Sublime

An inspiration engine for ideas

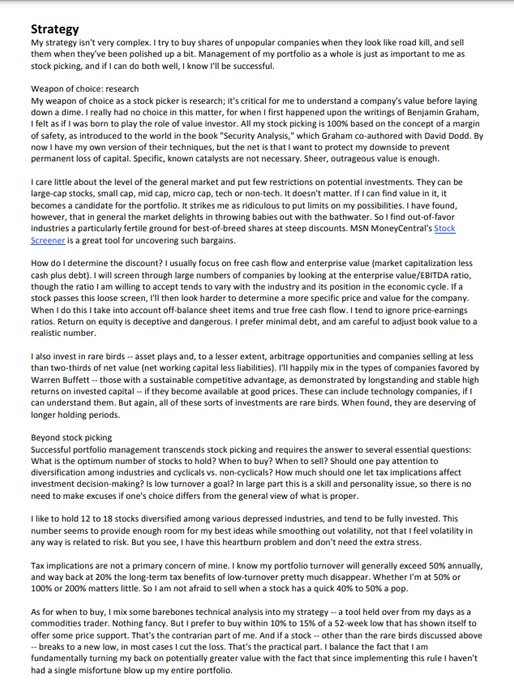

Burry's investment one sheet

worth reading for any investor https://t.co/ZqFn52xLsv

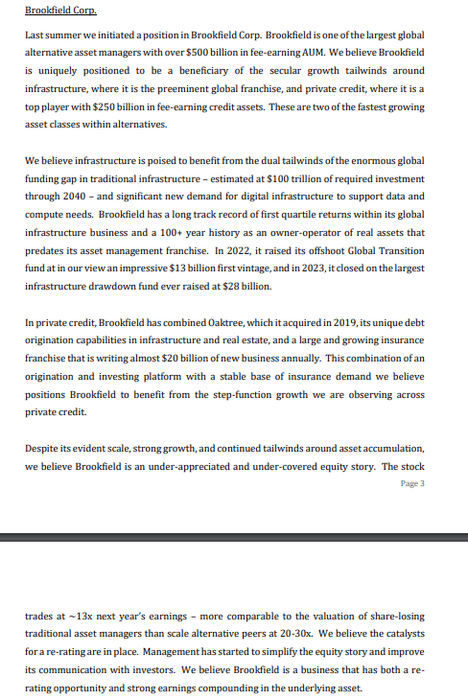

Daniel Loeb of Third Point on $BN

"We believe Brookfield is a business that has both a rerating opportunity and strong earnings compounding in the underlying asset." https://t.co/nYTtQEN3D5

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.com

Acquiring lower-middle market companies is the best opportunity to build wealth right now.

Here’s how Permanent Equity’s 2023 shareholder letter explained the opportunity:

- The market is huge: There are 350,000 US companies classified as lower-middle market ($5m to $100m in annual... See more

Spent 7 hours researching a true master of small cap private equity:

- 586 transactions

- Acquire $1 million to $10 million EBITDA companies

- Average deal $12 million

- 72% IRR

- 7x cash on cash returns

He had two rare public... See more

PrivateEquityGuy (Mikk Markus)x.com