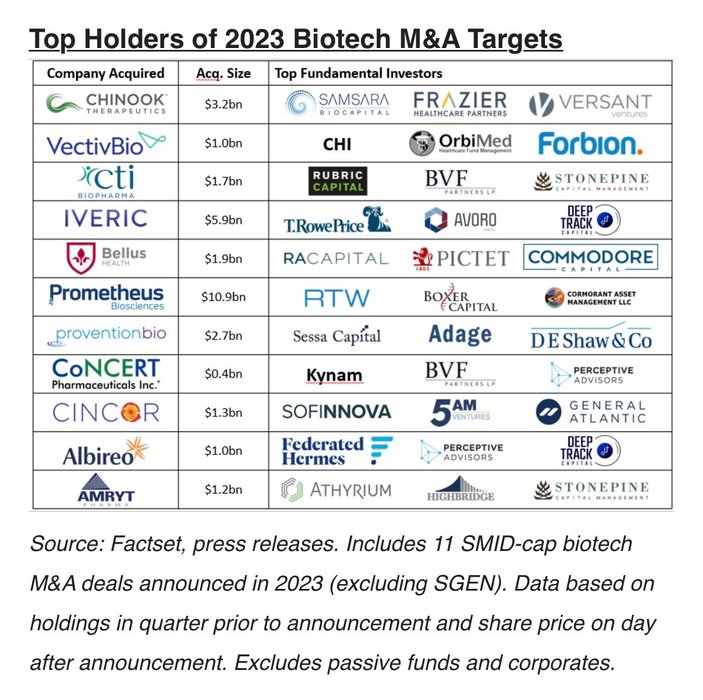

Top holders of 2023 biotech M&A Targets (via SVB Securities) https://t.co/qpdepfwcV3