Sublime

An inspiration engine for ideas

Charlie Munger says the first rule of compounding is to never interrupt it unnecessarily. But

Morgan Housel • The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Parag Parikh’s book Value Investing and Behavioral Finance.

Gautam Baid • The Joys of Compounding: The Passionate Pursuit of Lifelong Learning, Revised and Updated (Heilbrunn Center for Graham & Dodd Investing Series)

The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.

Peter Thiel, Blake Masters • Zero to One

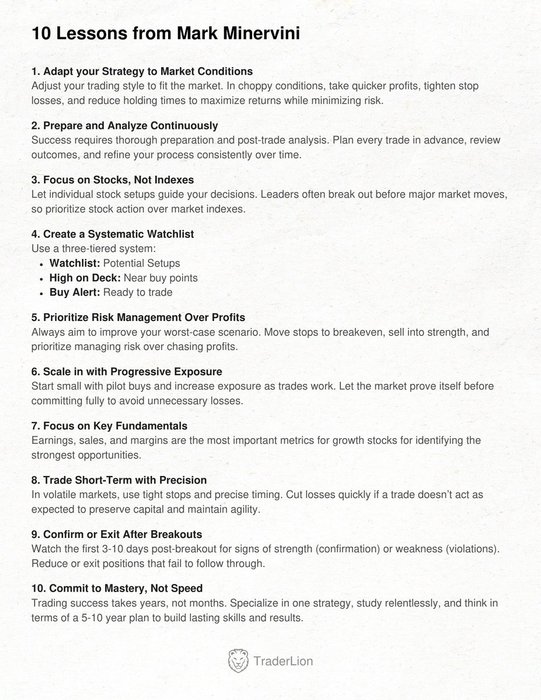

How does Mark Minervini succeed in volatile markets?

Here’s his winning formula: https://t.co/TaROpcuWJe

Also, I like to look for growth stocks that have a market cap of $5 billion or less. It takes a lot less money to push a $5 billion stock higher than it does a $500 billion market cap stock.

Matthew R. Kratter • A Beginner's Guide to the Stock Market

One Up On Wall Street

The seminal resource for DIY investors.

What you'll learn:

• Harnessing your local mall to find wonderful opportunities

• The importance of thorough research

• Why to take a long-term perspective... See more

There is a reason why Buffett is not only a great investor, but also a great teacher: He not only has a vast knowledge about everything related to business, he can also explain it all in simple terms.

Sönke Ahrens • How to Take Smart Notes: One Simple Technique to Boost Writing, Learning and Thinking – for Students, Academics and Nonfiction Book Writers

Great investors to research if you want to build wealth:

• Benjamin Graham - Margin of Safety

• Howard Marks - Risk Management

• Mohnish Pabrai - Asymmetry

• Warren Buffett - Compounding

• Charlie Munger - Rationality

• Nick Sleep -... See more

Kyle Grievex.com