Sublime

An inspiration engine for ideas

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.comQ2_2024_PitchBook_Analyst_Note_Establishing_a_Case_for_Emerging_Managers

This document explores the performance of emerging versus established managers in the private fund industry, focusing on buyout, venture capital, real estate, and private debt strategies.

LinkIn it’s heyday, Goldman’s special situations group was the navy SEALs of money making. Today’s guest, Alan Waxman, used to run that group before leaving to build Sixth Street, now a $115b behemoth.

SSG heads were sometimes of the more brainy, nerdy variety. Not Waxman. He is a force of nature and energy who apparently... See more

Patrick OShaughnessyx.com

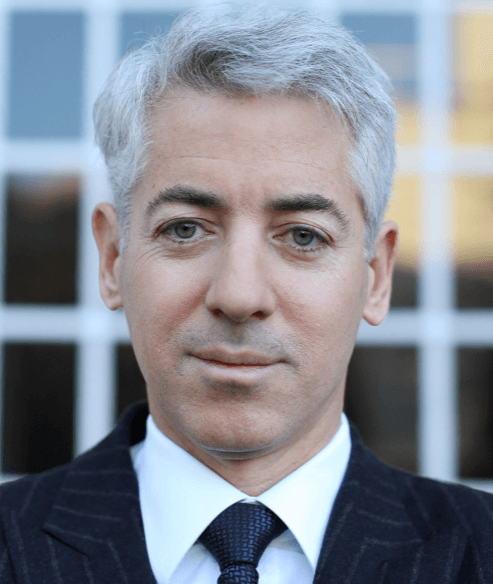

Bill Ackman Manages Over $8.7 Billion in Assets

Achieved 373% accumulative return 2004-2010.

A 58% return in 2019!

He makes all of his Analysts read these 11 books:

📚 https://t.co/XomKpXdDVI

Trends – Artificial Intelligence (AI) – May 2025 – BOND

The document analyzes rapid growth and transformative trends in artificial intelligence, highlighting unprecedented user adoption, technological advances, global competition, enterprise AI integration, and associated benefits and risks shaping the future.

bondcap.comStrategy Beyond the Hockey Stick: People, Probabilities, and Big Moves to Beat the Odds

amazon.com

Pierre

pierre.co

He was Uber CEO Travis Kalanick's right-hand man.

Meet @emilmichael, Uber's former Chief Business Officer who helped the company raise $15B.

(00:00) Fighting the "Taxi Mafia" in Italy 🤬

(04:03) Tips for building on-the-ground teams

(09:56) Founders "going direct"... See more

Jason Levinx.com