Sublime

An inspiration engine for ideas

Explaining why crypto has low correlation with risk assets and predicting its future as a major institutional asset class.

TRANSCRIPT

Yeah, so I actually strongly believe that Bitcoin and other blockchain assets are going to generally have a very low correlation with risk assets.

The reason is smart money doesn't own it.

And the reason all these other weird asset classes that intrinsically have nothing in common or highly correlated is modern portfolio theory was so successful

... See moreA Wealth of Common Sense - Personal Finance, Investments & Markets

awealthofcommonsense.com

I tend to like my ETFs vanilla plain, maybe with a few sprinkles. I like them to follow indexes that make sense. And, above all, I like their expense ratios looooow.

Russell Wild • Exchange-Traded Funds for Dummies

This is Jeff Yan.

He is the co-founder of Hyper Liquid, doing $10B in daily volume.

He went from being a quant at Hudson River Trading to running one of the largest decentralized exchanges in crypto.

Here's what you need to know: https://t.co/eZeRmKQ06g

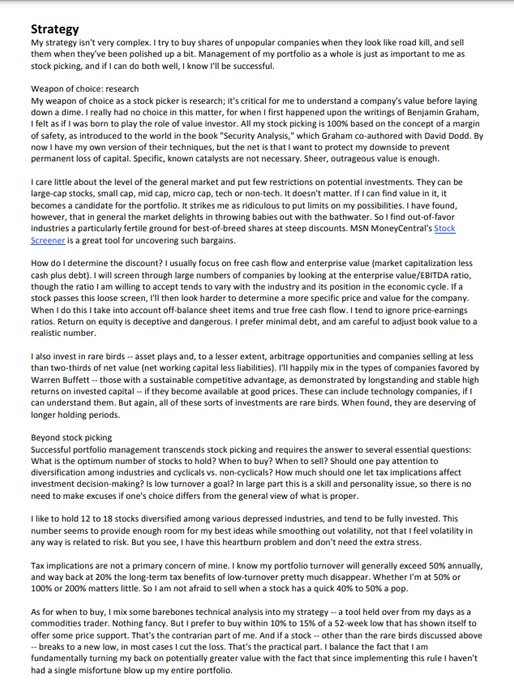

Burry's investment one sheet

worth reading for any investor https://t.co/ZqFn52xLsv

This is, in a way, a practical book about the Kelly criterion. I bought two copies by mistake. If we’re having lunch and you are interested, remind me to bring you the spare copy.

Haghani btw is “the” Haghani. With Larry Hilibrand, the real on-the-ground PM at LTCM. https://t.co/XcXO1tqSfC

30 seconds of thoughts on “prestige media” and the investing business:

its useful to divide this generation of “new media” pushes from asset management platforms into two predominate expressions:

first, real-time personality driven live shows/podcasts.

long... See more

Will Manidisx.com