Sublime

An inspiration engine for ideas

"I learned this from Schwarzman. People don't give money to the investors they think are going to make the most money, they allocate to people they like."

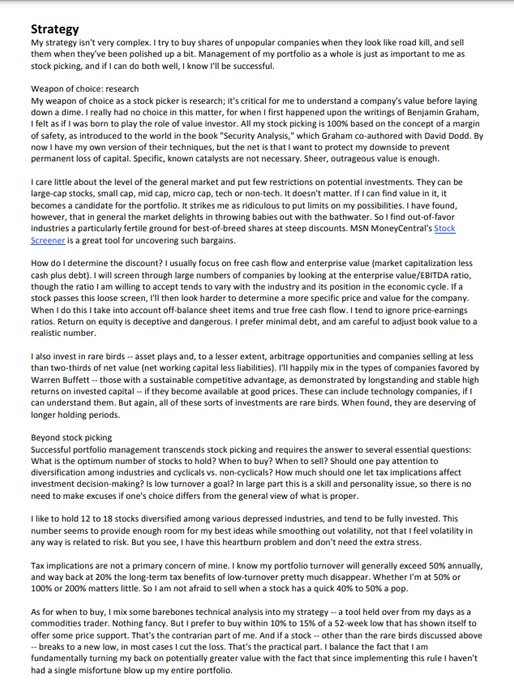

Burry's investment one sheet

worth reading for any investor https://t.co/ZqFn52xLsv

Last is the power of stories over statistics. “Housing prices in relation to median incomes are now above their historic average and typically mean revert” is a statistic. “Jim just made $500,000 flipping homes and can now retire early and his wife thinks he’s amazing” is a story. And it’s way more persuasive in the moment.

Morgan Housel • Same as Ever: Timeless Lessons on Risk, Opportunity and Living a Good Life

“People are careful with their money when they buy a refrigerator or plane ticket. But they hear about a stock on a bus and they'll put 5k, 10k behind it," Peter Lynch has said. https://t.co/m2tq2G146B

unusual_whalesx.com

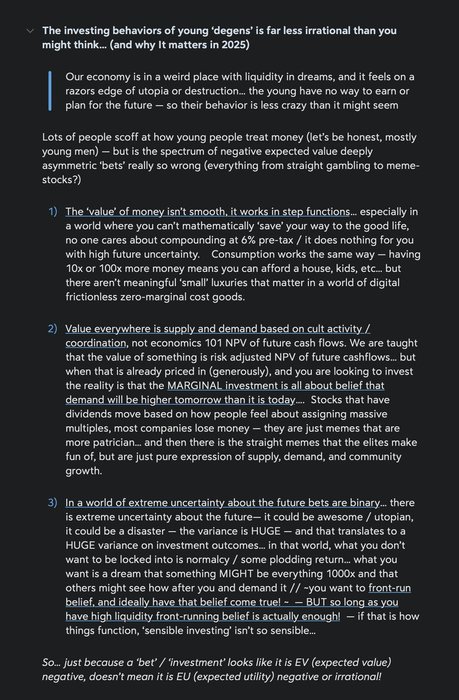

The investing behaviors of young ‘degens’ is far less irrational than you might think… (and why It matters in 2025) https://t.co/rZE70ZV5Tz

The Zurich Axioms: The rules of risk and reward used by generations of Swiss bankers

amazon.com